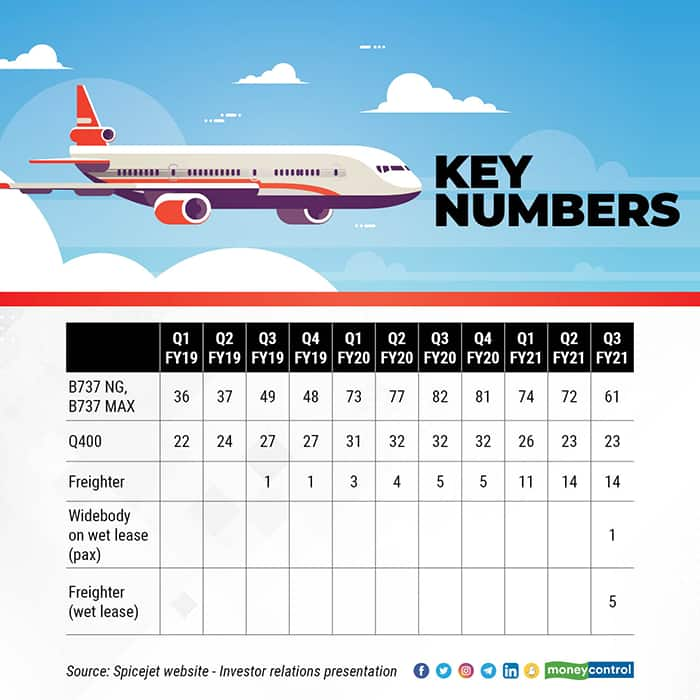

In the fourth quarter of FY18, everything about SpiceJet was modest. It had a modest fleet of 36 B737s and 22 Q400s. It operated a modest number of flights at a skosh over 400 a day. Number of passengers carried a day too was at a modest 54,000.

A year later, it was well, flying with ambition. SpiceJet expanded quickly; it then had 48 B737s, which included the B737 MAX (13 of which are in the fleet and grounded) and 27 Q400s. The airline had also ventured in the freighter segment by then.

SpiceJet was coming out of the dark, dreary shadows of December 2014 – when the debt-ridden carrier was temporarily grounded after oil companies refused to refuel its planes.

And then it was presented with a mouth-watering opportunity. Rival Jet Airways began to gasp for breath from December 2018. By April 2019, it was all over for Jet Airways. Once the largest airline in the country, it suspended operations for lack of cash. Close to 750 slots were up for grabs and the government linked the slots to addition of capacity by the airline.

What followed was a frenzy. Vistara inducted nine B737s—a type it hitherto did not operate. What about SpiceJet? It gobbled up over 30 aircraft that operated with Jet Airways. It was a win-win for the lessors who were able to place most of the aircraft in India.

SpiceJet then was reeling under the grounding of 13 B737MAX. Jet’s crisis presented an opportunity to scale up and become a formidable competitor to market leader IndiGo and fend off challenges from newbies such as Vistara, which was also trying to make its presence felt.

It was also an opportunity to get even—to get back the slots SpiceJet had lost in 2014. The October-December quarter of 2019 saw SpiceJet reach a peak of 82 B737NG and MAX aircraft along with 32 Q400 aircraft in its fleet with nearly 80, 000 daily passengers across its network!

While SpiceJet became the biggest beneficiary of the Jet Airways crisis, it did not really carry as many passengers in proportion to its induction of aircraft. All the hype came to a grounding halt in March 2020 when India and most parts of the world headed into a lockdown.

The last quarter for which the results are out—Q3 of FY21—the airline listed 61 B737s (including MAX), 23 Q400, one widebody on wet lease and 14 freighter aircraft with five more on wet lease. News reports have indicated that lessors have started asking the airline to ground planes as it struggles to pay the rentals.

The ups and downsAviation in India is dominated by IndiGo on the domestic front. With over half the market share, the airline has become a carrier of choice and on many routes has frequencies which are more than the entire competition put together!

In a cost-conscious market like India where market share follows capacity share and higher capacity share gives good pricing power - mostly to undercut competition - SpiceJet had no choice but to go for expansion.

There is only one hitch. The airline did not have the finances to sustain. For every quarter, the auditors have been making a note of its precarious financial position and questioning its ability to be a going concern. While finances are important to grow, equally important were slots which were available after the fall of Jet Airways.

A sudden spike in the numbers of aircraft, availability of prime slots, compensation from Boeing, a codeshare with Emirates, a hub at Ras Al Khaimah, a cargo subsidiary, movement to preferred terminals at Mumbai and Delhi, which would aid faster connections across the network – the announcements looked like a dream!

All of this would have aided the airline to raise funds, help retire old debt and have working capital. Who knows - this could have also attracted another airline to invest and helped grow its valuation but for the pandemic! Alas.

Retrospectively, when one looks back, one wonders what would have been the story had the airline not inducted any aircraft in 2019. Would the airline be in a better situation today than it was in the past? A leaner, meaner airline with lesser liabilities? Who can say?

The airline reported a modest loss of Rs 57 crore last quarter. This came on the back of compensation from Boeing for the grounding of MAX, which is being budgeted in each quarter but hasn't been received yet!

At an operational level, the airline had a loss of Rs 277 crore in the last quarter. The company’s negative net worth stands at Rs 2343.11 crore as of December 31, 2020. Last quarter, the auditors noted that the company’s current liabilities exceed its current assets by Rs 47,78.36 crore, casting significant doubt on the company's ability to continue as a going concern.

Tail NoteWhat looked like a brilliant strategy back then doesn't look that brilliant anymore. A smaller and nimble airline probably has a better chance to survive than an airline the size of SpiceJet with big liabilities. But then, who knew in May or June of 2019 that a deadly virus was about to get the world on its knees in the next few months? SpiceJet is the only airline in the country not backed by a major group.

With the kind of restrictions, market dynamics and travel patterns, it is nearly impossible for the airline to make so much profits that it would be able to get over the accumulated losses. The only option it has is probably to raise funds or for the promoters to infuse capital, which will help reduce the debt.

The spiral is risky with even the likes of Jet Airways or Kingfisher not being able to make it to the other side. With the kind of diversification that SpiceJet has shown - it sure is fighting, but only time will tell how nimbly it comes out of this quagmire.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.