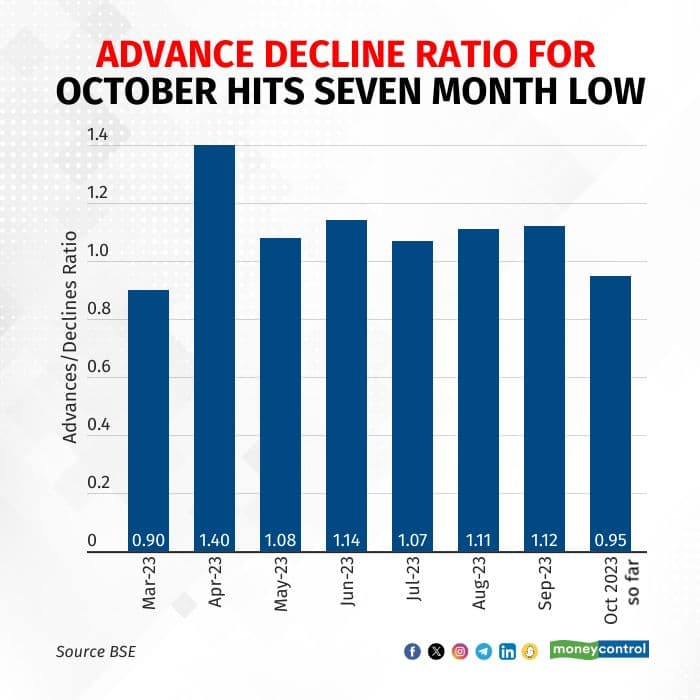

The advance-decline ratio, a widely used market breadth indicator, for BSE all listed firms for October so far fell below 1 for the first time in seven months amid a steep fall in share prices.

Analysts said this indicates that the mood is increasingly becoming bearish.

The advance-decline ratio compares the number of rising stocks to falling stocks. This has now fallen to 0.95, the lowest since March 2023. A ratio of one means that for every stock that is rising, one stock is declining. A ratio of less than one means more shares are declining than those that are gaining.

advance-decline

advance-decline

According to Anand James, Chief Market Strategist at Geojit Financial Services, the ongoing sell-off is due to concerns over expensive valuations as well as weakness in global markets.

Read: Markets likely to see a dead cat bounce in next 2-3 days, says Rohit Srivastava

Analysts have suggested that the Nifty may experience a period of considerable volatility in the coming sessions, however, the outlook is likely to remain cautious in the wake of the US Federal Reserve's forthcoming policy decision, the increase in US bond yields, and the escalating tensions in the Middle East.

Follow our blog for LIVE market action and business updates

Furthermore, brokers have noted that many high-net-worth investors have been taking advantage of the current market conditions, while foreign institutional investors have been increasingly active in the selling process rather than the buying one.

Rajesh Palviya, analysts at Axis Securities expect for the short term from a technical perspective Nifty will have strong support near the 18700-18750 zone and below the 18550-18500 which is near the 200-day moving average of 18600.

Read: As Nifty falls in the sinkhole, the trap is getting wider for Put writers

Major resistance will be seen at 19100-19200 which is also a gap area formed on the daily chart and a sustained move above the same will indicate some strength in Nifty and inching towards 19450-19500. However Long-term Investors can add fundamentally good stocks which are available at cheaper valuations, Palviya added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.