The bull frenzy around Bajaj Housing Finance, which saw overwhelming demand in the primary market and a blockbuster debut on the bourses shows no signs of slowing down. With the stock soaring 159 percent above its issue price of Rs 70, the Street is largely bullish, predicting an additional 24 percent upside from current levels (Rs 181). Brokerages have also initiated 'buy' calls, citing management's strong pedigree to position it as the next 'HDFC' coupled with its superior asset quality and AUM growth versus peers.

Narinder Wadhwa, Managing Director of SKI Capital, has set a target price of Rs 225 for Bajaj Housing Finance, driven by confidence in its future earnings and growth. He believes the company could benefit from the HDFC-HDFC Bank merger by tapping into the land financing market previously dominated by HDFC.

Phillip Capital also sees a 16 percent upside for Bajaj Housing Finance. They highlighted that the company's popular loan size of Rs 50 lakh, which covers nearly 65 percent of home loan originations in India will be a gamechanger. They project that in the next three years, Bajaj Housing's balance sheet could grow to Rs 2 lakh crore from present Rs 81,830 crore (as of FY24), valuing it at 6.5 times its expected book value for September 2026. The brokerage firm was the first to initiate a 'buy' rating on the stock.

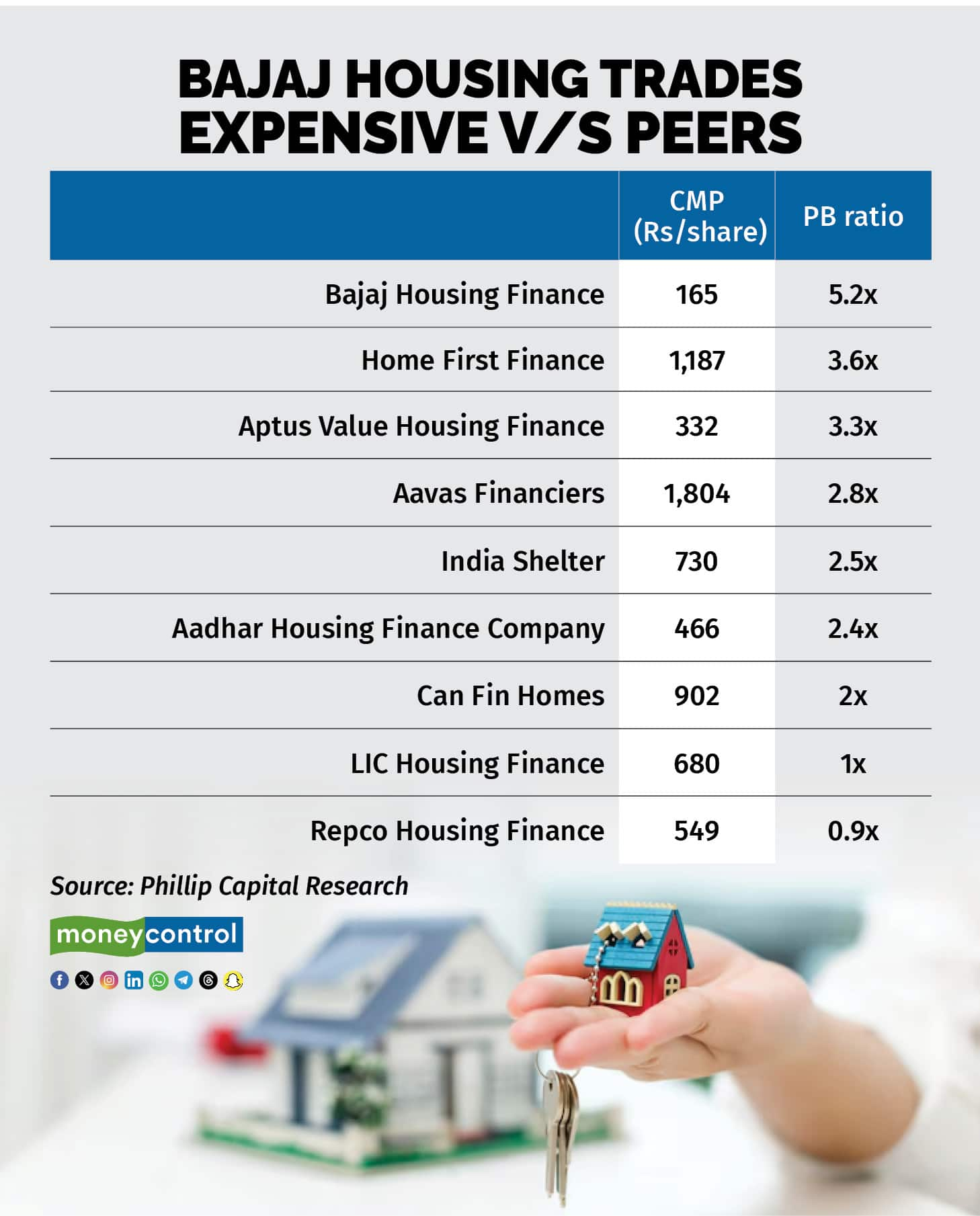

Are Bajaj Housing's premium valuations justified?After listing, Bajaj Housing Finance traded at a price-to-book (PB) ratio of 5.2x, significantly higher than its peers: Home First Finance at 3.6x, Aptus Home Finance at 3.3x, Aavas Financiers at 2.8x, Aadhar Housing Finance at 2.4x, and LIC Housing Finance at 1x.

While there may be some near-term consolidation in the stock, Jignesh Shial, head of the BFSI sector at InCred Capital, expects Bajaj Housing Finance to maintain a premium valuation. This is due to its anticipated 30 percent annual growth in assets under management (AUM) over the next few years.

Shial further explained that increased investor activity in Bajaj Housing Finance was seen as only 12 percent of shares were available for public trading, while 88 percent remained with its parent, Bajaj Finance. This limited supply, combined with high demand, pushed the company's market capitalisation to Rs 1.51 lakh crore, surpassing the combined market cap of HUDCO, LIC Housing Finance, and PNB Housing Finance.

