Companies with an improving trajectory of Return of Capital Employed (ROCE) tend to deliver superior returns when compared to those that that already have a higher ROCE as the starting level, said a recent study by Capitalmind Financial Services.

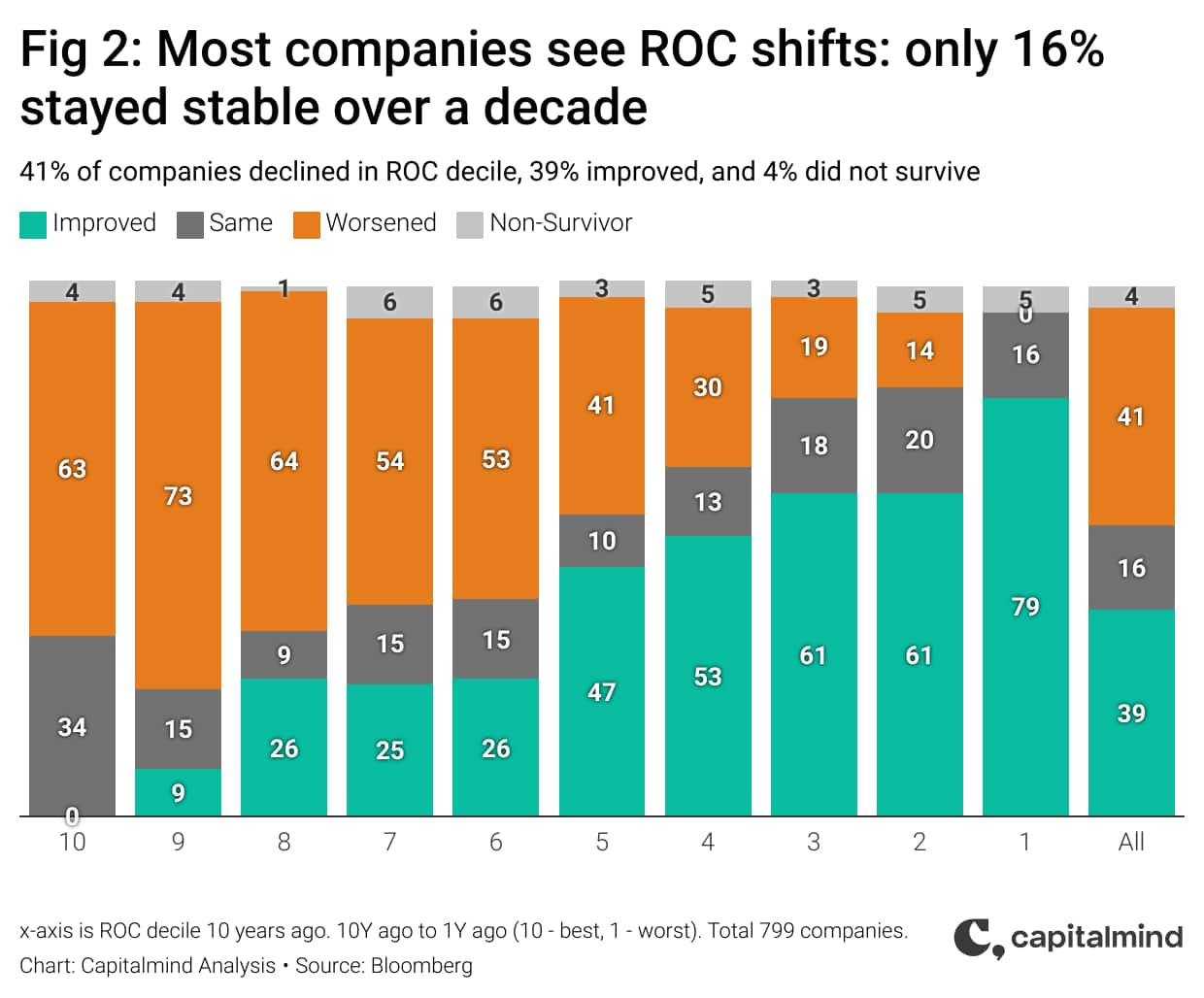

The study showed that a significant proportion of companies in the top ROCE category, a decade ago failed to maintain their rank, and many saw declining shareholder returns. Meanwhile, the companies at the bottom of the pile showed the most improvement in terms of shareholder returns.

It further showcased that companies with consistently improving ROCE have delivered 25 percent annual returns as compared to just 8 percent for those with declining ROCE. "In other words, the worst-returning cohort of companies were those that saw consistently declining ROC irrespective of their starting ROC decile 10 years ago. Conversely, the companies that have shown improving ROC have shown significantly better shareholder returns than the overall universe," the study stated.

The study highlighted that only 59 companies out of 799 have consistently improved ROCE from the 10-year ago levels. According to Capitalmind Financial Services, as of November end, the top 20 companies by shareholder returns have recorded to have improved their ROCE to top deciles over the past 10 years.

Follow our market blog to catch all the live action

Commenting on the findings of the study, Anoop Vijaykumar, Investments and Head of Research, Capitalmind, said that what matters more is where a company’s Return on Capital (ROC) is headed than where it starts.

"Companies that consistently improve their ROC over time—transforming from average to exceptional—tend to deliver superior shareholder returns. On the other hand, even top ROC companies can falter if their competitive advantages erode or if high returns prove temporary," Vijaykumar added.

Concluding the argument, Vijaykumar stated that while ROCE is a valuable metric for evaluating efficiency, it must be combined with a forward-looking perspective to identify businesses capable of delivering exceptional long-term returns.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!