Finance Minister Nirmala Sitharaman will table the Union Budget for 2023-24 in the Lok Sabha on February 1.

Moneycontrol conducted a survey of 30 market experts, including fund managers, analysts, heads of research, chief investment strategists and officers, to get responses on some important questions relating to the upcoming Union Budget.

Tax (Capital Gains and Personal Income Taxes)

Considering the rising inflation and worsening job market, there is hope of tax relief in the Budget.

A large section of the market is of the view that there will be no change in capital gains tax. Around 79 percent participants believe so.

Here's what the survey suggests about nominal GDP growth, fiscal deficit and divestment

Merely 10.3 percent thinks there will be a hike in long-term capital gains tax rate for equities with duration being maintained and another 10.3 percent is of the opinion that there will be a hike in the duration of holding period with the capital gains tax rate remaining the same.

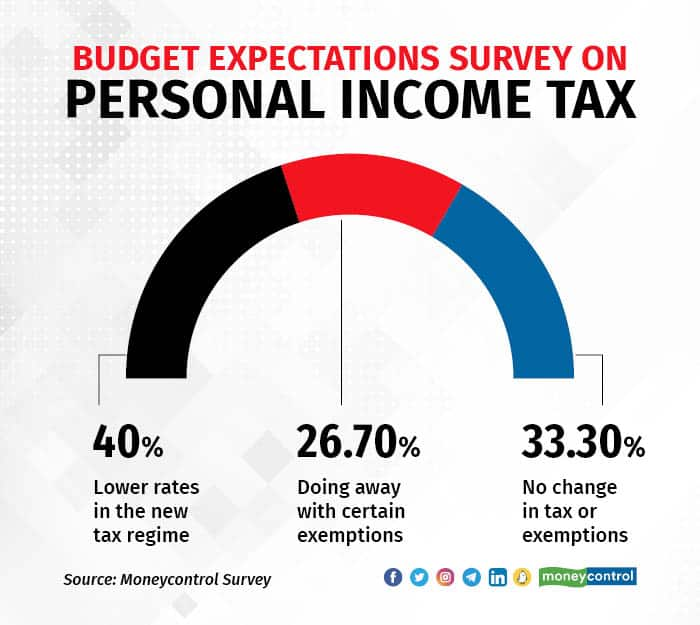

Regarding personal income tax rates, 40 percent feels the new tax regime would mean lower rates, while 26.7 percent thinks the government will do away with certain exemptions, and 33.3 percent is of the view that there will be no change in tax or exemptions.

Also Read | Five major announcements expected from Budget 2023

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.