Sajjan Jindal-owned JSW Infrastructure’s Rs 2,800 crore IPO opened for subscription on September 25 and the offer will close on September 27. The price band has been fixed at Rs 113-119 per share. Ahead of the IPO, the company raised Rs 1,260 crore from 65 anchor investors on September 22. Let’s look at JSW Infra’s financial performance, return ratios, shareholding pattern, ports and terminals and its comparison with Adani Ports & Special Economic Zone in five charts.

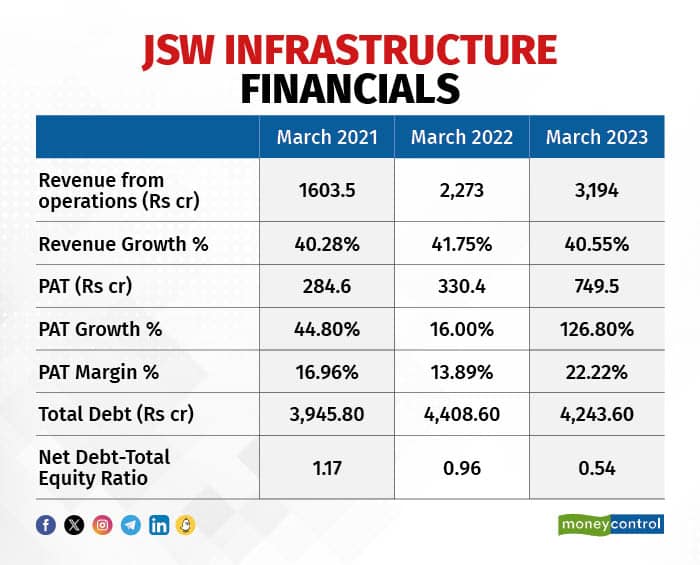

JSW Infra’s revenue from operations rose 40.55 percent year-on-year to Rs 3,194 crore in March 2023 from Rs 2,273 crore in the year-ago period. Profit after tax jumped 126.8 percent YoY to Rs 749. 5 crore in FY23 from Rs 330.4 crore in FY22.

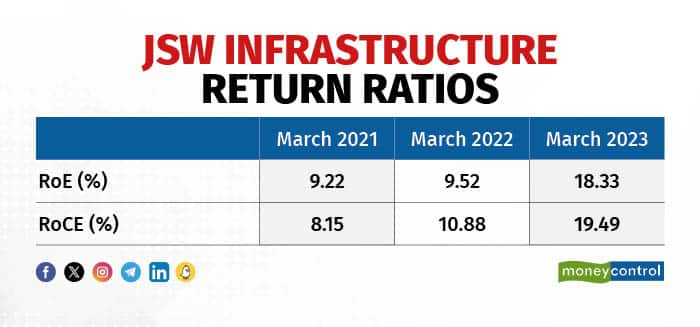

JSW Infra’s return on equity (RoE) in March 2022 and March 2023 were 9.52 percent and 18.33 percent, respectively. While the return on capital employed (RoCE) was 19.49 percent in March 2023, compared to 10.88 percent in March 2022.

