Mainboard, and small and medium enterprises (SMEs) stocks listed in fiscal year 2024 with premiums are retracting gains in line with the decline in the Indian equity market. The shares of one-third of companies listed in FY24 now trade below their issue price.

BSE data showed that 73 Indian mainboard companies raised a total of over Rs 60,000 crore in the primary market in FY24. Twenty-six of these 73 companies are trading below their offer price. These IPOs heavily oversubscribed included Credo Brands Marketing by over 51 times, EPACK Durable by 17 times, Muthoot Microfin by 13 times, Capital Small Finance Bank by four times, and GPT Healthcare by eight times.

On the SME front, 177 firms raised over Rs 5,100 crore, and 57 of these are now trading below their issue price. These issues were overbought two to 18 times.

Analysts said many initial public offerings (IPOs) debuted at a premium, leaving little room for investors in a bullish market. While many of these companies enjoyed rich valuations, their less-than-stellar corporate performance as reflected in the earnings suggests limited upside, leading to potential profit booking.

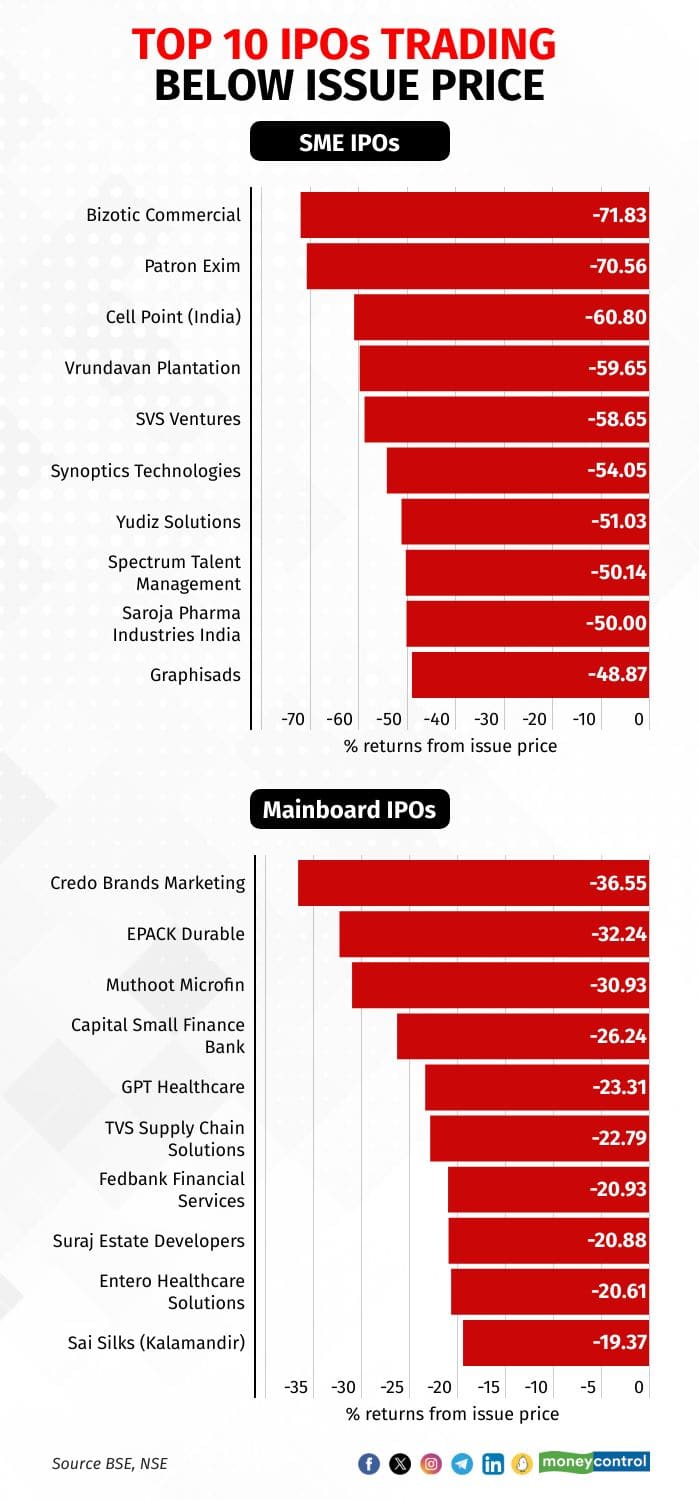

On the mainboard, Credo Brands Marketing, EPACK Durables and Muthoot Microfin are among the top losers, experiencing drops of around 36, 32 and 31 percent, respectively, from their issue prices. Others include Capital Small Finance Bank, GPT Healthcare, TVS Supply Chain Solutions, Fedbank Financial Services, Suraj Estate Developers and Entero Healthcare Solutions, which saw stock declines ranging from 20 percent to 26 percent.

Among SME IPOs, Bizotic Commercial recorded the steepest decline, plummeting 72 percent from its issue price. Patron Exim and Cell Point India followed, dropping 71 percent and 61 percent, respectively. Others on the list included Vrundavan Plantation, SVS Ventures, Synoptics Technologies, Yudiz Solutions, Spectrum Talent Management and Saroja Pharma Industries India, dropping between 50 percent and 60 percent from their issue prices.

Ambareesh Baliga, an independent market expert, said during an IPO boom, a focus on oversubscription and listing prices overshadows valuations. Investors in such situations tend to put in applications for shares without adequate research. However, when market dynamics change, interested parties may aim for oversubscription to generate enthusiasm. It's crucial during the public offering to assess if genuine buyers are present in the markets, a consideration often overlooked.

In January, the Securities and Exchange Bureau of India (SEB) said that it was investigating mule accounts and the submission of faulty IPO applications to create a false impression of high subscription levels. SEBI chairperson Madhabi Puri Buch disclosed the examination of three cases but didn't specify details or whether they pertain to mainboard or SME IPOs. Expressing dissatisfaction with observed malpractices, she hinted at involvement by certain merchant bankers and emphasised the need for more data.

Some analysts say that in some cases, those monitoring listing counters exit when retail investors enter, wiping out the initial high openings. Additionally, investors focused on oversubscription may face scams such as artificially inflated applications getting rejected, allowing retail investors to receive allotments instead.

Recently, Buch also acknowledged signs of manipulation in the SME segment. She mentioned the regulator's ability to identify manipulation patterns through technology and the feedback received from market participants. Despite having the necessary information, regulatory action is pending as the regulator aims to build a robust case. Buch highlighted SEBI's efforts to create a more facilitative listing environment for SMEs, recognising their challenges in complying with the stringent requirements.

Deepak Jasani, head of retail research, HDFC securities, said that so long as the market remains soft and the regulators remain issuing cautions, mainboard IPOs could get a lukewarm response. This may result in some of them getting postponed and some others seeing a downward revision in their issue price. SME IPOs, due to their small sizes, continue to be liable to manipulation/oversubscription till the time the regulator brings in stricter regulations.

Harshad Borawake, Head of Research & Fund Manager, Mirae Asset Investment Managers, noted that SEBI’s steps should not deter the investor confidence and they should continue to focus on business fundamentals and valuations before investing.

“The market will judge each company on its merit. Companies that came to the market riding on good fundamentals, strong earnings track record, reliable business model, experienced management, and strong corporate governance, will be rewarded by the market. Those having issues on these fronts will be punished by the market sooner or later,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.