Fast moving consumer goods (FMCG) companies faced a series of googlies in the year gone by.

Right about the time consumer spending was recovering from COVID-induced lockdowns, high commodity prices, spurred by the Ukraine-Russia war, rammed them head on.

Then, inflation reared its ugly head. Rural spending and non-food categories took a hit as India struggled to keep up with soaring prices. The consumer price index (CPI)-based retail inflation remained above the Reserve Bank of India's 6 percent target for 10 consecutive months.

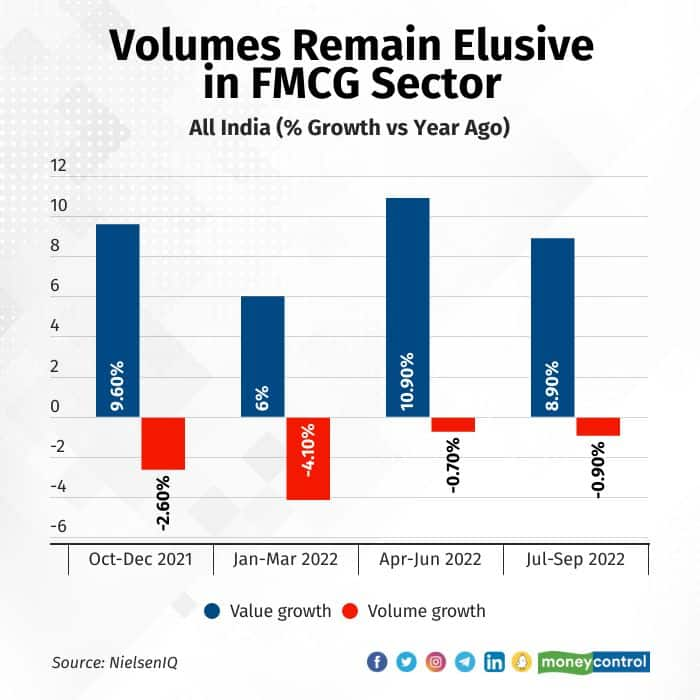

Meanwhile, for FMCG companies, the top-line growth continued. They passed on raw material inflation by taking calibrated price hikes over a few quarters. According to NielsenIQ, the industry in value terms grew 10.9 percent year-on-year and 8.9 percent YoY over the past two quarters.

Top-line expansion reflected in the stock prices of some companies. ITC was the top performer with 60 percent gain last year, followed by Britannia and Hindustan Unilever with 24 percent and 13 percent gain, respectively. Meanwhile, Dabur, Marico and Tata Consumer generated only 4-7 percent returns.

Volume growth

While revenue grew, volume growth took a hit. Be it HUL or Nestle India, low to mid- single digit volume growth became the norm for the biggies in FY23 against 10-11 percent volume growth in the pre-pandemic era. On an aggregate level, urban and rural markets combined, volumes have been declining for four straight quarters.

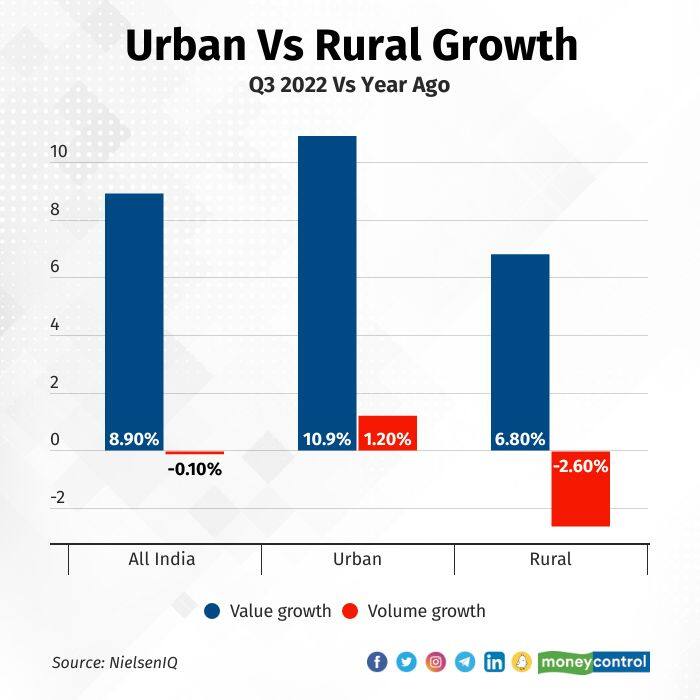

A major reason behind the contraction of volumes has been downtrading in rural markets. Consumers either moved to lower unit packs or switched to cheaper unbranded regional alternatives as inflation burned a hole in their pockets.

Many FMCG companies also resorted to ‘shrinkflation’, in order to protect margins amid high-cost raw materials.

‘Shrinkflation’ is the practice of reducing the quantity in a packet but retaining the price per packet, therefore the customer ends up getting less for the same price.

Margin pressure

When prices of palm oil, wheat and sugar – the key inputs for food and non-food FMCG companies – surged in the initial months of 2022, margins went for a toss. In Q1 and Q2 of FY23, gross as well as operating margins contracted over 150 basis points for most companies.

One basis point is one-hundredth of a percentage point.

