Navi Mumbai-based surfactants manufacturer Galaxy Surfactants is set to launch its initial public offer for subscription on January 29, with a price band of Rs 1,470-1,480 per share.

Bids can be made for minimum of 10 equity shares and in multiples of 10 shares thereafter.

Equity shares are proposed to be listed on BSE and NSE. ICICI Securities, Edelweiss Financial Services and JM Financial Institutional Securities are the book running lead managers to the issue.

Here are 10 things that you should know before subscribing the issue:-

Company Profile

The company is one of India’s leading manufacturers of surfactants and other speciality ingredients for personal care and home care industries. Its products are mainly use in a host of consumer-centric personal care and home care products including skin care, oral care, hair care, cosmetics, toiletries and detergent products.

Currently, its product portfolio comprises over 200 product grades (45 are performance surfactants and 155 are speciality care products), which are marketed to more than 1,700 customers in over 70 countries.

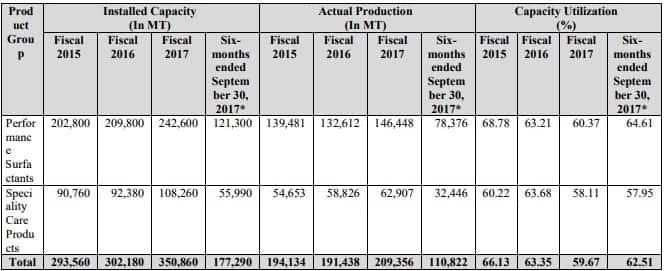

Capacity and Utilisation

Galaxy Surfactants which commenced operations as a local supplier to FMCG companies in India, has diversified customer base currently comprises multinational, regional and local FMCG companies, including, Cavinkare Private Limited, Colgate-Palmolive (India) Limited, Dabur India Limited, Henkel, Himalaya, L’ORÉAL, Procter & Gamble, Reckitt Benckiser, Ayur Herbals (Private) Limited, Jyothy Laboratories Limited and Unilever.

At present, company has 7 strategically-located manufacturing facilities, out of which 5 are located in India and 2 are located overseas.

Corporate Structure

The company had paid dividend for last five financial years - Rs 6 per share each for FY17 & FY16, Rs 4 per share each for FY15 & FY14, and Re 1 per share for FY13 on face value of Rs 10 per share.

About the Issue

Galaxy Surfactants' 63,31,674 equity shares IPO will close on January 31, 2018. It is a complete offer for sale issue from selling shareholders who are promoter and promoter group.

The issue comprises of an offer of sale of up to 39,250 equity shares by promoter Sudhir Dattaram Patil and up to 21,07,804 equity shares by 15 promoter group selling shareholders, including main promoters Gopalkrishnan Ramakrishnan, Sudhir Dattaram Patil, Unnathan Shekhar and Shashikant Rayappa Shanbhag & his wife.

It also comprises of offer for sale of up to 41,84,620 equity shares by 291 other selling shareholders and together with the promoter selling shareholder and promoter group selling shareholders.

The company aims to raise Rs 930.75-937.08 crore at a price band of Rs 1,470-1,480 per share. Out of which, it already garnered Rs 281.13 crore from 33 anchor investors at Rs 1480 per share on January 25.

Objects of the Issue

The main objects of the offer are to achieve the benefits of listing the equity shares on the stock exchanges and the sale of equity shares by the selling shareholders.

Hence, Galaxy will not directly receive any proceeds of the offer and all the proceeds of the offer will go to the selling shareholders.

Strengths

It is an established global supplier to major FMCG brands with demonstrated track record;

It has robust product portfolio to address the needs of a diverse range of customers and applications;

Its emphasis on R&D has been a catalyst for the growth of businesses and contributes significantly to ability to meet customer needs in a competitive market;

Over the years, company has successfully diversified both product profile and geographical footprint by way of organic growth and inorganic expansions;

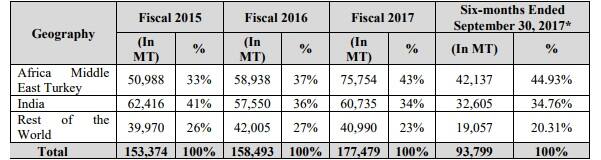

It has strong presence in high growth markets of India and Africa Middle East Turkey (AMET) region;

It has a professionally managed organisation that is driven by a qualified and dedicated management team;

It has track record of robust financial performance

Financial Performance

From FY14 to FY17, as per the restated consolidated financial statements, profit after tax increased from Rs 76 crore to Rs 146.31 crore, representing a CAGR of 24.40 percent. Return on net worth for FY15, FY16 and FY17 was 19.27 percent, 24.88 percent and 28.68 percent, respectively.

What is surfactants and about industry?

Surfactant is a surface-active substance or agent. The word surfactant is a shortened form of surface-active agent.

