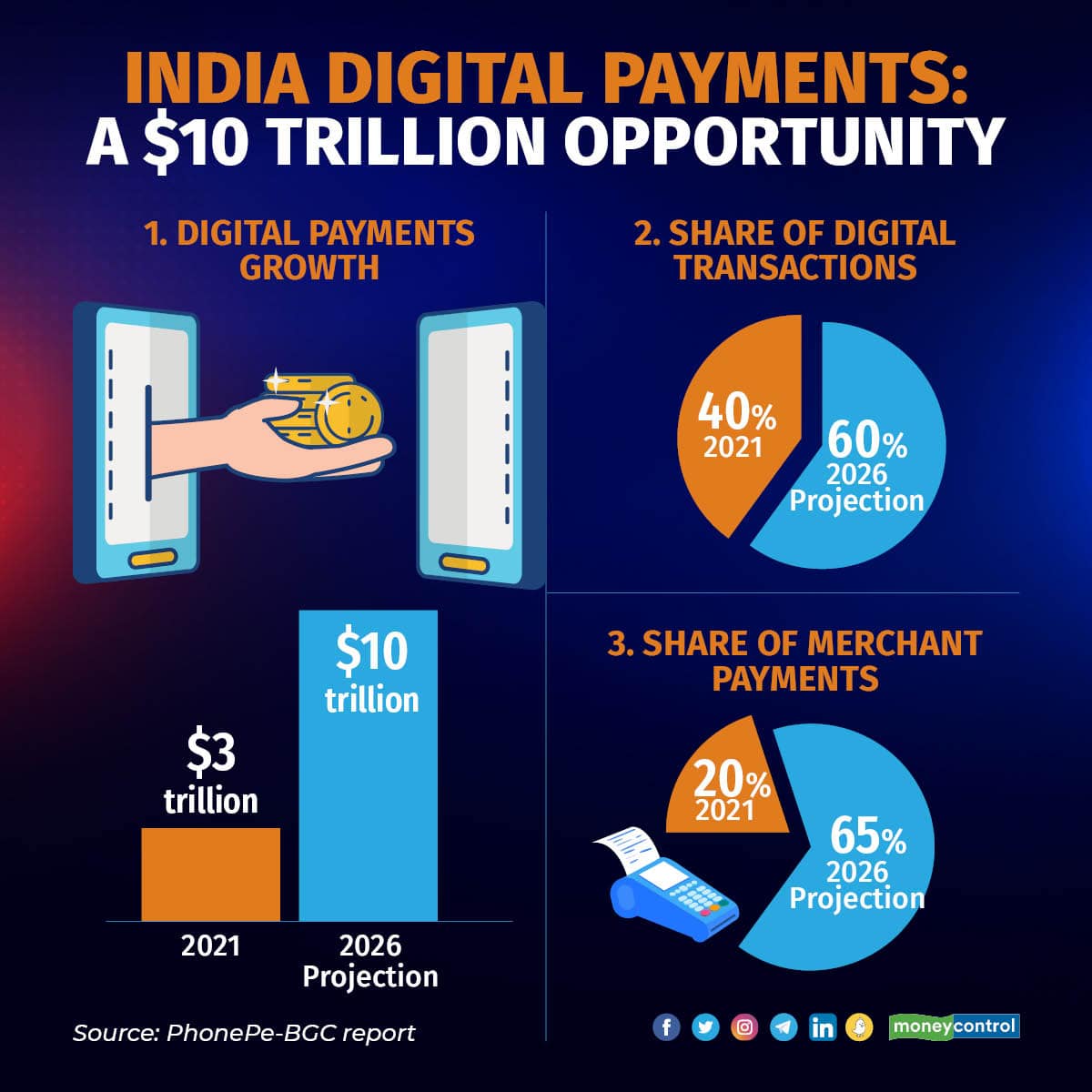

The Indian digital payments ecosystem will nearly triple to $10 trillion by 2026 from the current $3 trillion led by growth in merchant payments, according to a joint report by Unified Payments Interface (UPI) leader PhonePe and the Boston Consulting Group (BCG).

"The major contribution for the digital payments’ growth would be from merchant payments that are expected to significantly digitise in the next five years, increasing from 20 percent digital penetration by value today to about 65 percent by 2026," the report said.

This will mean 7x growth from $0.3-0.4 trillion digital merchant payments today to $2.5- 2.7 trillion by 2026.

The overall share of digital payment transactions will grow from 40 percent in 2021 to 65 percent in 2026, and will constitute two of every three payments in 2026.

Commenting on the report, Karthik Raghupathy, Head of Strategy, and Investor Relations at PhonePe, said, "As India’s largest fintech platform we have seen the growth of UPI over the last few years. UPI has supercharged India’s transition to non-cash payments when it comes to both person-to-person (P2P) and person-to-merchant (P2M) transactions."

UPI saw about 9x transaction volume increase in the past 3 years, increasing from 5 billion transactions in FY19 to about 46 billion transactions in FY22. It accounted for over 60 percent of non-cash transaction volumes in FY22. PhonePe alone enjoys a share of 47 percent in UPI volumes.

In the financial year 2021-22, UPI breached the $1-trillion mark in transaction values, a watershed moment for the indigenous payments system.

Raghupathy added, "While Tier 1-2 cities have witnessed high acceptance of digital payments, penetration in Tier 3-6 cities shows headroom for growth. The next wave of growth will now come from Tier 3-6 locations."

According to the report, the next phase of growth in digital payments will be led by factors including expanding merchant acceptance, Infrastructure push and setting up of a financial services marketplace to drive growth in underpenetrated regions and digitised value chains .

Lastly the report said that upcoming tech innovations and upgrades including Internet of Things (IoT), 5G, and the Reserve Bank of India's (RBI) initiative of a Central Bank Digital Currency (CBDC) will help increase adoption of digital payments.

Prateek Roongta, Managing Director & Partner of the Boston Consulting Group said, "We will increasingly observe digital payments get embedded in all forms of commerce, we will also witness the progression from embedded payments to embedded finance."

"As more and more merchants begin to accept digital payments, it will unlock a significant change in access to credit for small merchants due to the creation of a digital transaction trail," he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.