For investors who track the broad market indices, it looks like a small scratch, but take a broader view and the blood on the street becomes apparent.

The widely-followed Nifty is trading just 5.2 percent lower than its highs, but the number of stocks touching new depths has been continuously increasing.

Indian markets have seen continued selling by foreign institutional investors (FII) with the overall outflow from the debt and equity markets touching a decade-high level. FIIs sold equities worth Rs 6,000 crore and debt of over Rs 41,000 crore, the highest since 2009.

With crude oil crossing the $75 a barrel and rupee touching a new lifetime low one cannot blame the FIIs for leaving. Add to that the trade wars now roiling the world, and we are looking at uncertain times not conducive for any investor.

Given this scenario, we did a deep dive to assess the structural damage to the market. Here are five charts that highlight what’s going wrong:

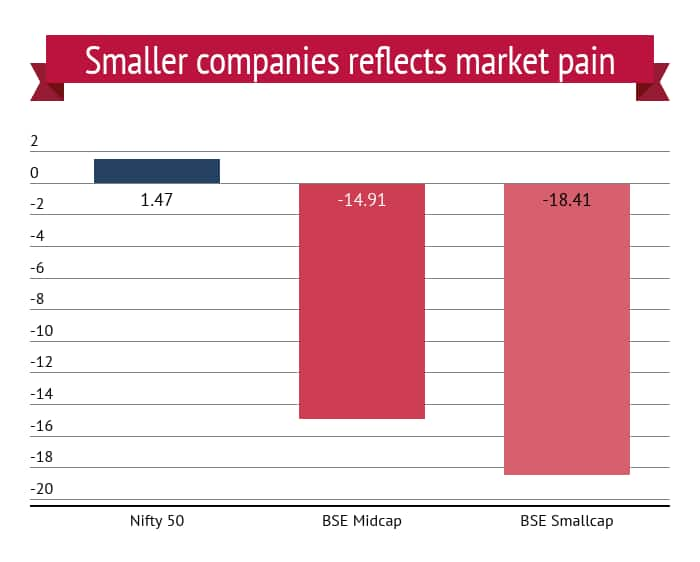

- Small becomes smaller: Stress in the economy has been felt on the small and mid-cap stocks, which largely cater to the domestic market. Accordingly, small and mid-cap indices have taken severe blows. Further, various regulations introduced by the finance ministry and the market regulator Sebi have affected the smaller companies more. Add to that the fact that the auditors have started asking questions from companies about the truth behind the numbers, and you have a perfect mix of toxic factors for the smaller stocks.

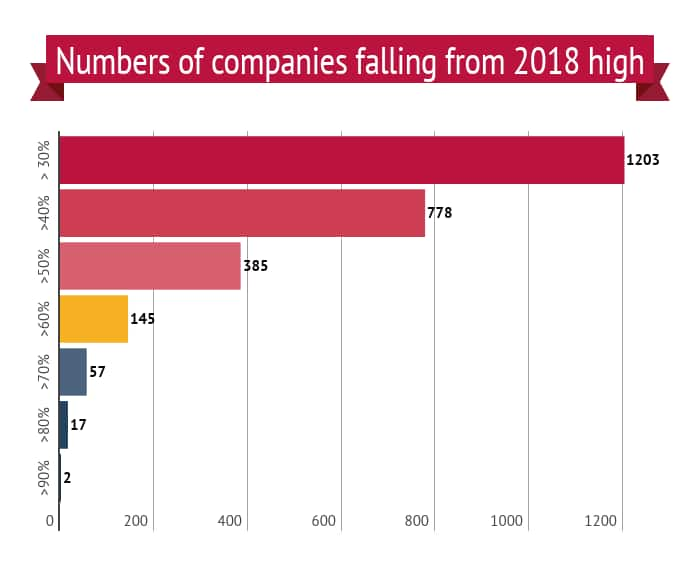

- All (almost) fall down: While the indices have shown strength, nearly 60 percent of the market has fallen by over 30 percent from its highs. The damage to the market is not only broad but also deep. With the market regulator now rolling up its sleeves to filter out companies trading on high valuations, some of these stocks are unlikely to see the price from where they have fallen anytime soon.

