Krishna KarwaMoneycontrol Research

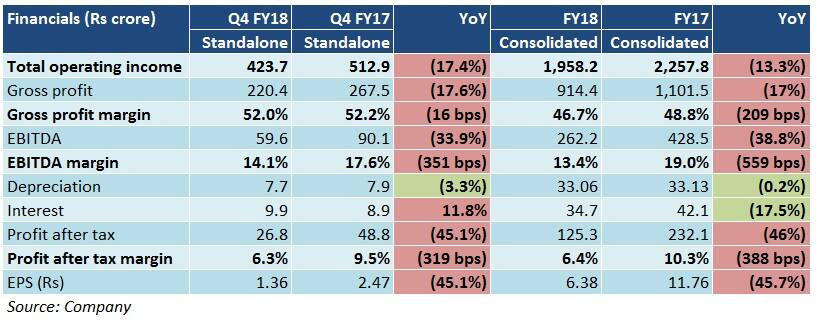

Indo Count Industries manufactures bed linen products such as bed sheets, pillow covers, quilts, comforters and coverlets. The company’s numbers in the quarter and fiscal gone by were tepid on all fronts.

Revenue de-growth in FY18 was attributable to destocking by major US retailers in the first half of the year, a strong rupee vis-à-vis the dollar and increased in-house consumption of yarn. Volatility in raw material costs and higher power expenses were the key factors behind the margin decline during FY18.

Is a respite on the cards?

Volume growth

The management plans to sell nearly 58-60 million metre of bed sheeting in FY19 as against 54 million metre sold last fiscal. Moreover, ramp up in utilisation levels from 60 percent at present to 90 percent by FY21 should aid sales growth and result in operating leverage.

Capex

Capital expenditure of Rs 300 crore will be incurred towards upgrading ICI’s existing yarn spinning facilities, investments in new fabric weaving capacity and purchase of specialised equipment for fashion and utility bedding. Completion of these processes by FY20 will boost margins.

Fashion bedding

Keeping margin-accretion and higher realisations in mind, impetus will be laid on increasing the share of fashion bedding products to overall turnover. Steps have been taken to increase the contribution of such products from 13 percent in FY18 to 25-30 percent over the next two-to-three years.

Cost management

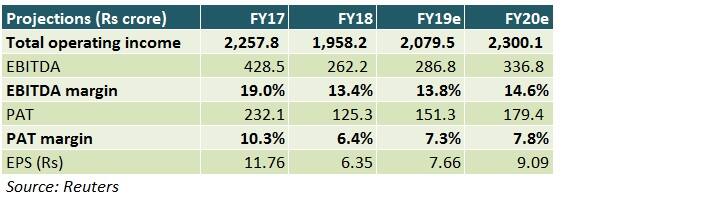

Going forward, volatility in cotton prices is expected to reduce. Modernisation measures, entailing a capex of Rs 60-70 crore in FY19, will be initiated to ensure operational efficiency. A combination of these two factors could stabilise ICI’s operating margins in the range of 14-16 percent in FY19.

Rupee depreciation versus the dollar

The dollar has been appreciating in recent times versus the rupee. This, coupled with preliminary signs of re-stocking at the American retailers’ end, may help ICI gain lost momentum from a region that contributes approximately 60-70 percent to its yearly topline.

Key roadblocks

The company is yet to make noticeable headways in the institutional bedding segment, which can contribute substantially to revenue growth. Institutional orders, more often than not, have a high ticket size, exhibit client stickiness characteristics and happen to be long-term in nature.

Benefits of incentive schemes (duty drawbacks, rebate of state levies and merchandise export from India) announced by the government haven’t accrued to ICI so far. Since ambiguities related to these are unlikely to get resolved before September, working capital may be strained.

Does the stock make a worthy investment?

Though FY18 has been challenging for ICI, the management believes that most headwinds may start easing gradually in FY19. Recent brand launches (Heirlooms of India, Boutique Living Coastal, ATLAS) in the US, apart from traction in the ‘Boutique Living’ brand in India, will be important monitorables.

At 9.4 times FY20e earnings, despite the non-demanding valuation, we remain cautious on the stock. Investors are advised to watch out for signs of improvement at least for the next couple of quarters before taking the plunge.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.