Abhishek Goenka

Few people, at this point, would disagree that the government’s finances are terribly strained. Fiscal slippage is imminent. Growth is weak and Central + State + PSU debt as a percentage of GDP is alarmingly high.

What the market would want to see from the government in the Budget is how transparent and candid it is about the current situation and how committed it is to initiate measures to revive growth.

The focus sectors of the Budget would be watched closely. Concrete demand-stimulating measures would be received well.

Well-directed infrastructure spending is the need of the hour, as it will have a cascading impact on demand. An increase in capex as a percentage of total expenditure will be a welcome move.

Other key focus areas should be agriculture, manufacturing and exports.

Acknowledging the fact that fiscal slippage was on account of structural reform (cut in corporate tax) and that it could slip in the next couple of years as well in an endeavour to stimulate the economy would augur better than window-dressing numbers and projecting revenue numbers that are far-fetched.

Overambitious estimates of disinvestment and GST collections would spook markets. Rolling out new schemes without laying down how these would be funded and without elaborating on how they would be executed would not go down well.

In fact, redirecting expenditure away from schemes that have not worked well towards initiating demand- augmenting measures would be a wise decision.

It is a delicate balancing act that the FM has to perform between stimulating growth and containing deficit. The mantle of putting the economy back on a firm growth trajectory rests squarely on the government, given that the room for monetary policy accommodation looks limited.

The government's credibility is at stake and investors, both domestic and global would be watching closely. The last person one would want to be at this point is the FM.

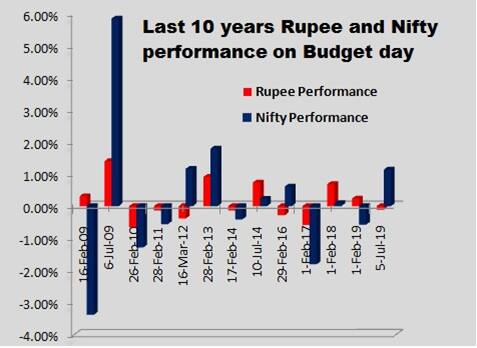

IFA view on rupee, equities and bonds

The rupee is consolidating in a broad 70.50-72.50 range. A break in either direction could entail a vertical move in that direction. We expect the Reserve Bank of India to intervene to smoothen volatility.

The Budget this time is on a Saturday and stock markets will be open that day. For the Nifty, 11,800 is a crucial support, a break of which could convince market participants that a medium-term top is in place.

On the upside, a break above 12,400 could prove to be the beginning of a fresh leg of a move higher towards 12,800.

In terms of bond yields, 6.85-6.90 percent is a strong support for the 10-year benchmark bond. On the other hand, 6.42% is a strong resistance. We expect measures to deepen domestic bond markets to be announced in the Budget.

(The author is CEO & founder, IFA Global)Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.