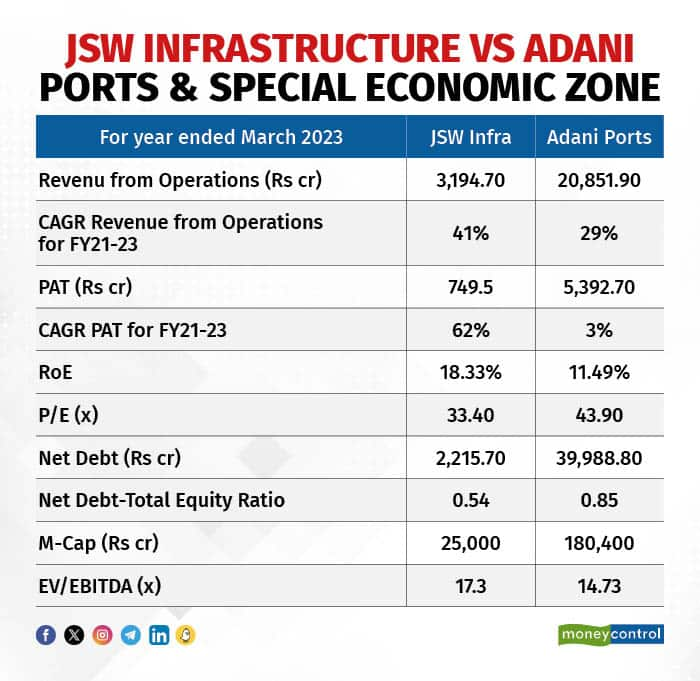

JSW Infra reported revenue from operations at Rs 3,194 crore in FY23 while Adani Ports’ revenue came in at Rs 20,851.9 crore in the same period. JSW Infra’s revenue from operations recorded a CAGR of 41 percent during FY21-23 compared to Adani Ports’ CAGR of 29 percent.

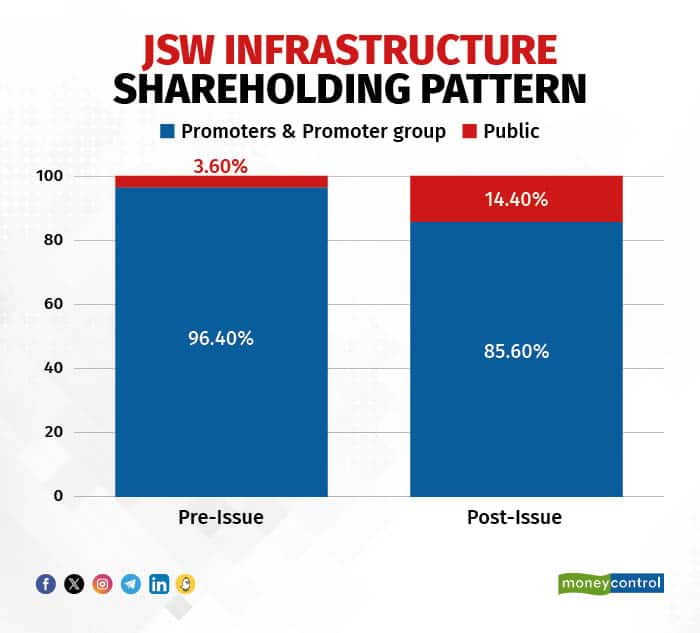

Pre-issue, the promoter and promoter group held a 96.4 percent stake in JSW Infra while the public owned 3.6 percent. However, post-issue, the promoter stake will come down to 85.6 percent and public stake will increase to 14.4 percent.

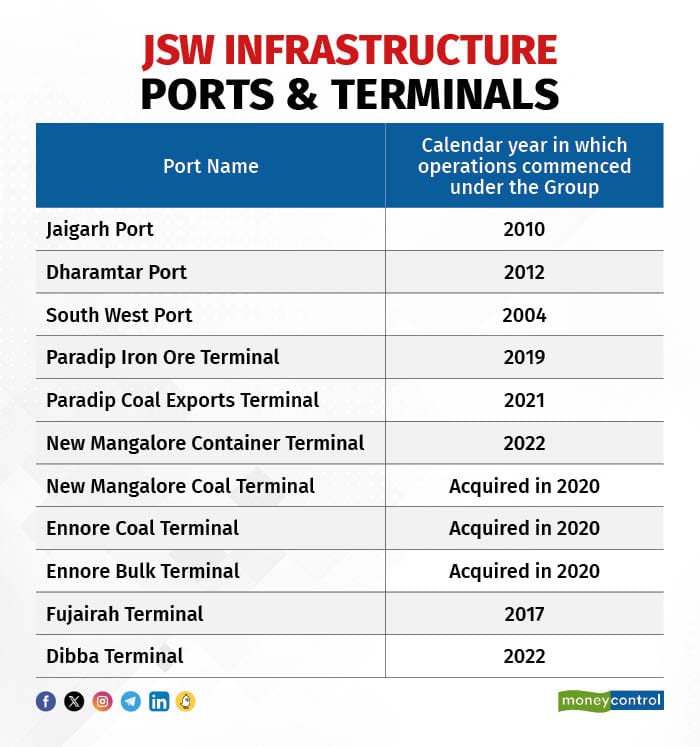

JSW Infrastructure, as of June 30, 2023, operates two ports and seven terminals. It also operates terminals under O&M arrangements in the UAE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.