City gas distributors, once a highly promising sector with a clear edge over traditional fuels due to its pricing advantages, has now become one of the most challenging spaces. The reason? The government has slashed supplies of cheaper domestically produced natural gas to CNG retailers for the second time since October. Back then, supplies were cut by over 20 percent, and now, another 20 percent reduction has been implemented.

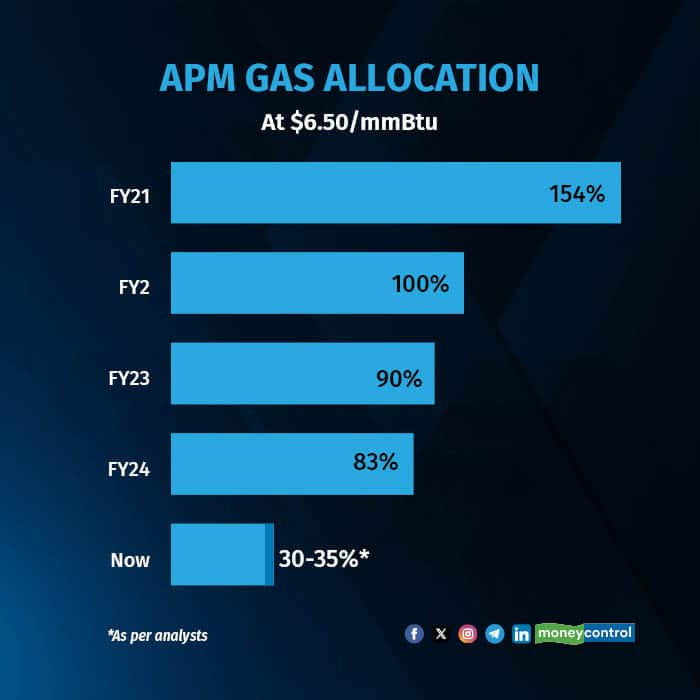

Currently, city gas distributors receive domestic gas allocations to meet CNG sales requirements at a government-fixed price of $6.5 per mmBtu. Gas allocations to city gas firms have dropped significantly, from 154% in FY21 to around 30-35 percent today.

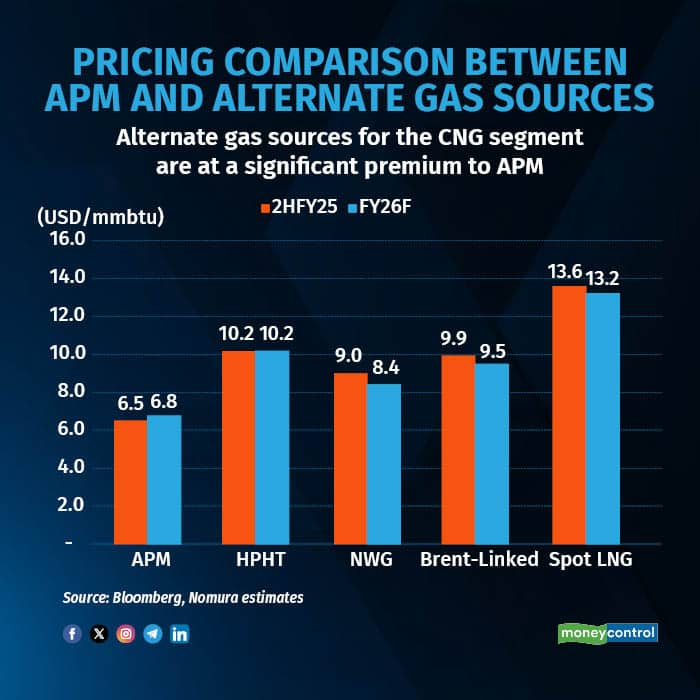

The speed of this deallocation has certainly taken the market by surprise. What’s more concerning is that global brokerage firm Jefferies predicts that domestic gas allocations could be completely phased out by mid-2025, with Administered Price Mechanism (APM) gas becoming unavailable. So, what are the alternatives for city gas distributors who retail CNG to automobiles and supply piped cooking gas to households in cities like Delhi? They will likely be forced to rely on imported gas, which costs twice as much as domestic gas. This will involve sourcing a mix of spot LNG, high-pressure, high-temperature (HPHT) gas from challenging wells, gas from new fields, and whatever remains of the APM gas.

