It’s almost human nature to root for the underdog. After all, who doesn’t love a David versus Goliath story? With the flurry of recent listings, a new version of this narrative is set to unfold on the bourses: the upcoming debut of retail player Vishal Mega Mart (VMM) against the incumbent consumption major Avenue Supermarts, which houses the DMart retail chain.

Both diversified retail players follow a similar business model: discounted grocery offerings. But how does David, with a market cap of ₹35,200 crore, stack up against the ₹2.2 lakh crore behemoth?

Size matters

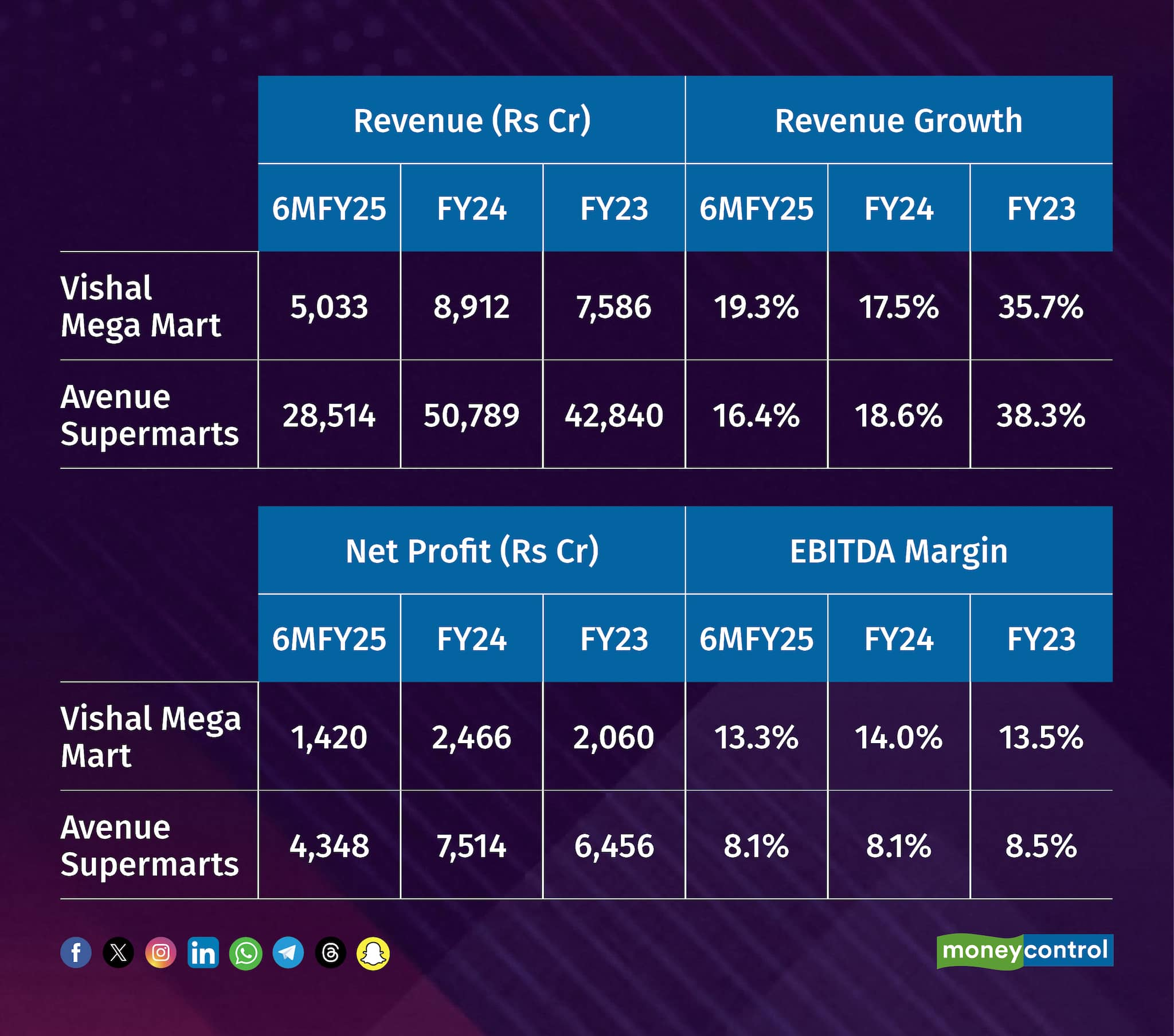

In terms of size, Goliath remains Goliath. Thanks to its long-standing presence, DMart’s sales and net profit far outweigh those of Vishal Mega Mart. DMart clocked ₹50,788 crore in sales in FY24 compared to ₹8,911 crore for VMM.

However, profitability tells a different story. Despite having only one-fifth of DMart’s sales, VMM’s profits are nearly a third of its larger rival, thanks to significantly higher operating profit margins of 14% compared to DMart’s 8%.

