The Indian market took a break from four consecutive weeks of selling to close more than 2 percent higher in the week ended March 11. Hopes of de-escalation between Russia and Ukraine, falling crude prices, and the BJP’s convincing win in four of the five state elections aided sentiment.

Experts said caution and volatility would prevail as the Russia-Ukraine war enters its third week and fighting intensifies. Commodity prices will be in focus. In a truncated week, the market, which will be shut for Holi on March 18, will closely follow the US Federal Reserve's policy meeting for an interest rate hike.

"Given the significant events including FOMC meet, inflation numbers, and Ukraine-Russia crisis, volatility may rise, and investors are recommended to continue cherry-picking resilient stocks while avoiding vulnerable counters," said Yesha Shah, Head of Research at Samco Securities.

On March 14, the market will first react to January industrial output that grew 1.3 percent against 0.4 percent in December.

Ajit Mishra, VP Research at Religare Broking said participants should continue with a cautious stance until the prevailing geopolitical tension eases.

"Markets are offering opportunities on both sides however overnight risk and excessive volatility during the day are not easy to handle. The prudent approach is to focus more on risk management aspects," he said.

In the week gone by, the Nifty jumped 385 points, or 2.4 percent, to 16,630, and the Sensex rallied 1,216 points, or 2.2 percent, to 55,550. The BSE midcap and smallcap indices gained more than 3 percent each.

The weekly rally was supported by metals, infra, IT, energy, FMCG, pharma and oil & gas stocks.

Here are 10 key factors that will keep traders busy next week:

The Ukraine-Russia crisis is expected to keep making headlines, as Russian troops inch closer to the Ukrainian capital Kyiv.

Russian forces fired eight missiles at a Ukrainian military facility near the Polish border on March 14, officials said, in what appeared to be the westernmost attack of the war, and air raid sirens again woke residents in Kyiv, a Reuters report said.

"The occupiers launched an airstrike on the International Center for Peacekeeping and Security" in Yavoriv, the Lviv regional military administration said in a statement. "According to preliminary data, they fired eight missiles."

Click Here To Read All Live Updates on Ukraine-Russia War

A CNBC report, quoting NBC News, said that Ukrainian President Volodymyr Zelenskyy on March 12 expressed some optimism about recent discussions between Ukrainian and Russian sides.

"I believe that this is a fundamentally different approach and it should be so," Zelenskyy said at a press conference. He called for a “peace process, the end of the war process.” and said it would need to begin with a ceasefire.

On the same day, he, however, also warned Russian forces that they faced a fight to the death if they try to occupy Kyiv.

"If they decide to carpet bomb and simply erase the history of this region ... and destroy all of us, then they will enter Kyiv. If that's their goal, let them come in, but they will have to live on this land by themselves," Zelenskiy said.

Crude prices

Oil prices cooled down considerably during the week amid hopes of improvement in supply outlook. The supply concerns mounted after the beginning of Ukraine's invasion but last week, some OPEC countries hinted at more supply.

The street will closely watch the volatility in oil prices. International benchmark Brent crude futures closed at $112.67 a barrel on March 11, down sharply from $139 during the previous.

Crude remains an important factor for emerging markets, including India as the country imports more than 80 percent of oil requirement.

Also read: Don’t read too much into MNCs' boycott of Russia

FOMC meeting

The outcome of the Federal Reserve's two-day meeting will be the key factor to watch out for in the coming week. The interest rate decision will be announced on March 16 night and markets, including in India, will react to it the next day.

Earlier a 50 bps hike was expected but given the war, the interest rate increase could be limited to 25 bps. The commentary on further rate hikes amid elevated inflation would the key. The US inflation in February hit a 40-year high of 7.9 percent on rising fuel and food costs.

"This Fed meeting is especially important considering the unknowns emerging out of the Russia-Ukraine crisis. Market players will be looking for clues from the Federal Open Market Committee's assessment of the inflation risk and how aggressive it is willing to be with interest rate rises," said Shah of Samco Securities.

Inflation data

The inflation data for February will be released on March 14. Experts said the print would likely is expected to remain within the RBI's target range, given the decline in food prices and the real impact of record-high oil prices would be seen in the March numbers.

"We forecast headline CPI inflation will moderate slightly in February, slowing to 5.9 percent YoY. On a sequential basis, food prices are likely to decline for the third straight month. We also expect core inflation to moderate, easing to 5.8 percent YoY largely on a high base," Rahul Bajoria of Barclays India said.

After factoring in the recent surge in crude, which could be passed on to consumers from mid-March, Barclays raised its FY22-23 CPI inflation forecast to 5.1 percent YoY from 4.5 percent YoY.

"Our revised forecast assumes crude oil prices average $110 a barrel in H1 FY22-23 and then decline modestly in H2 FY22-23, as futures prices imply. Our forecast also factors in the slower economic growth we now expect," it said.

