Diversified gaming and sports media platform Nazara Technologies plans to build its presence in the skill-based real-money segment in a structured and pragmatic manner, CEO Manish Agarwal said during the company's earnings conference call on November 1.

The first step in this direction is integrating its fantasy sports app Halaplay with its skill gaming firm OpenPlay Technologies to have a common technology platform. “Going forward, we will continue to look at building the segment through consolidation,” he said.

Nazara Technologies founder Nitish Mittersain said in his prepared remarks during the call that the platform will eventually operate a network of skill gaming destinations “Our endeavour is to build India’s largest vernacular, social, gaming and entertainment platform and further strengthen our position in the large opportunity presented in the skill gaming space,” he said.

Nazara Technologies had picked up a 100 percent stake in Hyderabad-based OpenPlay for about Rs 186.4 crore in August. It also owns a majority stake in real-money social quizzing app Qunami and offers real-money versions of its cricket (WCC Rivals Clash) and carrom gaming (Carrom Clash) titles. OpenPlay posted revenues of Rs 53.5 crore in FY21 and has an annualised gross gaming revenue run rate of Rs 80 crore for FY22, the firm said.

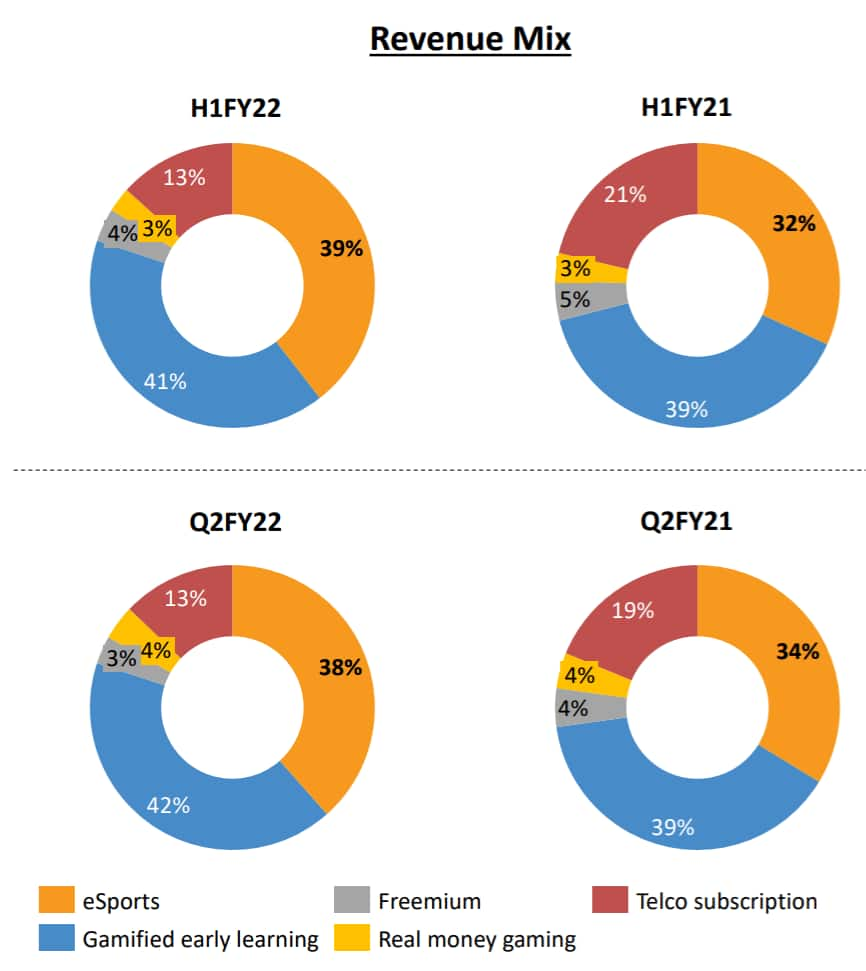

To be sure, skill-based real-money gaming currently contributes very little to the firm's turnover, accounting for only 2.8 percent of its overall revenues in H1FY22. But Agarwal had told Moneycontrol in an earlier interview that they see a big opportunity in this segment.

“The overall market is very large, around Rs 11,000-13,00 crore, and the business has very strong network effects of trusted brands, concurrent users and liquidity pool on the platform. You cannot really compete in the market being a really small player. If we can consolidate some of the companies in the market, we will be able to create a formidable position for us to be able to compete on unit economics with deeply entrenched players,” Agarwal had told Moneycontrol on October 7.

Revenue Mix of Nazara Technologies

Revenue Mix of Nazara TechnologiesHowever, India's first publicly listed gaming firm doesn't intend to invest a significant amount of capital to gain market share in the segment.

“Our ideology is that we are not going to burn money on the EBITDA (earnings before interest, tax, depreciation and amortisation) level in the skill-based real-gaming business. Because if you go on that path, you will go down to invest substantial money in building player concurrency and liquidity. We do not wish to do that through a massive amount of marketing spends, whether on brand or performance,” Agarwal said during the earnings call.

Gambling is a state subject in India, and several states like Andhra Pradesh, Telangana, Tamil Nadu and Kerala have banned or tried to ban real-money games, with Karnataka being the latest one last month. The suspensions in Tamil Nadu and Kerala have been struck down by Madras High Court and Kerala High Court, respectively, in recent months while the Karnataka suspension has been legally challenged by several gaming firms and the All India Gaming Federation, a skill gaming industry body.

“There have been more positives than negatives in the skill-based real-money gaming business. While Karnataka got closed, Tamil Nadu and Kerala opened up and Tamil Nadu is a large state from a contribution point of view compared to Karnataka,” Agarwal said.