Growth – all the same

Both companies are growing at similar rates, though VMM has edged ahead in recent quarters. DMart’s strategy involves setting up fewer but larger stores in concentrated areas, while VMM focuses on smaller stores spread across the country.

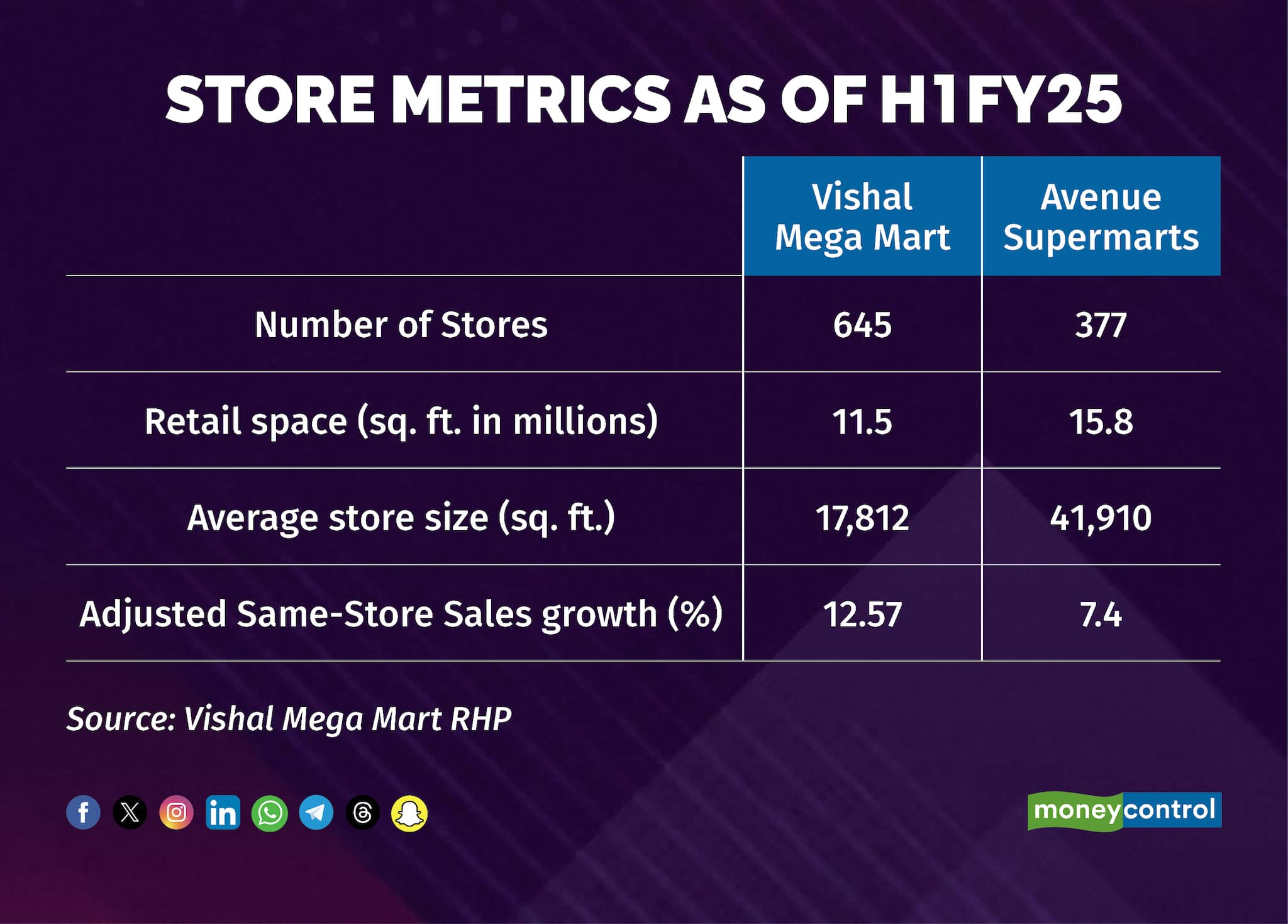

By September 30, 2024, VMM boasted 645 stores, compared to DMart’s 377. However, DMart operates on a larger scale, with an average store size of 41,910 square feet compared to 17,812 square feet for VMM.

Ultimately, both companies aim to achieve growth by adding new stores and driving higher sales from existing ones, known as Same Store Sales Growth (SSSG). Analysts reckon that DMart’s focus is more on increasing SSSG – it has increased average store size by 20% over the past two years; its mature stores now make up 80% of the mix, up from ~72% pre-COVID.

Analysts at Nuvama Institutional Equities estimate Avenue Supermarts will achieve an SSSG of 9% in FY25 and add 45 stores.

