The Nifty50 rallied about 3.5 percent in the month of October on the back of various measures taken by the government to revive the economy and kick-start investment cycle, as well as, positive global cues on the trade war front.

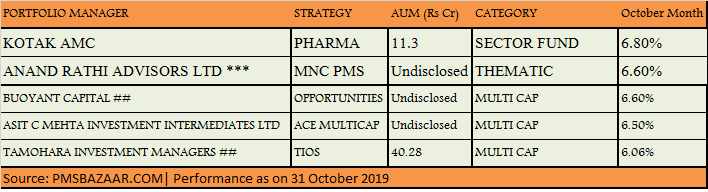

In the same time, around 39 PMS schemes managed to outperform the index with Kotak AMC’s Pharma fund topping the list, returning 6.8 percent during the month gone by, data collated by Pmsbazaar.com, an online portal used for PMS comparison, showed.

The investment objective of the Kotak AMC Pharma sectoral fund is to generate capital appreciation through investments in equities with a medium to long-term perspective. The strategy is to invest in pharma and healthcare-related companies with 10-20 stocks.

The fund not only outperformed the Nifty50 in October but also the Nifty Pharma index which rose 4.3 percent in the same period.

Portfolio Management Services cater to wealthy investors with portfolio sizes exceeding Rs 25 lakh. The professional fee charged by them is slightly higher than regular mutual funds (MFs).

Four other funds from thematic and multicap space managed to generate over 6 percent return. These include Anand Rathi Advisors MNC PMS (6.6 percent), Buoyant Capital Opportunities fund (6.6 percent), Asit C Mehta’s ACE Multicap (6.5 percent), and Tamohara Investment Managers’ TIOS (6.06 percent).

Largecap Outperformers:

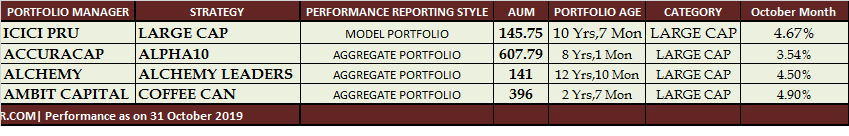

Under the largecap category, as many as 4 stocks outperformed Nifty50 in October which include Ambit Capital’s Coffee Can, followed by ICICI Prudential Large Cap, Alchemy Leaders, and Accuracap’s Alpha 10.

Ambit Coffee Can PMS invests in equities focusing on the ability of a business to deliver consistently healthy growth and ROCE over a long time.

The Coffee Can philosophy has consistent growth of revenues in excess of 10 percent YoY for a decade or more and has delivered ROCE of over 15 percent on a YoY basis for a decade or more.

ICICI Prudential Largecap is a diversified equity portfolio that endeavours to achieve capital appreciation in Indian companies or sectors with the potential for growth.

Alchemy Capital Management Largecap Leaders invests 75 percent in largecaps/diversified businesses and focuses on 12-15 growth companies who are leaders in the field.

Acuracap’s Alpha 10 fund has a diversified portfolio comprising of 12-35 high-quality companies with an intelligent ranking algorithm. It has a strong focus on business fundamentals and risk management.

Multicap Outperformers:

There are as many as 25 PMSes under the multicap category which outperformed Nifty in October. These include Buoyant Capital, Asit C Mehta, Tamohara Investment Managers, O3 Securities, Marcellus, Prabhudas Lilladher, Sundaram AMC, among others.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.