Ace investor Ashish Rameshchandra Kacholia has picked more than 2 percent stake in silica ramming mass manufacturer Raghav Productivity Enhancers, earlier known as Raghav Ramming Mass, via an open-market transaction on November 4.

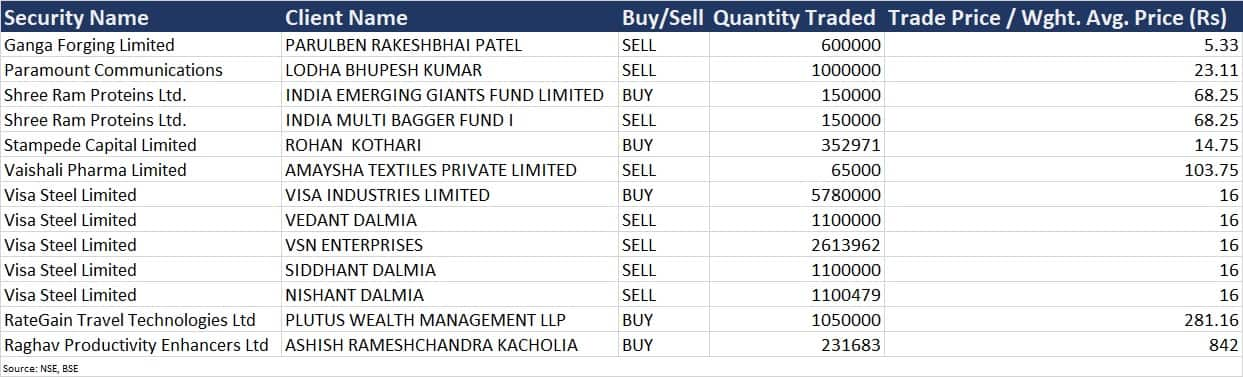

Per the bulk deals data available with the exchanges, Kacholia has bought 2.31 lakh shares in the company on the BSE. The average buying price for these shares was Rs 842 per.

The buying price was an intraday low that the stock had touched in early trades on Friday, November 4. It then picked up pace and traded higher through the session to hit a day's high of Rs 984.

It closed at Rs 954 on the BSE, up 12.29 percent with a volume of 6.57 lakh shares. The stock has rallied significantly since October 14 this year, gaining more than 70 percent in a short span of time.

Raghav Productivity Enhancers is a producer of ramming mass mineral, which is a refractory material used in induction furnaces. The company has recorded a 42 percent year-on-year (YoY) growth in consolidated profit at Rs 6.17 crore, backed by a strong topline as well as operating performance.

At Rs 35.87 crore, consolidated revenue for the quarter increased by 50.3 percent, and EBITDA (earnings before interest, taxes, depreciation, and amortisation) jumped 55 percent, to Rs 8.81 crore, compared to the year-ago period. The EBITDA margin expanded by 77 basis points (bps) on-year to 24.55 percent for the September FY23 quarter.

Sequentially as well, the company has reported strong numbers. It has registered nearly 16 percent growth in profit and 7.5 percent increase in revenue for the quarter ended September FY23. On the operating front, its EBITDA grew by 14.6 percent and the margin rose by 1.5 percentage points.

Among other bulk deals, Plutus Wealth Management LLP acquired an additional 10.5 lakh shares in RateGain Travel Technologies, which provides SaaS solutions for the travel and hospitality sectors.

Plutus Wealth, which bought the shares at an average price of Rs 281.16 per share, already held 4.39 percent stake (47.5 lakh shares) in the company as of September 2022.

India Emerging Giants Fund bought 1.5 lakh shares in cottonseed processing company Shree Ram Proteins at an average price of Rs 68.25 per share. India Multi-Bagger Fund I was the seller for these shares.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.