The US Federal Reserve, Bank of England and the Bank of Japan (BoJ) are all slated to announce their monetary policy decisions this week. However, while expectations of the current rates being maintained by the US Fed and the Bank of England have been priced in, all eyes are on the Japanese central bank.

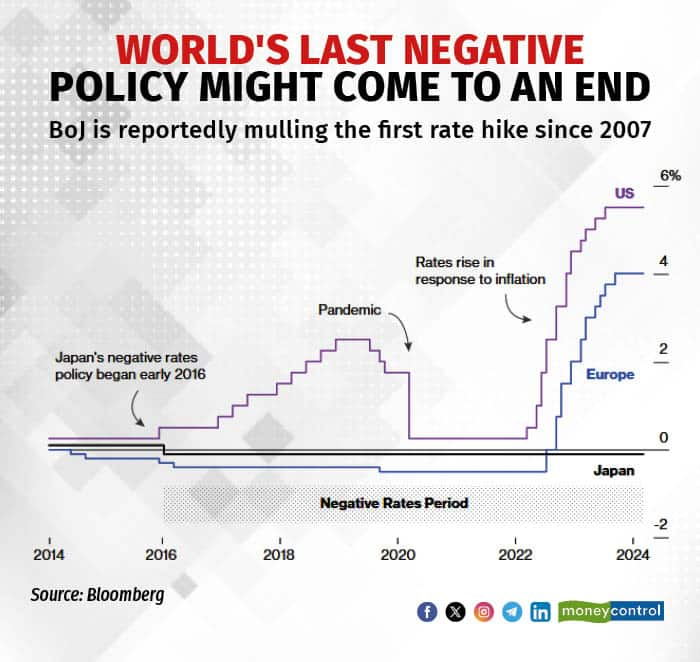

Reports suggested that Japan, touted as the last bastion of negative interest rates, will tighten its monetary policy on March 19. Following a two-day meeting, the BoJ is likely to hike its interest rate for the first time in 17 years. The policy rate could be raised by more than 10 bps to guide short-term interest to the 0-0.1 percent range.

"If we confirm that a positive wage-inflation cycle is strengthening, we can examine modifying our massive monetary easing measures," said BoJ governor Kazuo Ueda in the Japanese parliament last week, adding to the bets of Japan exiting the negative interest rate cycle.

Also Read | The trouble with narratives like Japan is back, China is over

The BoJ is the only major central bank that has not hiked borrowing costs during the current monetary policy cycle. Instead, the bank has maintained its main policy rate at minus 0.1 percent since 2016.

During a period when inflation was falling, Japanese banks lent money at very low rates to revive economic activity. But that only increased the amount of money in the system. However, over the past few months, the country’s inflation has finally settled around the 2 percent level mandated by the BoJ, with January’s core CPI coming in at 2.2 percent.

Additionally, Japanese wages are likely to see substantial hikes in the year’s wage negotiation. There is an expectation that core inflation will persist around BoJ's 2 percent target, given the robustness of labour unions’ negotiations. “Notably, major corporations such as Toyota and Nissan have offered their most substantial pay raises in decades, with other companies following suit,” said Hitesh Jain, strategist, Yes Securities India.

Japan’s GDP increased by 0.4 percent in Q4CY23 compared to -0.1 percent in Q3CY23, which further raises speculation that the BoJ is likely to increase its interest rates and discontinue its ultra-loose monetary policy.

Impact on bonds

When decoding the impact of the policy shift on bonds, experts suggest that this has already been priced in by the markets.

In a conversation with Moneycontrol, Mahendra Kumar Jajoo, CIO - Fixed Income, Mirae Asset Investment Managers (India), said, “The Bank of Japan is very late to the party. The markets might see a reaction in two cases: if the Bank of Japan adopts a hawkish stance and hints at further rate hikes or if there is no rate hike. However, currently, the Bank of Japan’s policy stance will likely have more of a domestic impact. Instead, all eyes will be on the US and the Federal Reserve, which is the mother market.”

In comparison, market expert Ajay Bagga said on social media platform X that BoJ’s move will impact markets. “The rising Japanese bond yields will lead to higher bond yields globally,” he said.

However, Jain noted that in the event of an increase in Japanese 10-year yield to 0.9 percent (from the current 0.75 percent), they would still be significantly lower (by 350-400 bps) than US yields. Similarly, major Asian markets offer comparatively higher yields. This rationale alleviates concerns that a significant shift in BoJ policy would have far reaching global implications, given its substantial holdings of foreign securities totalling $4.43 trillion.

If there are shifts in the global bond markets, Atul Parakh, CEO, Bigul, said, “The impact on Indian bonds is likely to be indirect and driven more by global market movements.”

Deepak Jasani, Head of Retail Research at HDFC Securities, said investors will closely watch as to whether the BoJ winds down its enormous buying programme for assets ranging from Japanese government bonds to listed equity funds.

The expectation is that the BoJ is expected to persist with its purchases of Japanese Government Bonds, which maintain a wide yield spread between Japanese bonds and those of other major economies.

Impact on currencies

The impact of the policy move on the Japanese yen is most likely to be positive. Higher interest rates usually attract higher inflows, as investors seek higher returns on various asset classes.

As a result of its low borrowing cost, the Japanese yen was the currency of choice employed in the “carry trade” forex strategy. Simply put, the carry trade strategy is global funds borrowing in yen and deploying them in currencies, bonds, or equity markets that can give them higher returns.

As the yen appreciates it will lead to lower returns on the carry trade strategies employed by traders across the world. While this will have an impact on currency pairs, such as USDJPY or AUDJPY, there will be a minimal impact on the Indian rupee, according to Kunal Sodhani, Shinhan Bank.

“This ‘carry trade’ impact will take some time and more rate hikes to work through global fund flows. Being the first hike since 2007, we are in uncharted territory with the BOJ rate hikes,” said Ajay Bagga on X.

Impact on equities

After scaling to 30-year highs earlier this month, Japan's frontline index Nikkei 225 has pared its gains. However, the move will have a negative impact on Japanese equities, as other asset classes will gain attractiveness.

As the yen gains, the export oriented large-cap firms could see stress, further causing pressure on the Japanese equity indices. Parakh said, “Global equity markets could experience volatility as investors re-price risk assets based on the BoJ's policy guidance.”

“Weakness in Japanese stocks, which have been outperformers for more than a year, will transmit into weakness in global stocks, as the correlation with the developed markets, especially with the US stock markets, is strong,” said Bagga on X.

If the rate hikes continue it could have significant implications for global financial markets. Jasani said that the US stock market, which is sensitive to international monetary policies, may experience heightened volatility if the BoJ continues to raise rates.

In a contrasting opinion, Shrikant Chouhan, Head - Equity Research, Kotak Securities noted that if the BoJ exits the negative rate policy it would have little negative impact on equities. “However, if the BoJ keeps rates unchanged it will have a positive impact on equities in the short term, but the fear of rate hikes will remain high.”

Rajesh Sinha, Senior Research Analyst, Bonanza Portfolio, said there could be an impact on Nikkei 225, but there will not be much of an impact on the global markets.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.