Hived off from Bajaj Finance in 2018, Bajaj Housing Finance is dedicated to focus on India's expansive housing market. Within just seven years, the company exhibited industry-leading superior asset quality and stable margin despite intense competition. Remarkably, its AUM grew to over one-third the size of LIC Housing Finance, India’s largest mortgage lender, which has been operating for more than three decades.

In FY24, Bajaj Housing Finance reported a net non-performing assets (NPA) ratio of just 0.1 percent, significantly lower than its competitors. In comparison, LIC Housing Finance posted a net NPA ratio of 1.68 percent, PNB Housing Finance recorded 0.92 percent, and HUDCO reported 0.3 percent. Additionally, Bajaj Housing Finance maintained a strong net interest margin (NIM) of 4 percent, surpassing LIC Housing Finance's 2.7 percent, PNB Housing's 3.65 percent, and HUDCO's 3 percent.

Looking ahead, Bajaj Housing Finance’s management aims to build a low-risk, sustainable balance sheet with an increased focus on salaried housing loans. The company also plans to expand its reach across India, particularly in tier II and tier III cities, by leveraging technology, including AI and digital channels, to enhance customer access.

According to Phillip Capital analysts, Bajaj Housing Finance is on track to achieve a balance sheet exceeding Rs 2 lakh crore within three years. With a projected gross NPA (GNPA) of 0.6-0.8 percent, credit costs are expected to remain low in the near term. Combined with its focus on a low-risk strategy, this is expected to result in a return on assets (RoA) of 2 percent and return on equity (RoE) of 12 percent between FY25 and FY27.

Bajaj Housing Finance’s IPO set several records, being subscribed 64 times on the final day of bidding and attracting bids worth nearly Rs 3.23 lakh crore—the highest-ever demand in the history of the Indian primary market. The stock also hit upper circuit for two consecutive days, delivering a 159 percent gain over its issue price of Rs 70.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.