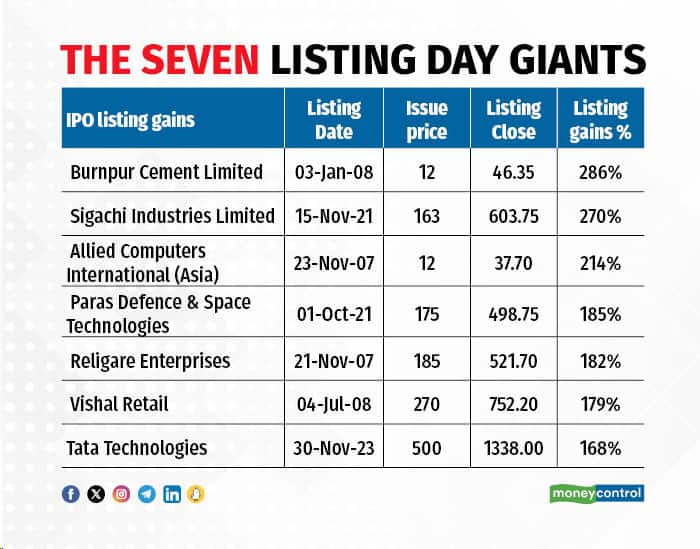

The Tata Technologies stock surged around 168 percent from its issue price, making it the seventh highest-listed company in India. The stock opened with a 140 percent premium and traded at Rs 1,334 on the BSE, up 168 percent from its issue price, within minutes.

Burnpur Cement had recorded the biggest single-day rise on the listing day, shooting up more than 286 percent in January 2008, followed by Sigachi Industries Ltd, which was up 270 percent on listing in November 2021, and Allied Computers International (Asia) that jumped 214 percent in November 2007.

Paras Defence and Space Technologies had surged 185 percent, Religare Enterprises Ltd 182 percent, and Vishal Retail Ltd 179 percent on their respective listing days respectively in October 2021, November 2007, and in July 2008.

Read: With Nifty above 20k, time to move money from smallcap to large stocks, say fund managers

Cut to the present day, when Tata Tech entered the league. Burnpur Cement was trading around 41 percent below the issue price, while Sigachi Industries was up 286 percent from its issue price. Allied Computers International, the third on the list, however, faces trading restrictions due to non-payment of annual listing fees, violating Sebi norms and exchange regulations, according to the BSE.

Paras Defence was up 300 percent on November 30, 2023 from its issue price, while Religare Enterprises traded 17.4 above the IPO price, and Vishal Retail was down 15 percent.

The public issue of Tata Technologies Ltd IPO ran from November 22 to 24, raising approximately Rs 3,042 crore at an issue price of Rs 500 per share. The public offer was oversubscribed by 69.43 times. The stock traded at a P/E multiple of 75.6x intraday on November 30, aligning with its industry peers. Analysts recommend short-term investors should consider booking profits.

Read: India’s bull market is underpinned, it could be a 40-year story: Ridham Desai

Moneycontrol recently reported significant stock price fluctuations in Vietnamese EV manufacturer Vinfast, one of the a top five clients of Tata Technologies. Vinfast, along with Jaguar Land Rover (JLR) at Tata Motors, contributes substantially to the Tata Group company's topline. In the first half of FY24, approximately 57 percent of the overall revenue and 71 percent of service revenue came from the five anchor clients.

Vinfast has been a client of Tata Tech since 2018. But analysts have recently expressed concerns about Vinfast's Nasdaq-listed status due to related party-driven EV sales, high valuations, and declining customer interest.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.