He said Tamil Nadu opened up towards the fag end of the quarter, which will come into play in the second half of the year. “Karnataka is definitely at 12-13 percent contribution, which we will lose, but this is kind of a portfolio where you have to look at the net sum rather than individually,” Agarwal added.

The firm, backed by ace investor Rakesh Jhunjhunwala, had raised a Rs 315-crore war chest on October 6 through a preferential allotment from Singapore sovereign wealth fund GIC-managed investment firm Gamnat and Ahmedabad-based Plutus Wealth Management.

Read: We are now looking at larger deals as our scale is increasing: Nazara Technologies CEO

Gamified learning and Esports drive revenuesNazara Technologies still derives the bulk of its income from its gamified early learning business and e-sports business, both of which accounted for a combined 80 percent share of the company’s revenues in H1FY22.

The gamified early learning segment (Kiddopia) grew by 35 percent year-on-year (y-o-y) to Rs 105.9 crore in H1FY22 while the e-sports segment (Nodwin, Sportskeeda) grew 62 percent y-o-y to Rs 103 crore in H1FY22.

Kiddopia had about 3,24,699 paying subscribers as of September 2021, a 16 percent increase from 2,80,891 paying subscribers in September 2020. Monthly average revenue per user was around $6.30-6.50 and the monthly churn was between 4 and 7 percent across the months in Q2FY22, the company said. North America accounted for 90 percent of the business for the subscription-based app that caters to 2-7-year-old children.

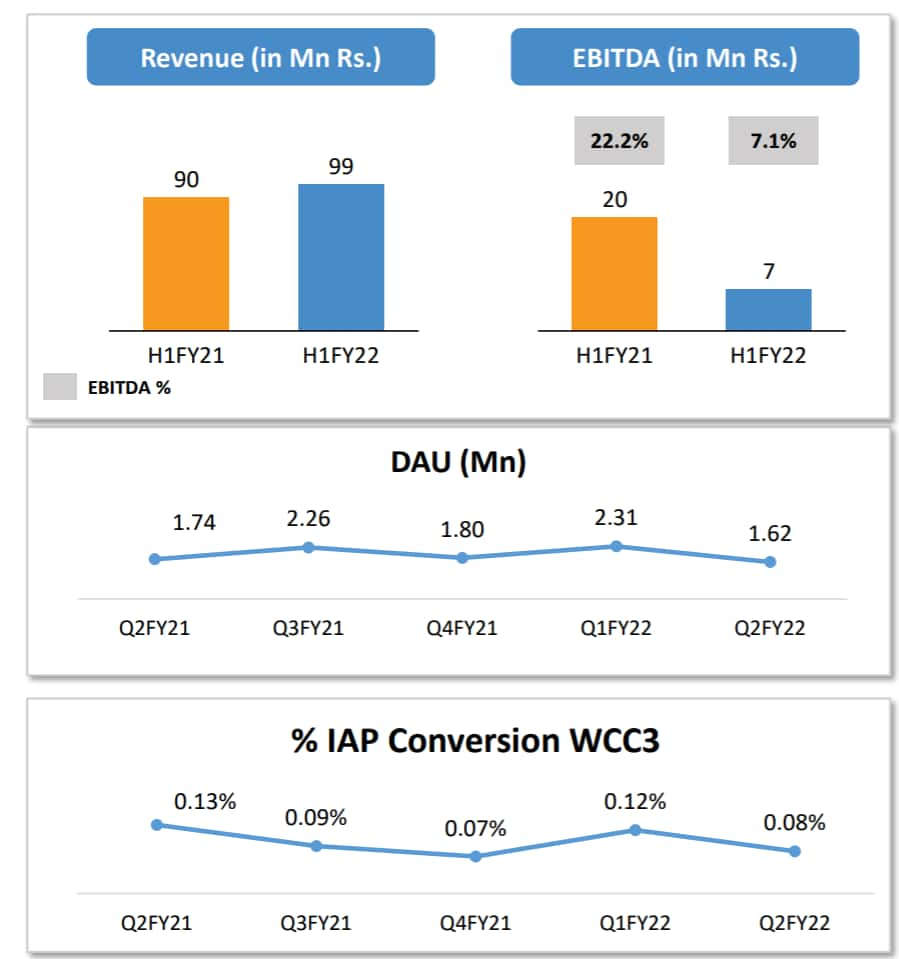

The firm's freemium games business saw a modest 10 percent increase in revenues to Rs 9.9 crore in H1FY22, with in-app revenues registering an 8 percent increase y-o-y. Agarwal said this business is among the key focus areas for the company since “there's a huge opportunity for us to grow but with the right unit economics in place”.

A snapshot of Nazara Technologies' Freemium businessNazara Freemium

A snapshot of Nazara Technologies' Freemium businessNazara FreemiumNazara’s telco business generated revenues of Rs 34.7 crore in H1FY22, a 19% decline from the Rs 42.8 crore posted in H1FY21.

“As we have maintained, the contribution from this segment will keep coming down. It was 16.5% last year, now it is 13%, and we continue to see a decline in contribution from the telco business going forward as well,” Agarwal said during the call.

Overall, Nazara Technologies saw a 30% growth in its revenues to Rs 260.8 crore in H1FY22 from Rs 200.5 crore in H1FY21. It posted a profit of Rs 28 crore during the period against a loss of 8.3 crore in H1FY21.

“We expect our FY22 consolidated revenues to grow in the range of 35-40 percent on a y-o-y basis with an EBITDA margin profile at 13-15 percent. The growth shall be supported by organic and inorganic activities,” Agarwal said.

.

“At the group level, we are looking at how we fill in the white spaces which we have in our portfolio across segments, whether gamified (early learning), freemium, e-sports or real-money gaming and how do we ensure that we can report strong growth as a segment in terms of scale, growth and right unit economics,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.