Wholesale Price Index inflation numbers for February, too, will be released on March 14.

The selling by foreign institutional investors (FIIs) and foreign portfolio investors continues. They sold more than Rs 43,000-crore worth of shares in just first eight trading sessions of this month.

If the selling persists, the monthly outflow could be highest in second half of FY22, which could cap the upside, though domestic institutional investors (DIIs) have been hard at work to make up for the outflow.

FIIs have net sold shares worth more than Rs 2.31 lakh crore since October 2021, while DIIs bought equities worth Rs 1.6 lakh crore, including Rs 30,329 crore in March, during the period.

Technical View

The Nifty formed a Bullish Engulfing pattern on the weekly charts, as the index gained more than 2 percent after four straight weeks of losses.

On the daily scale, the index formed a bullish candlestick on March 11 as the closing was higher than opening levels. The Nifty gained 0.2 percent for the day.

The index has to decisively surpass 16,750-16,800, the key hurdle, to climb to 17,000, while, 16,450-16,200 could be an important support.

"The short-term trend still remains bearish on the charts and the Nifty is facing strong selling pressure around 16,800 levels," said Mishra of Religare Broking. The undertone for global indices continues to be bearish.

Till the Nifty decisively goes above 16,800, traders should maintain a neutral to the mild bearish outlook, he said. Aggressive traders can look to take a short position in the Nifty on a break below 16,450, keeping the stop-loss at around 16,750, he said.

F&O cues

On the options front, maximum Call open interest was seen at 17,500 strike, followed by 18,000 and 17,000 strikes. Call writing was seen at 17,500 strike, followed by 17,000 and 17,600 strikes, with Call unwinding at 16,200 and 16,100 strikes.

There was maximum Put open interest at 16,000 strike, followed by 15,500 and 16,500 strikes. Put writing was seen at 16,000 strike, followed by 16,500 strike and 15,400 strike.

The data indicates that the Nifty could remain in a broad range of 16,000-17,000 levels for coming sessions.

"On the data front, significant short additions were seen in the headline indices during the month so far. While the Bank Nifty open interest is one of the highest ever seen, the Nifty open interest is also at a multi-month high.

“A short-covering move can be expected if the Nifty remains above 16,500 in the coming sessions and may move towards 17,000, 17,200 levels ahead of Fed policy," said ICICI Direct.

Santosh Meena, Head of Research at Swastika Investmart, said FIIs' long exposure in the index future stands at 43 percent, which is still in negative territory, whereas the Put-Call ratio has improved to 1.03 level. "If we look at the open interest distribution chart then 17,000 is looking a crucial hurdle."

India VIX

The volatility cooled further, which brought stability in the market that was in bears' control earlier.

If the volatility falls further and breaks 20 levels on the downside, it could bring more stability and confidence among bulls, experts said.

India VIX, the fear index, closed at 25.34 levels on March 11, down more than 9 percent on weekly basis and falling 25 percent from its recent high of 34 levels on February 24.

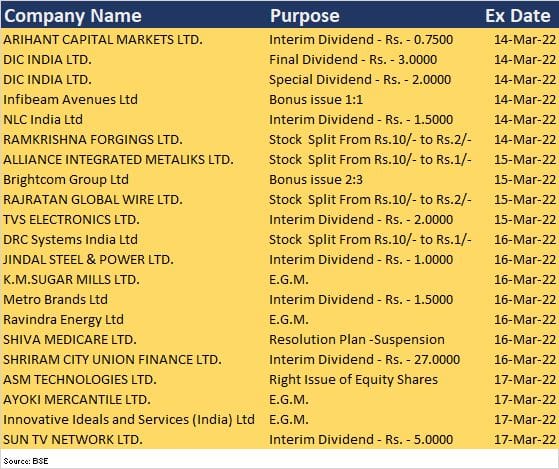

Corporate Action

Here are key corporate actions taking place in the coming week:

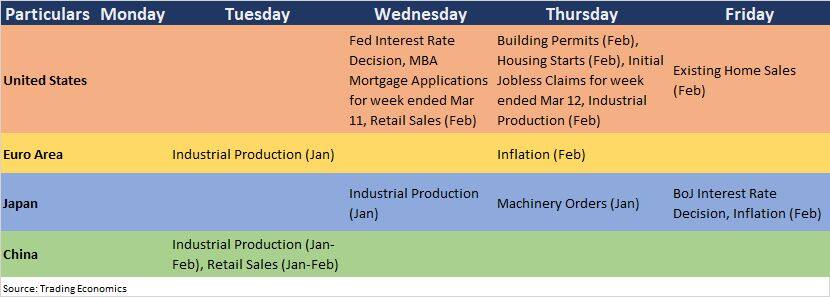

Global Data Points

Here are key global data points to watch out for next week:

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.