In a relief to traders, Finance Minister Nirmala Sitharaman on July 5 proposed to restrict Security Transaction Tax or STT to the difference between settlement and strike price in case of exercise of options.

This change, however, will not affect the levying of STT on any other transaction on the exchanges.

“Essentially what it means is that it will result in lesser tax for equity derivatives option traders. The settlement price is the average closing of the underlying on the day of expiry. The strike price is the level of underlying for which the Call or Put option is bought,” Jayant Manglik, President - Retail Distribution, Religare Broking Ltd told Moneycontrol.

“It means that now the difference between strike and settlement will be calculated and STT will be levied on just that, a change from the previous method when STT was calculated on the entire settlement price,” he said.

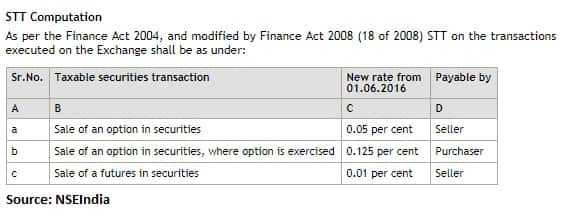

Sale of an option in securities attract STT of 0.05 percent for the seller while sale of an option in securities where the option is exercised by the purchaser is 0.125 percent, and sale of a future contract in securities attract a STT of 0.01 percent.

“The STT change is a big relief to options traders as the STT charge will no more be made on the value of the contract but on the difference between the strike price and the market price only,” Rohit Srivastava, Fund Manager - PMS, Sharekhan by BNP Paribas told Moneycontrol.

“For options that close in the money, it would not force traders to square up in the last hour of trading as was the case earlier. Most traders would try squaring up to avoid the higher STT that made it expensive to hold onto a position that was in the money ahead of expiry. Now the cost is not restrictive and once can allow it to expire in the money to lock in gains,” he said.

Amit Gupta, CEO and Co-founder TradingBells told Moneycontrol that “This is a huge relief to the markets. STT levy has been streamlined. That's a relief since now traders won't have to be worried about compulsorily squaring off in-the-money options before expiry,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.