In contrast, VMM is opening smaller stores, with 451 of its 645 stores located in Tier-2 and below areas. It plans to expand into cities with populations exceeding 50,000, a largely untapped market for organized retail.

A significant portion of VMM’s revenue comes from Uttar Pradesh, Karnataka, and Assam, while DMart’s revenue is heavily concentrated in Maharashtra and Gujarat.

Profitability – the main differentiator

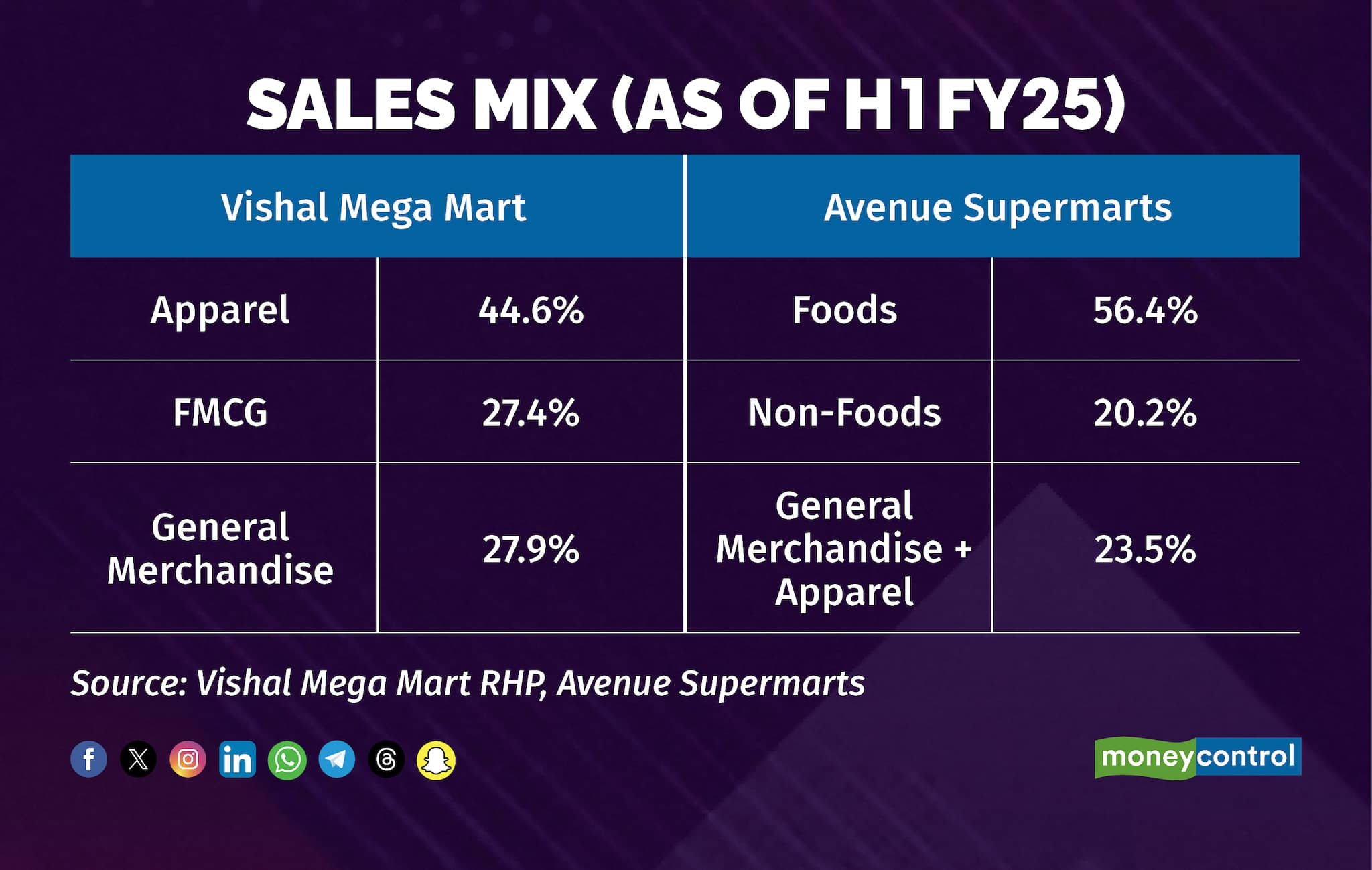

General merchandise (GM) and apparel contribute roughly 72.5% to VMM’s sales mix but only 23.5% to DMart’s revenue. These segments are more margin-accretive than groceries and FMCG items. According to its prospectus, VMM highlighted that gross margins in fashion and GM are 800-1,200 basis points and 400-600 basis points higher, respectively, than in grocery.

