September could well end as the best-ever month in the current calendar year in terms of net buying by foreign institutional investors (FIIs), if the current trend continues during the second half of the month.

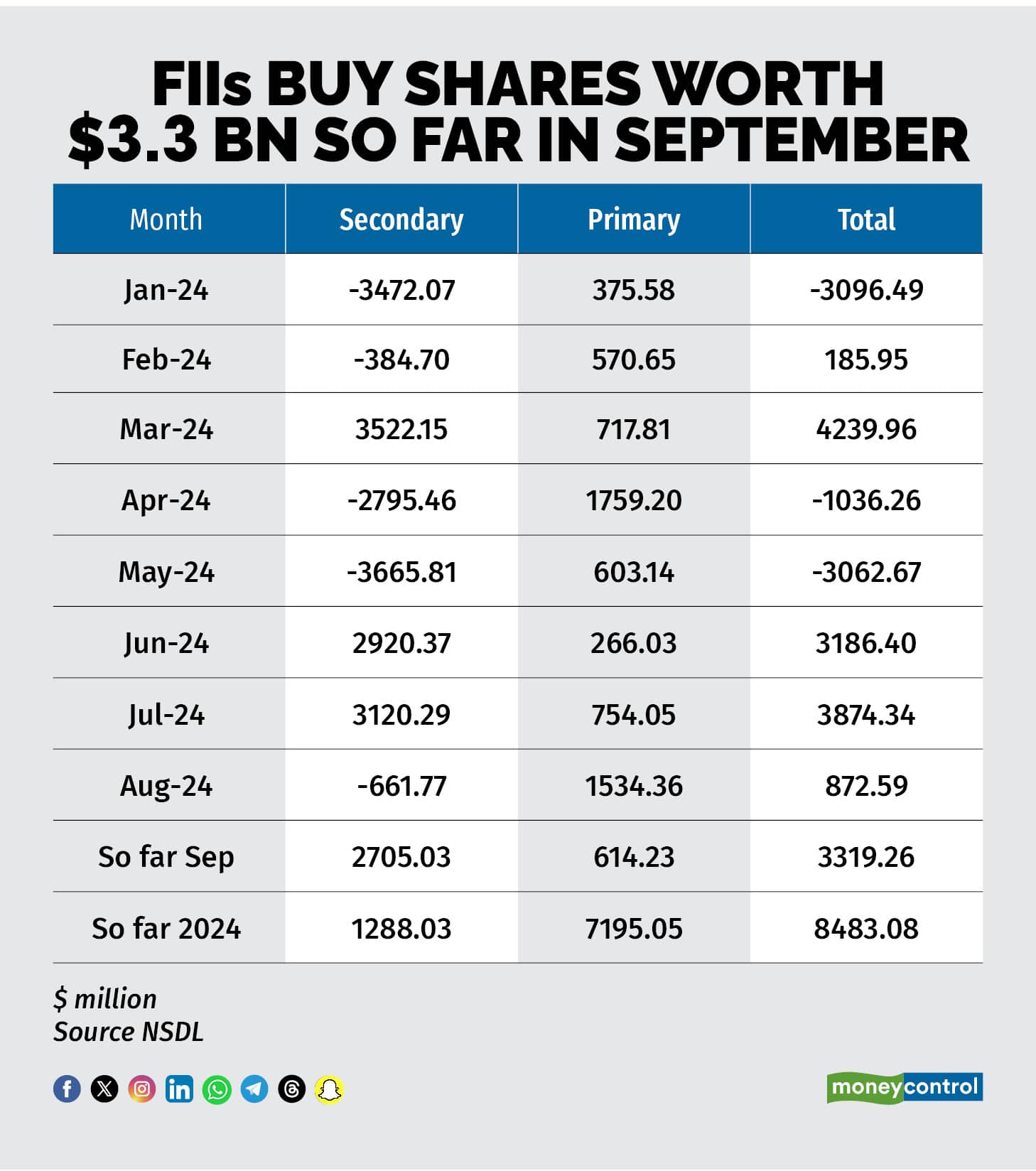

In the current month till date, FIIs have been net buyers at $3.3 billion, which is a huge jump from last month’s total buying of $873 million. Further, while $2.71 billion has been invested in the secondary markets in the month till date, the balance $614.23 million went into IPOs, as per data from NSDL.

Despite 10 IPOs worth Rs 11,248 crore in September, FIIs favoured secondary markets. In 2024, FIIs invested $8.48 billion in Indian equities, with $1.29 billion bought in secondary markets and $7.2 billion in IPOs. They were net buyers in the secondary market only in March, June, July, and September. The highest net buying was in March at $3.52 billion, followed by $3.12 billion in July and $2.92 billion in June.

Kranthi Bathini, Equity Strategist at WealthMills Securities, attributes the trend to the flurry of IPOs and high market volatility, with large block deals by promoters and PE investors. FIIs took advantage of these block deals and employed a “buy on dips” strategy amidst the market volatility. Most IPOs this month were small, apart from Bajaj Housing Finance, leading FIIs to focus more on the secondary market. They mainly bought large caps, banking, and engineering stocks. After minimal buying in the past 7-8 months, FIIs seized the opportunity in September, he said.

Earlier, between January and May, FIIs were net sellers, offloading around $2.77 billion in equities. While they invested $4 billion in IPOs, they sold $6.8 billion in the secondary markets. The heavy selling in secondary markets was mainly due to concerns over high valuations and political uncertainty ahead of the elections.

Now with the political uncertainty settled and June quarter earnings released, there are growing expectations of a US Federal Reserve rate cut. This potential rate cut could benefit many emerging markets, including India. This, in turn, has led to FIIs changing their stance, fuelling the rally in local equities, which seems unlikely to reverse for more than a few sessions. This shift has even encouraged the more hesitant investors, including many short-term FIIs, to jump in, say market players.

Deepak Jasani, Senior VP - Head Retail Research, HDFC Securities believes that once the US Fed announces its rate cut decision in the next few days, global markets, including India, might experience a temporary peak. It's a classic “buy on expectation, sell on the news” situation. While it may take a couple of days, it seems likely to happen.

Rajesh Palviya, an analyst with Axis Securities, stated that FII buying in Indian markets is largely driven by the anticipated US Fed rate cut. Compared to global markets, Indian markets are more stable and offer a favorable environment for FIIs. The Indian economy is strong, and corporate earnings have been steady, with no significant negative signs so far, boosting investor confidence.

He noted that markets are likely to continue their upward trajectory. After some volatility and correction in September, along with sector rotation, sectors like pharma and IT have performed well. These sectors are linked to global markets and have always been FII favourites, giving them a comfort zone. FIIs have heavily invested in IT and healthcare, signalling their preferred direction. With markets at all-time highs, Palviya expects this trend to continue, targeting a Nifty range of 25,600 to 25,800, with support around the 25,000 level. Sectors like pharma, IT, automobiles, and consumption-related industries such as FMCG remain the top picks for FIIs.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.