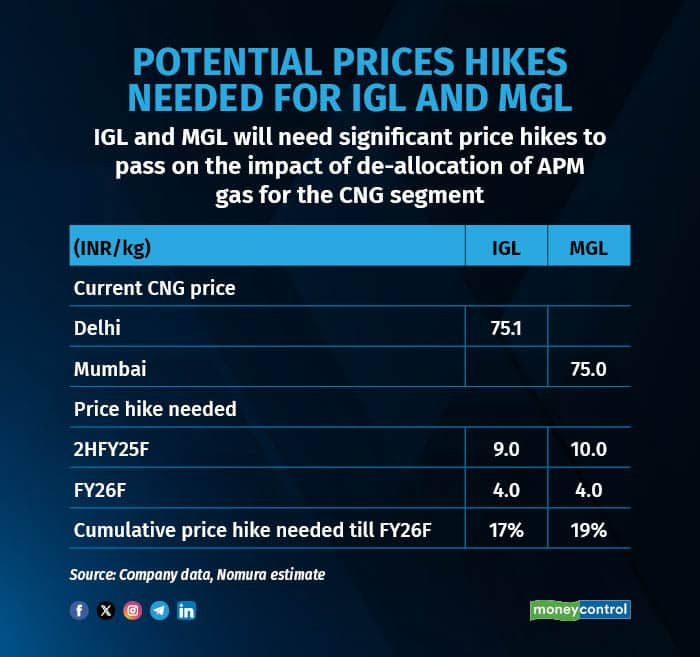

This would result in an increase in the cost of raw material for city gas distributors. Moreover, 50 percent of sourcing will have to be done via market-linked prices, which will further drive up costs. As a result, their earnings are likely to take a major hit, with profitability and margins squeezed for the players as they lose the advantage of maneuvering prices. An increase in raw material prices would mean companies would be forced to undertake price hikes to protect their margins. Analysts believe, a hike of as much as 10 percent may be necessary to nullify impact of higher costs.

If gas loses its appeal compared to other fuels, and these companies lose their pricing power, it could lead to a substantial de-rating in the sector. Analysts view this as a significant risk, creating uncertainty about the government’s ongoing commitment to supporting the CNG business. An ideal scenario would have been a gradual reduction in allocations, which would have led CGDs to increase prices gradually, similar to petrol and diesel, but that hasn’t happened. The rapid cuts in allocation and higher costs will put pressure on margins, and it's questionable whether these companies can manage this change without significant strain.

Gone are the days of 20 percent+ return ratios. Expectations are now being adjusted to 14-16 percent, with Emkay Global lowering their RoE forecast for Indraprastha Gas (IGL)/ Mahanagar Gas (MGL) to 14 percent for FY26-27E, down from the previously expected 17-18 percent. ICICI Securities acknowledges the material hit to gas costs for CGDs but suggests that the competitive pricing of CNG compared to alternate fuels, along with the growth potential in new CNG user segments, could help mitigate some of the damage, albeit gradually.

The concern is that price hikes could dampen volume growth, as higher prices would erode the price advantage of CNG over petrol and diesel. However, ICICI Securities points out that the current differential between CNG and petrol/diesel remains at 35-48 percent, which provides some room for price adjustments to offset the higher gas costs.

The price correction for companies like Indraprastha Gas and Mahanagar Gas has been striking, with shares plunging over 40 percent since the first gas allocation cut in October. In fact, prices have dropped to levels not seen since 2017. Does this signal a further downside, and should these stocks be written off after such a sharp correction?

Mayuresh Joshi of William O'Neil acknowledges that volumes and profitability will be impacted but believes the market has already priced-in most of the negatives. He notes that stocks may consolidate due to a lack of fresh earnings triggers. While the widening price gap between CNG and petrol/diesel may curb incremental volume growth, he believes that existing vehicles will continue using CNG due to its cost advantage, despite the narrowing discount. Consumers may face inflationary pressures but will likely still prefer CNG due to cost dynamics.

While near-term challenges are clear, analysts are not entirely discounting the future potential of these companies. They believe CGDs can diversify by expanding intercity pipelines, building regional networks, and increasing urban coverage, while also investing in last-mile connectivity and LNG refueling infrastructure. These efforts will help tap new markets, meet evolving energy needs, and reduce reliance on specific segments. This may also force a change in mindset and prompt companies to scout for inorganic opportunities for better prospects. But the question is will those measures be sufficient? Only time will tell.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.