Jefferies' Chris Wood does not believe President-elect Donald Trump will go ahead with a 60% trade tariff on Chinese imports, adding that this, along with many other policies of the upcoming administration could be inflationary for US.

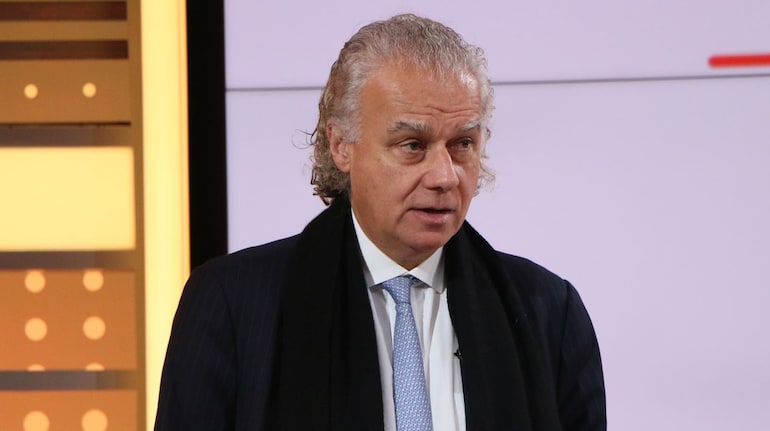

Speaking at the CNBC-TV18 Global Leadership Summit on November 14, Wood said Trump's position on trade barriers may also be from a point of negotiation, since he is "intrinsically unpredictable and transactional".

Tariff Barriers?

"I am sceptical if Trump will put 60% tariff on China, if he does, it will increase the cost of goods. I believe this is part of his negotiation tactics. While he will raise tariffs, I doubt if it will be 60%," Chris Wood said.

From China's stand point, Chris Wood sees the scope of a deal between the two countries. "If I am the Chinese leadership, I would opt for Trump in the White House and not the Democrats, as under the Democratic leadership it would have been a status quo, which means an ongoing deterioration," he added.

Chris Wood believes the policy that China actually does not want is the restrictions on access to semiconductors, and not the issue of tariff imposition. "I think from China's point of view, there is scope for a new deal, and I think China will be willing to trade higher tariffs for access to semiconductors."

Inflationary Risk?

Donald Trump's several proposed policies may be inflationary for America, such as his position on tariffs, crackdown on immigration, or moving manufacturing home, said Chris Wood, implying he sees "a lot of inflationary headwinds" in America going forward.

US Equities Outlook

The Wall Street rally is likely to continue going into the Inauguration Day in January, Wood said, as one of the drivers for US equities is the proposed extension of corporate tax cuts, that are set to expire in 2025. This, along with the expectation of an "aggressive deregulation" is helping the US shares, said Chris Wood. Trump's campaign promises included rolling back some of the green regulations that have hindered oil and gas drilling, and coal mining.

For US tech stocks, Chris Wood bets the capex on AI will continue in 2025, but the street may question this pace of investment at some point of time.

Trump 2.0

Deregulation could be a key theme under Trump 2.0, impacting energy to finance, offering short-term growth and lower costs for businesses. Chris Wood said there is also this expectation that President-elect Trump may address the Ukraine crisis quickly, as he has made it clear that he is not keen on funding the war.

Another factor that Chris Wood will be watching very closely are the plans by the Department of Government Efficiency - DOGE - under billionaire Elon Musk's leadership. Musk has said he intends to cut down $2 trillion worth of Federal government spending. "If he manages to do that, this will be treasury bond, US Dollar bullish, and deliver an inflationary shock to the US market, which initially will be negative for the stock markets but the long term outcome will be positive," Chris Wood said.

India View

Chris Wood said Jefferies is not changing its India investment strategy just because Trump has been elected to the White House. "I don't think for India, Trump's election makes much difference, and the country is on track for a 6-8% real GDP growth during the forthcoming Trump administration."

India's ongoing market correction is 'healthy', said Chris Wood, and the foreign outflow also implies that the FIIs have the ability to buy into India after a sharp fall. The concerns over consumption is certain pockets is a "cyclical slowdown" and "nothing dramatic", he added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.