According to Crisil Ratings, the sector’s margin is expected to moderate to 18-19 percent this fiscal, versus pre-pandemic level of ~20 percent, despite price hikes. On a sequential basis, there was some improvement in Q3 but advertising and promotion costs were shored up by companies in H2FY23 to bring back volumes.

In the October-December quarter, HUL’s ad-spend increased by 15 percent YoY to Rs 1,200 crore, higher than pre-pandemic spend of Rs 1,163 crore in Q3 FY20.

Rural vs urban demand

On the back of festive season and slight cooling down in inflation starting October 2022, analysts were expecting a decent bounceback in FMCG revenues - again led by price hikes. Meanwhile, expectations on the volume growth front remained muted.

Going by companies’ Q3 business updates, rural demand did not improve in the quarter gone by, largely because retail inflation was still elevated when compared to pre-pandemic levels. Dabur India highlighted that the pressure was further aggravated by the late onset of winter in north India. Parachute oil maker Marico said that the hinterlands only saw a muted recovery in demand.

To bring back volumes into rural markets, companies like HUL and Godrej Consumer cut prices of soaps when palm oil prices dropped from their all-time highs. But that did not help.

As per NielsenIQ data, pack size growth also remains negative, with greater traction towards smaller packs in modern trade. "The FMCG industry in India grew by 8.9 percent in the third quarter of 2022—two percent lower than the previous quarter. The decline is being driven by rural markets, where consumption dropped to –3.6 percent in Q3 of ’22,” said the report.

Industry wish list

If softening in inflation sustains, then affordability will start helping rural consumption at the end of Q4 FY23 or early Q1 FY24, believe analysts. As per Crisil, operating margins of FMCG companies should improve by 50-70 basis points almost reaching pre-pandemic level in the next fiscal. Revenue might grow 7-9 percent in FY23 as well as FY24, it added.

Since price hike-led revenue growth is not sustainable for a longer period, FMCG companies need volume growth back to help their margins and drive sales. For this, consumers should have more disposable incomes.

“For the middle class and those with low salaries, the government should look at tweaking income-tax slabs at the bottom end. This will ensure more money in the hands of consumers,” Saugata Gupta, MD and CEO, Marico, said.

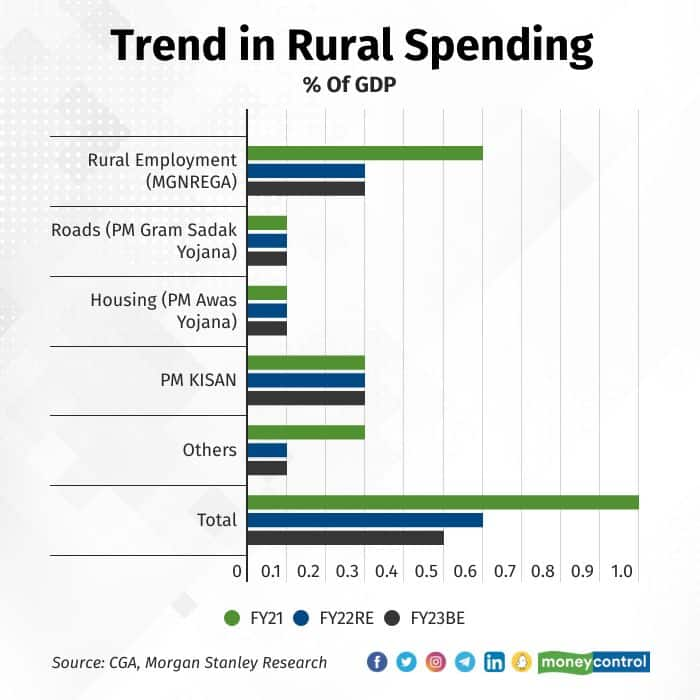

Improved environment for rural jobs and government expenditure can aid rural demand growth. “Demand for MGNREGA jobs is going down and is only a tad above the pre-pandemic levels, implying better-paying jobs are available. With 2023 being the year before general elections, we expect the government to ensure enough spending to revive the rural economy,” according to a report from Nomura. The analysts therefore expect mass consumption articles to see volume growth with an improvement in rural demand.

More investments for rural infrastructure and PLI (product-linked incentives) schemes can also drive productivity in the hinterlands. In the coming Budget, overall rural spend is expected to be 0.5-0.6 percent of GDP, lower than pandemic era spend of 1 percent.

With a permanent break on the pandemic-era free food programme, Morgan Stanley’s chief India economist Upasana Chachra believes the government’s subsidy bill will come down now, thus boosting spending under other heads like rural infrastructure and jobs. She expects food subsidy to moderate to 0.8 percent of GDP in FY24 from ~1.1 percent in FY23.

Last year, the Budget had allocated 0.6 percent of GDP on rural employment, 0.1 percent each on ads and housing, and 0.3 percent on PM KISAN.

Finally, a major fillip to the industry can come from income support to farmers. Experts believe the Centre may enhance the PM-KISAN scheme to Rs 8,000 from Rs 6,000/year in the upcoming Budget to boost consumption.

The wish list is certainly long and all eyes will be on which ones are checked off on February 1.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!