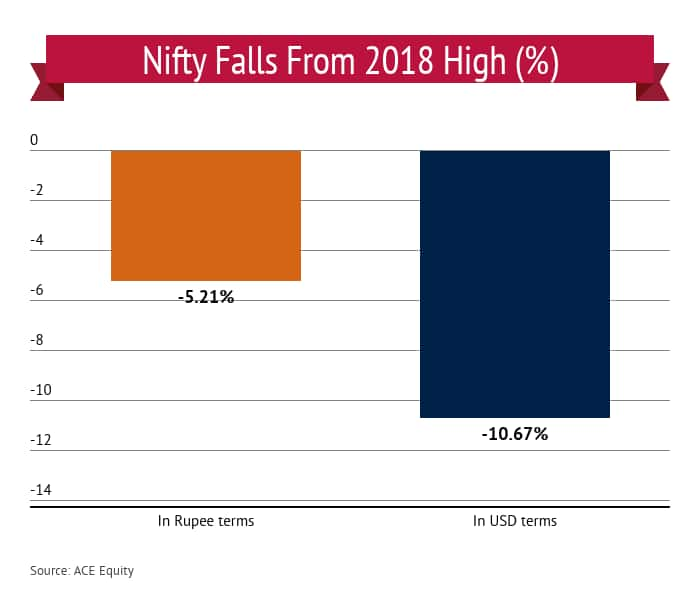

- FIIs hit the most: It started as a trickle but is now an exodus. FIIs are leaving by the truckload and who can blame them, given the uncertainty across the globe. This phenomenon is not restricted to India alone but all emerging markets. Investors in emerging markets have lost $2.2 trillion in the last six months as FII withdrawal touched a 54-month high. The MSCI Emerging market index has fallen by 18 percent during this time. But for FIIs, especially in India, it has been a double whammy. A falling rupee meant that impact of the market slide was more severe. Even if we take the broad market in rupee and dollar terms, FIIs who count their money in dollars have been hit twice as much as their Indian counterparts who invest in rupees.

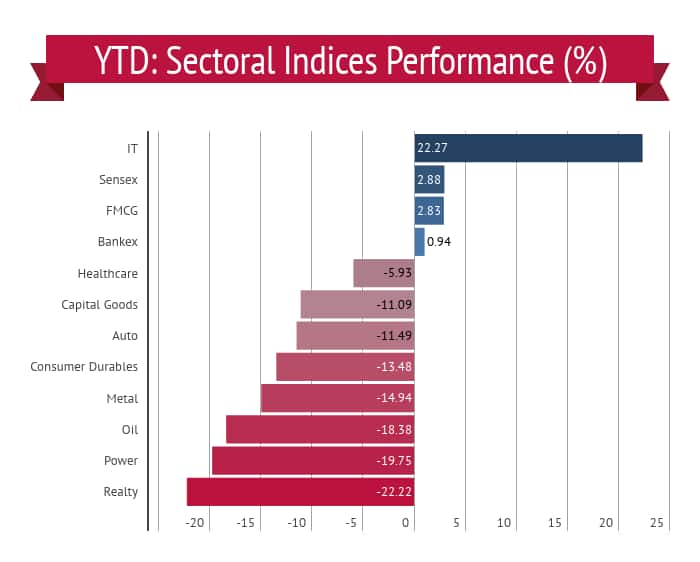

- Most sectors in red: The depth of the weakness in the market can be seen from the sectors that have taken the brunt. IT has been the single sector that has saved the market from an embarrassing performance. Though Bankex is also showing a positive return for the year the real reason behind it has been a superior performance by some private sector banks like HDFC Bank and Kotak Bank.

- A few stocks holding the market: Even the broad indices, it is only a handful of stocks that have been holding the market. Apart from IT and private sector banks, Reliance and the FMCG pack have done most of the heavy lifting.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.