While DMart’s focus on FMCG ensures rapid turnover, the company is pivoting toward private label offerings to improve margins. VMM already derives 71.8% of its sales from its own brands, contributing ₹6,399 crore to total revenue in FY24.

Who should you bet on

VMM’s focus on private labels and non-grocery segments gives it significantly higher operating margins. However, DMart excels in return ratios, boasting a return on net worth of 13.56% compared to VMM’s 8.18%. Analysts believe DMart’s capital-efficient business model drives better returns on equity, a key determinant of valuations.

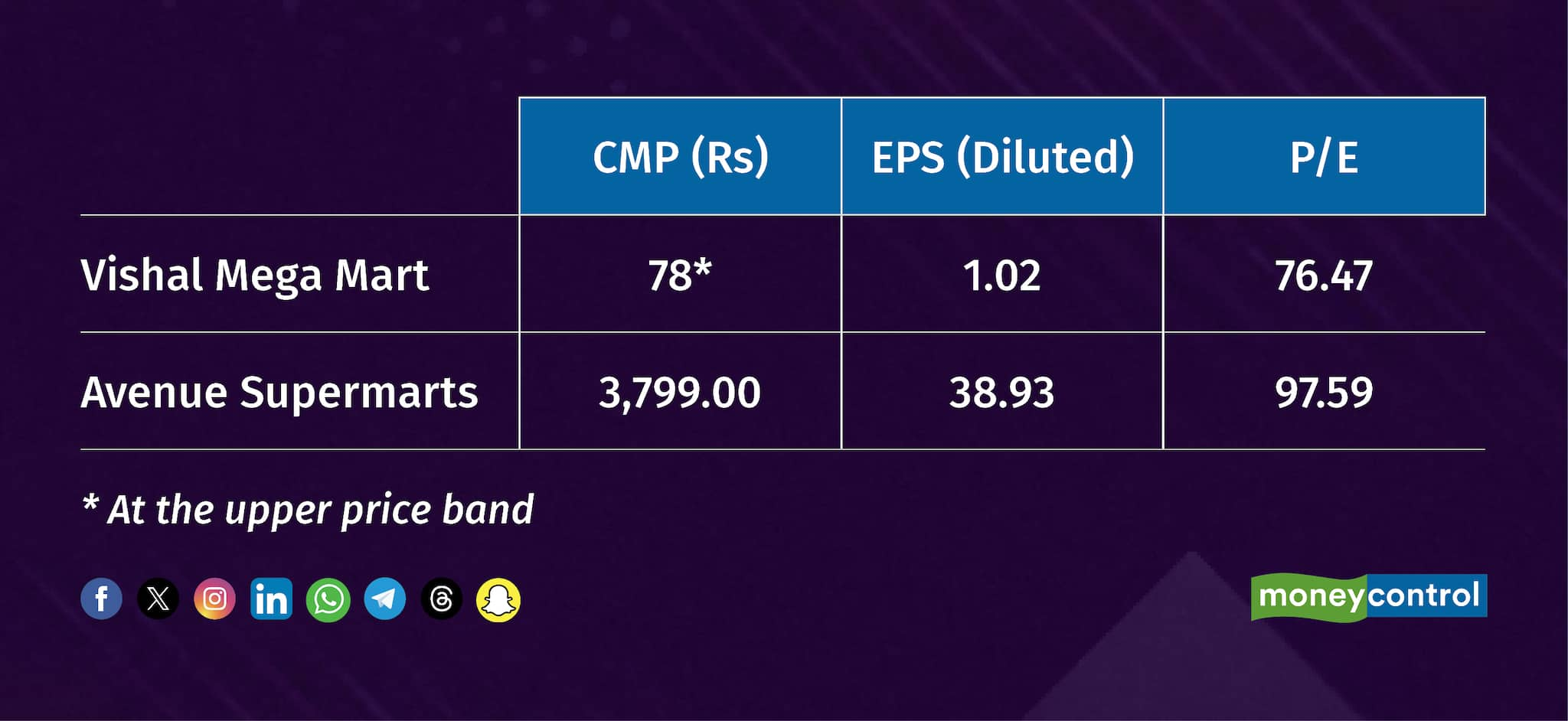

Now, the big question: which stock offers better value? VMM’s IPO is priced at 76x FY24 earnings, compared to DMart’s P/E of 97x. Analysts feel this price differential is justified given DMart’s superior business model and focus on capital efficiency. However, VMM’s near-term growth prospects could lead to better traction for the stock on the bourses.

“We are expecting a 50% growth in EPS for VMM in FY26,” said Lemonn, a broking application. “The IPO’s valuation at 76x FY24 P/E makes it relatively affordable compared to peers and offers a promising opportunity for retail investors,” noted the analysts.

With steady growth in its top and bottom lines, expanding store count, and visible near-term growth, many brokerages have issued a ‘subscribe’ rating for VMM’s IPO.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.