The S&P BSE Sensex has fallen by over 25 percent from its peak and a similar carnage has been seen in individual stocks which might have fallen by 30-40 percent from their respective highs triggered by selloff caused by COVID-19 outbreak in the last month.

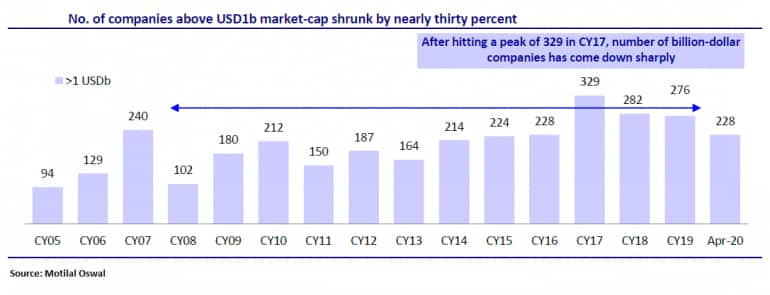

The number of companies with a market capitalisation of more than $1 billion or Rs 7,600 cr (roughly) has fallen to 228 so far in April 2020 compared to 329 in 2017 (when it was at its recent peak) – a fall of about 30 percent.

The carnage on the Street has wiped out more than Rs 31 lakh cr of investor wealth so far in the year 2020. The average market capitalisation on the BSE fell from Rs 155.53 lakh cr recorded on 31 December 2019 to Rs 123.72 lakh cr on April 20, 2020.

At a time when most economists are talking about near-zero GDP growth rate for India, and the world experiencing a scenario similar to Great Depression, investing in risky assets such as equities is likely to become challenging.

Corporate earnings are likely to take a hit not just in March quarter but it would be much more brutal in forthcoming quarters if the lockdown period across India extends further.

So, the next big question in front of investors is – what should they do? “The important things to watch out for are the known unknowns – how long does this lockdown, or semi-lockdown continue globally; what the second and third-order effects are and what are the changes in consumer and business behaviour in the post-COVID-era,” Sandeep Jethwani's designation is Senior Managing Partner and Head of Advisory, IIFL Wealth told Moneycontrol.

“From a market’s standpoint, while each time is different, it is useful to look back at the previous recessions or bear markets. Such periods bring with themselves larger market volatility with many intermediate dips and up moves. Investors should be prepared for larger market moves, both ways in times like these,” he said.

Note: Here is a list of 50 companies filtered on increasing order which have a market cap of more than $1 billion or Rs 7600 cr. The list is for reference and not buy or sell ideas --

Investors should look at an allocation into equities only from within what they have kept aside as an investment/savings pool. These are good times to refresh this asset allocation, suggest experts.

In the short-term, the market is expected to be fairly volatile and will move based on global flows as well as news about COVID-19. Foreign portfolio investors (FPIs) have withdrawn a net Rs 12,650 crore from the Indian capital markets in April so far amid the coronavirus crisis.

“The global flows, in turn, are being determined more by factors such as fear. It helps to keep in mind that “In the short term the markets are a voting machine but in the long term a weighing machine,” Gaurav Misra, Senior Fund Manager- Equity, Mirae Asset Investment Managers India Pvt. Ltd told Moneycontrol.

“If they are unallocated/under-allocated to equity, given risk profile, this is a wonderful opportunity to correct that imbalance. The recent correction brings valuations to attractive levels given that fair value of businesses have not got impaired anywhere close to what the prices are suggesting,” he said.

Misra is of the view that a mix of Lumpsum and staggered approach might be fine in the current circumstances.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.