Cement stocks are in focus on September 2 as Macquarie noted that while consolidation in the sector bodes well for medium-term margins, near-term risks remain. Despite healthy demand and cost moderation, muted cement prices are expected to keep Q2 and Q3 earnings subdued, the brokerage said.

Sluggish domestic demand significantly contributed to the muted performance in Q1FY25, and cement companies are unlikely to see a drastic improvement in Q2 as well.

Macquarie in its latest note also highlighted that successful delivery on cost efficiency targets could further enhance margins, but advised waiting for better entry points, suggesting that improved earnings visibility and valuation would offer more favourable opportunities.

Follow our market blog to catch all the live action

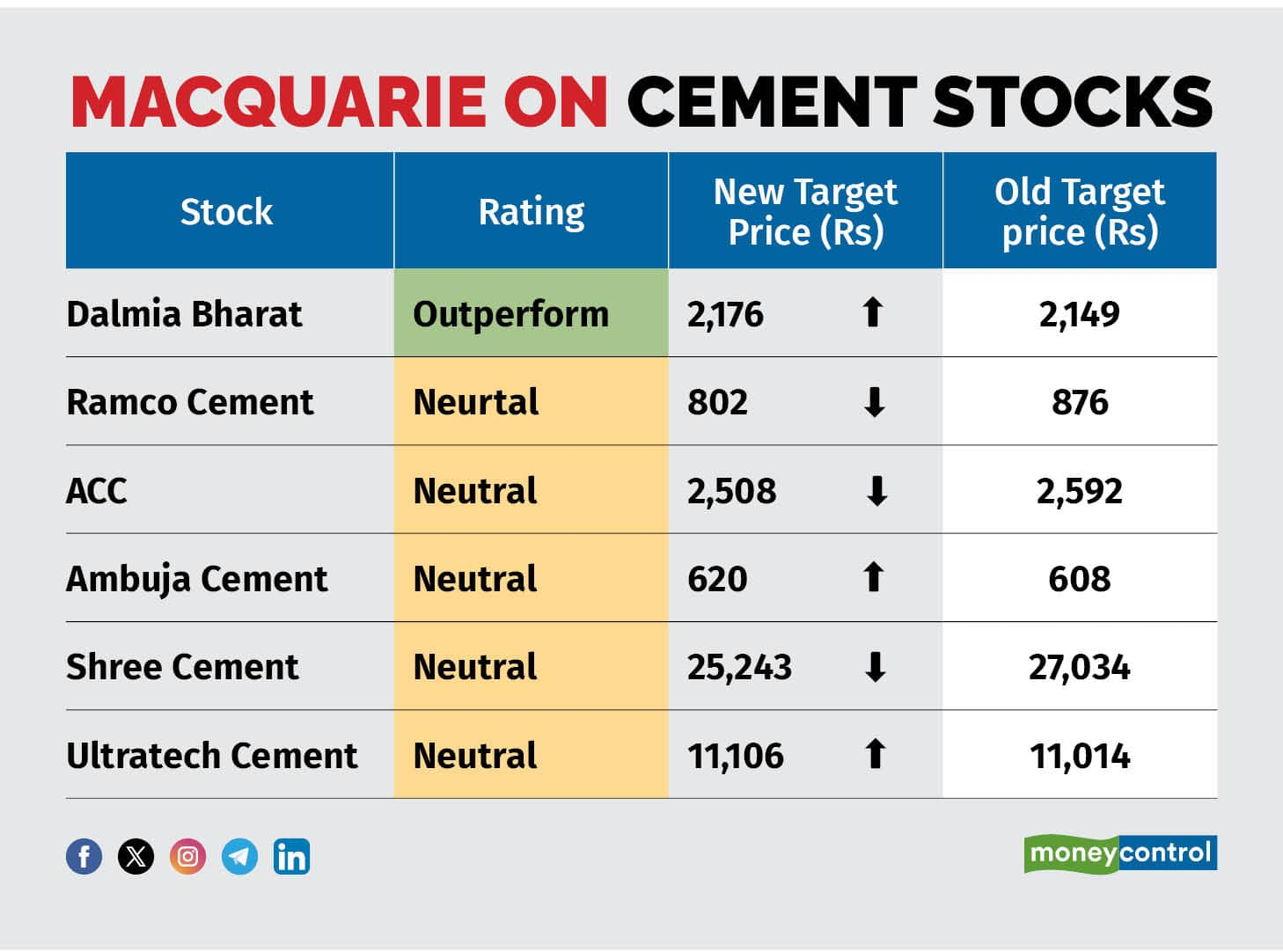

The international brokerage firm has issued mixed calls on various cement stocks, reflecting a cautious outlook for the sector. Analysts at Macquarie maintained an 'Outperform' rating on Dalmia Bharat and has slightly raised the target price on the stock.

However, it adopted a more neutral stance on other major players like Ramco Cement, ACC, Ambuja, Shree Cement, and UltraTech Cement. For these stocks, Macquarie has either adjusted target prices downward or made modest upward revisions, indicating a balanced view of their potential amidst ongoing sector challenges.

Notably, several cement companies tried to raise prices in August, but many of these increases were reversed due to weak demand.

A recent report by Elara Securities indicates that a significant price hike of Rs 40-50 per bag is expected in East India, while firms in other regions may attempt more modest increases of Rs 10-25 per bag. However, these hikes are likely to be partially rolled back, given the weak demand and lack of pricing discipline among companies.

The outlook for the sector for H1FY25 is subdued, with cement prices falling for ten consecutive months, reaching a three-year low. Despite concerns about weak demand, investors are unlikely to offload shares, as demand is expected to pick up in the second half of the fiscal, according to Nirmal Bang.

With election-related disruptions behind and the monsoon season ending, analysts anticipate a resumption of construction activity, which, along with post-festival demand, could help revive cement prices.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!