The Unified Payments Interface (UPI) has breached the $1-trillion mark in transaction values for the financial year 2021-22, a major milestone for the payments system which has witnessed substantial growth over the past two years and led to further digital adoption for payments and financial services.

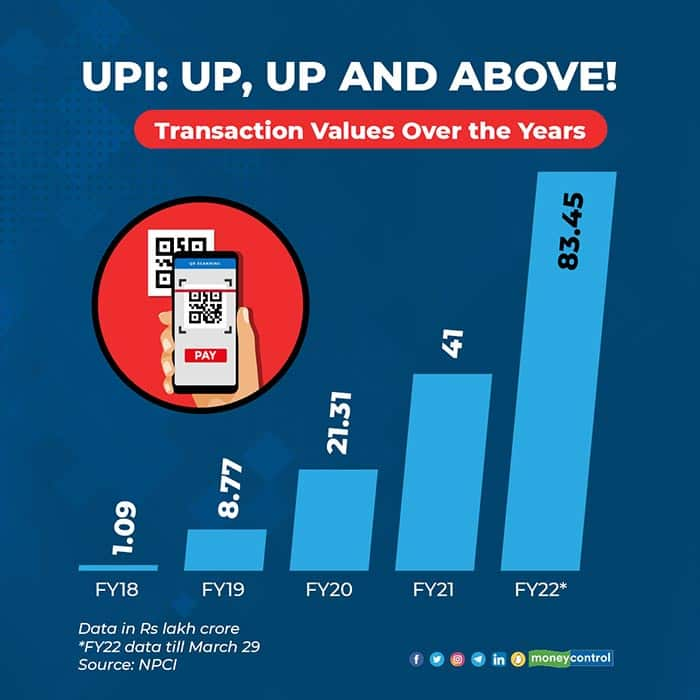

According to data until March 29 by the National Payments Corporation of India (NPCI), which operates and manages UPI payments, UPI has recorded transaction values of Rs 83.45 lakh crore in FY22. As per the current conversion rate, $1 trillion amounts to approximately Rs 75.82 lakh crore.

The payments system crossed the 500-crore mark in volumes for the first time in March. As per NPCI’s data, 504 crore transactions were recorded by March 29 itself.

In terms of transaction values for the month, UPI saw transactions worth Rs 8.88 lakh crore as of March 29, a growth of 7.5 percent over February.

Over the past two years, UPI has seen a significant rise in transactions aided by the pandemic and the subsequent widespread adoption of digital payments in India. The payments mode has broken multiple records in the past two years and is now inching closer to Rs 9 lakh crore in monthly transaction values.

At the beginning of FY22 i.e. in April 2021, UPI had recorded around 260 crore transactions valued at Rs 4.93 lakh crore. A year later, monthly transaction volumes were higher by 94 percent, and values by 80 percent.

UPI’s share in the volume of total retail payments in the country has been increasing consistently. In FY22, 60 percent of volumes of India’s retail payments came from UPI. However, it continues to be the preferred mode of payment for low-value transactions and amounted to only 16 percent of transaction values in FY22, according to a Macquarie Securities report.

Around 50 percent of UPI transactions are up to Rs 200, and 75 percent of the total volume of retail transactions (including cash) in India are below Rs 100 in value.

To further encourage the usage of digital modes of payments, the Reserve Bank of India (RBI) directed the NPCI to launch UPI for feature phones as well as for offline transactions for small-value payments.

On March 8, RBI Governor Shaktikanta Das unveiled UPI 123Pay for feature phones which allows all transactions to be done through feature phones without an internet connection, except scan and pay. During the launch, Das had highlighted that the UPI transactions are on track to cross the $1-trillion mark in this financial year.

The NPCI in a circular to banks detailed its plans for UPI Lite for small-value offline digital payments of up to Rs 200. For implementing this, it has designed an on-device wallet in which a balance of Rs 2,000 can be maintained at any given time.

The transactions can be executed without a UPI PIN as well. Customers using multiple UPI apps will be allowed to have multiple on-device balances. Users will receive consolidated debit SMS for financial transactions at regular intervals.

By giving access to more customers beyond the top cities and towns, NPCI is hoping to achieve a run rate of one billion transactions a day in three to five years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.