Surfactants can be broadly defined as compounds which concentrate at surfaces (interfaces) such as waterair or water-oil when dissolved in water. Surfactants and surface activity are controlling features in many important systems, including emulsification, detergency, foaming, wetting, lubrication, water repellence, waterproofing, spreading and dispersion, and colloid stability.

The major application fields of surfactants are classified as under household cleaning, industrial cleaning, personal care products, etc.

According to the research by Acmite Market Intelligence, the Indian Surfactants market is a USD 1.35 billion market (2015) which is expected to grow at a CAGR of 6 percent to touch USD 2.28 billion by 2024.

In terms of application, household cleaning and personal care together made up for 49 percent of the total surfactants market. Personal care surfactants market is expected to be the fastest growing market growing at a CAGR of 7.6 percent till 2024.

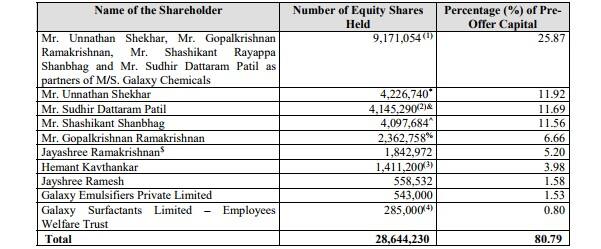

Shareholders

Here are top 10 shareholders of the company as of January 12, 2018:

Promoters

Promoters Unnathan Shekhar, Gopalkrishnan Ramakrishnan, Shashikant Shanbhag and Sudhir Dattaram Patil, have been associated with the company since its incorporation in 1986.

Unnathan Shekhar, the Managing Director, holds a bachelors degree in chemical engineering from the University Department of Chemical Technology, Mumbai and a Post Graduate Diploma in Management from Indian Institute of Management, Calcutta. He has over 30 years of experience in the chemical manufacturing industry.

Gopalkrishnan Ramakrishnan, a non-executive director, holds a Masters Degree in Commerce from University of Bombay. He has over 30 years of experience in personal and home care in the area of business creation and marketing.

Sudhir Dattaram Patil, a non-executive director, holds a bachelors degree in chemical engineering from the University Department of Chemical Technology, Mumbai. He has over 30 years of experience in the chemical manufacturing industry.

Shashikant Shanbhag holds a bachelors degree in commerce from University of Mumbai. He has over 30 years of experience in the chemical manufacturing industry. He was a former whole-time director of the company.

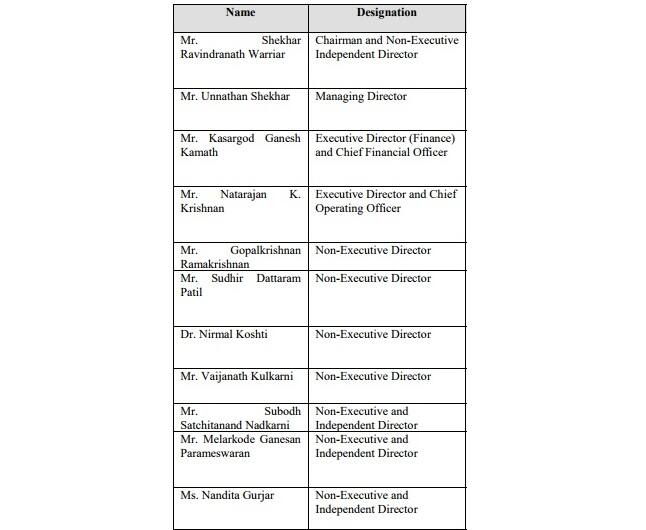

Management

Here are board of directors of the company:-

Key Management Personnel

Risks and Concerns

Here are key risks and concerns highlighted by brokerage houses:-

1> Fluctuations in raw material prices;

2> The company does not have long-term agreements with suppliers for its raw materials;

3> Top 10 customers contribute around 60 percent revenues. Hence it faces the risk of concentration;

4> The business of the company is dependent on its manufacturing facilities. Any slowdown or shutdown in its manufacturing operations or underutilisation of its manufacturing facilities could have an adverse effect on its business, results of operations and financial condition;

5> Its operations are subject to various hazards associated with the production of chemical and other products;

6> Galaxy operates in industry which is characterised by rapidly changing preferences. Hence its revenues can be significantly impacted if it fails to anticipate changing customer preferences;

7> Its operations are subject to extensive government regulation;

8> Higher exposure to foreign currency fluctuations;

9> Dependence on a single key supplier for one of its raw material. Any disruption in supply would have a material adverse effect on the business;

10> If GSL is unable to introduce new products and respond to changing consumer preferences in a timely and effective manner, the demand for products may decline;

11> If any of the products of customers cause, or are perceived to cause, severe side effects, GSL’s reputation, revenues and profitability could be adversely affected.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.