Krishna KarwaMoneycontrol Research

The government's move to hike customs duties on certain product categories to prevent further widening of the current account deficit may have an upside for India's organised jewellery sector. Basic customs duty (BCD) on gold, which stands at 10 percent, hasn't been increased to keep smuggling of the yellow metal under check.

India is among the highest importers of gold globally and settles such import transactions in US dollars. Therefore, if India’s macros continue to deteriorate, one cannot rule out the possibility of an increase in BCD on gold too.

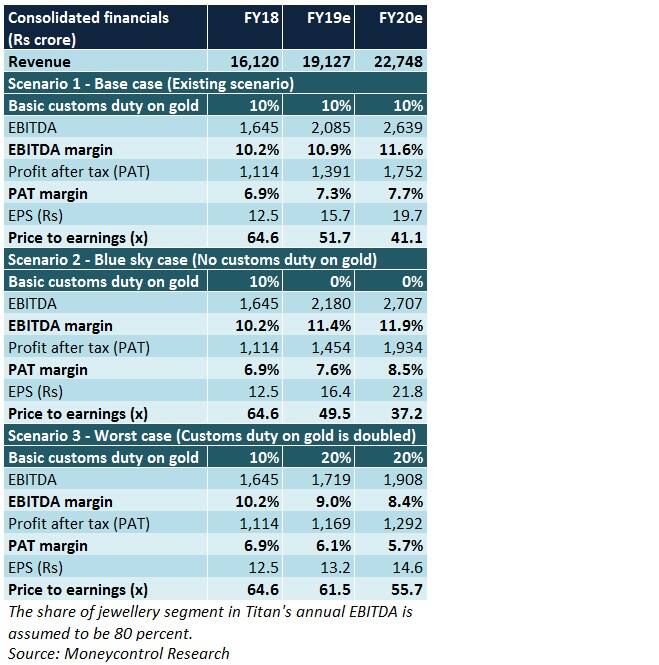

In this context, it is important to assess the consequent effect of this development on Titan, an industry leader in the jewellery space. Here's how things would pan out for the company under 3 different scenarios:-

The impact

While marginal custom duty hikes of 2-3 percent are likely to be passed on by Titan to customers, anything more could dent profitability in a noticeable manner.

Organised jewellers will be forced to revise product prices upward on account of a steeper BCD on gold. As gold will be costlier to procure through official custom channels, illegal inflow into India will be triggered.

Unorganised jewellers, that constitute a significant chunk of the industry size, would be able to source illegally procured gold at cheaper rates from entities that don’t comply with official requirements. This gives them a pricing advantage over branded jewellers.

In a bid to remain competitive and not lose out on market share, organised players will not be able to pass on the entire hike in BCD on gold to the consumers. Consequently, their margins will be compressed.

What is Titan doing to trim the risk?

Titan is undertaking efforts to increase the contribution of margin-accretive studded and wedding jewellery variants to annual turnover (from the current 30-35 percent mark). It is looking at increased spends on advertising and aggressive expansion of the ‘Tanishq’ store network in smaller cities, mainly through the franchise-run route.

The company’s gold exchange programmes have been witnessing good traction in recent years. Of the total gold jewellery bought by Titan’s customers, purchases under the exchange schemes increased to over 40 percent from 15 percent in 2013.

Customers tend to refurbish golden ornaments and convert them to new jewellery after design and quality refinement. Thus, for Titan, the need to source gold for manufacturing additional quantities of jewellery is reduced. Unsurprisingly, the management is shifting its attention on this front to keep dependence on gold imports low.

Titan will foray into the silver jewellery segment in the next 3-6 months. Silver will be imported from nations like Thailand and transactions are likely to be settled in Indian Rupee. However, in the initial phase, the share of revenue from this will not be material enough to influence the company’s overall financials.

Why choose Titan?

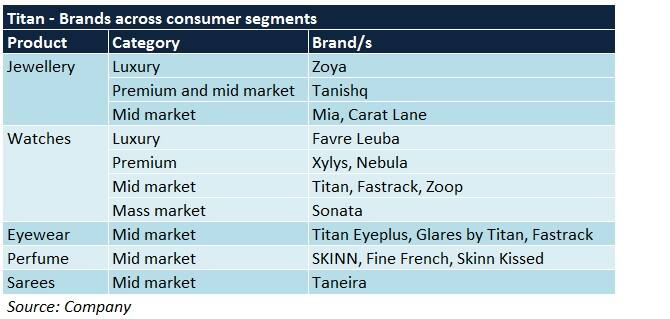

Even though jewellery remains of core importance to Titan’s success, the company has been gradually transitioning itself into a consumer-focused brand by foraying into new product categories.

Besides tackling the typical seasonality associated with jewellery products (H2 of a fiscal year tends to be better than H1), the move would help the company leverage the strength of its brand across smaller segments.

Adequate revenue visibility in terms of jewellery, improved watch designs and increased presence of the same in large format stores, distributor consolidation in the eyewear segment, scaling up of lifestyle businesses (sarees, cosmetics) and robust financials to fund future growth plans will augur well for Titan in the long-run.

However, the likelihood of higher BCD on gold, reintroduction of Prevention of Money Laundering Act (PMLA) provisions and difficulties in normalising promotional costs/overheads (through the desired degree of revenue generation) could dampen earnings.

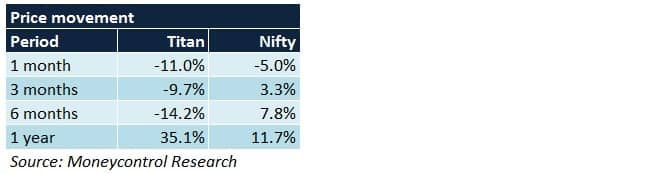

The stock, despite its sharp correction and noticeable underperformance vis-à-vis the Nifty in the past 6 months, trades at 38 times its 2-year forward earnings. Though the valuation is far from cheap, the company undoubtedly has the moats to attract the attention of prospective investors.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!