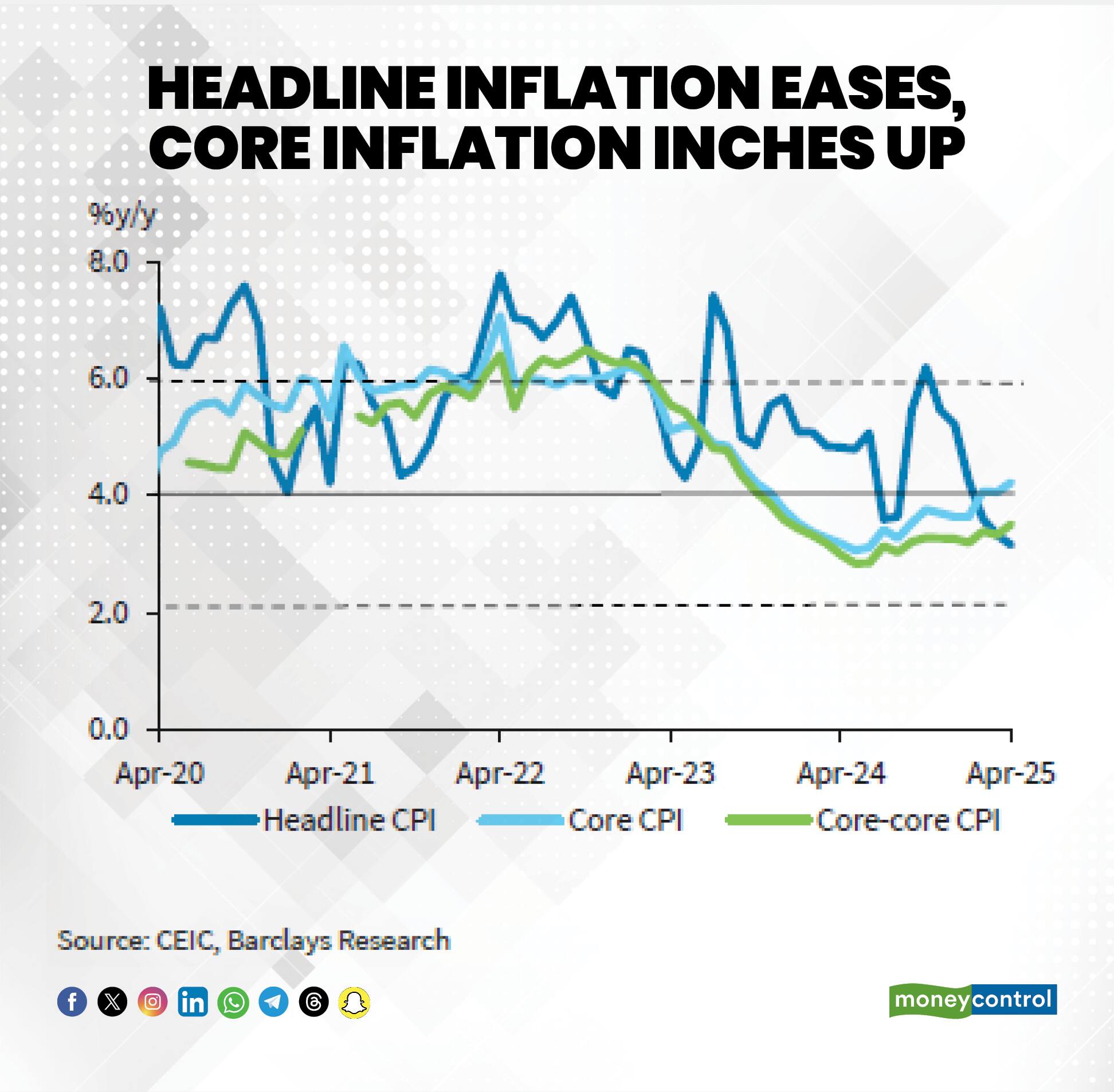

The clarion call for the Reserve Bank of India to deepen the monetary policy easing cycle has turned louder, as consumer price inflation for April eased to 3.16 percent, down to multi-year lows. With food inflation moderating, led by degrowing vegetable prices, experts suggest the case for further cuts in the benchmark lending rate have strengthened.

Under the stewardship of the new Governor Sanjay Malhotra, over the past two meetings, the central bank has trimmed the repo rate by 50 basis points, from 6.5 percent to 6 percent. Going ahead, most economists are penciling in a 25 bps cut during the RBI Monetary Policy Committee's meeting in June, with some expecting a terminal rate between 5.25 and 5 percent during this quantitative easing cycle.

Apart from direct easing, the RBI has taken a slew of measures to unwind tight liquidity conditions. Going ahead, with inflation under control, the central bank now has greater flexibility to accelerate the pace of monetary easing, which is a must according to Nuvama Institutional Equities, given global uncertainties and fiscal consolidation.

Quantum of easing during the current cycle?

Most estimates peg the terminal rate between 5 and 5.25 percent. The easing food prices, reflecting reflationary pressures, caused the headline inflation to cool. Going ahead, favourable weather conditions in the form of La Nina and above-normal monsoon expectation should aid food prices in the near term.

"The lower-than-expected inflationary pressures opens up room for rate cuts, but it would be unrealistic to expect front-loading to the extent of 50 bps in June 2025," said domestic brokerage JM Financial.

Barclays Research advanced its expectation of a 25 basis point repo rate cut from the August meeting to June. "A likely third successive repo rate cut, alongside a sizable liquidity surplus, are set to drag effective rates much lower, aiding monetary transmission which would benefit from an ‘accommodative’ monetary policy stance."

From current levels, Nuvama sees a rate easing cycle to the tune of 100 basis points. The brokerage noted that disinflation is underway and should continue over the course of the year, particularly given the likelihood of a normal monsoon. However, uncertainties prevail around the growth outlook.

"Even with the recent US-China tariff relaxation, the extent of the trade/tariff uncertainty is difficult to fathom. Thus, monetary policy may need to do the heavy lifting in India by being more countercyclical than fiscal this year. Domestic inflation dynamics will provide comfort to the RBI," noted Emkay Global's Madhavi Arora.

The RBI's policy focus towards keeping liquidity in surplus and toward, or even higher than 1 percent of Net Demand and Time Liabilities (NDTL) should also be seen as a de facto rate cut, which would influence the extent of conventional easing, added Arora.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.