Polling in Bengal is taking place across all seven phases from April 19 to June 1. Three blocs — the Trinamool Congress (TMC), Bharatiya Janata Party (BJP), and the Congress in alliance with the Left — are fighting it out in the ongoing Lok Sabha polls.

The parliamentary constituencies of Darjeeling, Raiganj and Balurghat are set to see voting in the second phase on April 26. These three seats are presently held by the BJP.

As the election battle heats up, Moneycontrol looks into the key economic metrics of the country’s fourth largest state economy that will send 42 members to the 18th Lok Sabha.

West Bengal’s gross state domestic product or GSDP (measured at constant prices) with 2011-12 as the base year likely grew 7.65 percent in 2023-24 as per provisional estimates, compared to 7.32 percent for India as a whole, as per the state’s economic survey for 2023-24.

For the four years from 2019-20, the state’s average GSDP (at constant prices) is pegged at 6.6 percent, twice that of the all-India real GDP during the same period. This was primarily on account of a 5.8-percent contraction in the country's growth in the pandemic year of 2020-21 while Bengal during this period witnessed a positive growth of 1.1 percent, as per state government data.

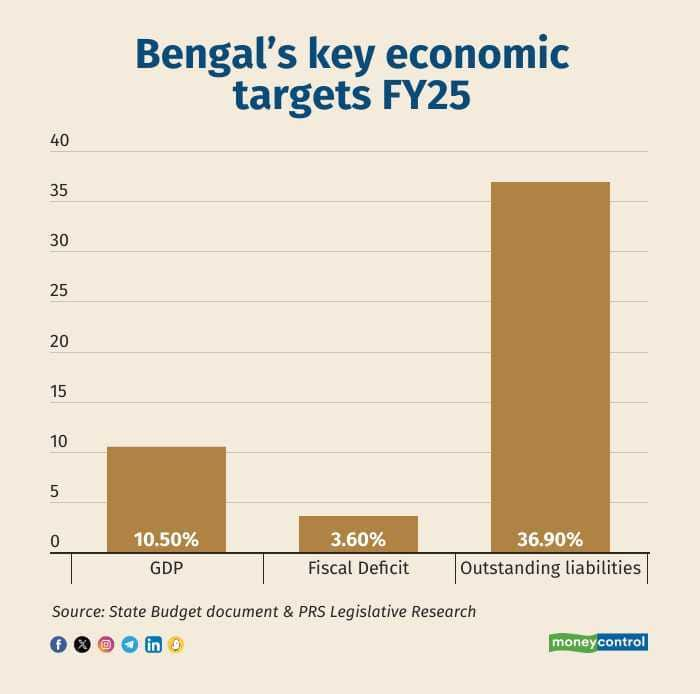

The GSDP for 2024-25 (at current prices) is projected to be Rs 18.8 lakh crore, amounting to a growth of 10.5 percent over 2023-24.

However, the fiscal deficit at 3.5 percent is expected to remain outside the 3 percent limit suggested by the 15th Finance Commission as per the revised estimates for 2023-24, and higher than the 3.1 percent average of all states and Union territories.

For FY25, the eastern state’s fiscal deficit has been projected at 3.6 percent of GSDP.

According to Paras Jasrai, senior analyst at India Ratings and Research Pvt Ltd, West Bengal is unlikely to achieve the indicative fiscal path suggested by the 15 Finance Commission of 3 percent of GSDP for FY26 given the numbers for 2022-23 and the revised estimates for the previous financial year.

Though the state bettered its fiscal deficit in FY23 at 3.3 percent from 3.7 percent in 2021-22, it has a long way to go before it can post a figure similar to that of 2019-20 when it brought the gap down to below 3 percent.

Red flags

The most concerning economic indicator for West Bengal is its high debt-to-GSDP ratio that has been estimated at 36.9 percent in FY25, lower than the revised estimate for 2023-24 (37.1 percent) but significantly higher than the indicative 32.8 percent debt projection by the finance commission.

West Bengal’s debt levels are also higher than the national average. As per the Reserve Bank of India, the debt-GDP ratio of states peaked at 31 percent at end-March 2021 and declined to 27.5 percent by end-March 2023. At a disaggregated level, the ratio could exceed 25 percent by March-end 2024, the central bank said on December 11, 2023.

“High public debt-to-GDP ratio of over 35 percent is a concern, if it is not used for capex formation or reducing the output gaps. The revenue deficit to GSDP is 1.7 percent. This will further constrain the state's fiscal space for future development spending. A fiscal consolidation procedure is imminent for West Bengal through strengthening the tax buoyancy rather than cuts in public spending for a sustainable economic growth recovery process,” said Lekha S. Chakraborty professor at National Institute and Public Finance and Policy (NIPFP).

A closer look at the data shows that the state’s capex has been less than ideal, falling short of budgeted targets due to fiscal pressures and capacity building issues.

Bengal met only 65.8 percent of the budgeted target for capex in FY23 and 54.3 percent for 2021-22. For the current financial year, the state is targeting nearly 16 percent growth on its spending on infrastructure compared to the revised estimate for 2023-24.

India Ratings believes the capex target budgeted for FY25 is high, given the average capex growth of 13.2 percent during FY16-FY23.

NIPFP’s Chakraborty said that given the constraints due to fiscal rules, states are identifying different strategies to enhance infrastructure development and West Bengal should do the same.

“Bengal should try for the elongation of debt maturity structure to invest in capital infrastructure and to envision a robust economic growth path. In that way, with more long-term bonds, the refinancing risks can be postponed and the state can focus on robust economic growth strategies,” she told Moneycontrol.

An analysis by PRS Legislative Research showed that West Bengal has allocated 1.9 percent of its expenditure towards roads and bridges for FY25, lower than the all-India average outlay towards this sector of 4.6 percent in 2023-24. Uttar Pradesh, for instance, allocated 5.9 percent of its total expenditure towards roads and bridges.

The trend in per capita income in West Bengal over the years is concerning too. In 1980-81, out of 25 states, West Bengal was ahead of 18, and at the end of the over three-decade-long Left rule, out of 28 states, 15 were ahead. But under the succeeding Trinamool Congress, in 2018-19, out of 29 states, 18 states were ahead, as per RBI data, though to be fair, the blame does not lie solely with the TMC.

West Bengal’s per capita net state domestic product (NSDP) of Rs 1,41,373 at current prices was lower compared to even a smaller state like Haryana with Rs 2,96,685 in 2022-23. Tamil Nadu, Punjab, Telangana and Karnataka were all ahead of the eastern state on this metric, while Madhya Pradesh ranked lower, as per data released by the statistics ministry back in July 2023.

Health, education

In its budget for 2024-25, West Bengal allocated 15.6 percent of its expenditure to education and 6.6 percent towards health. Both are higher than the average outlays for 31 states as per their budget estimates of 2023-24 that stood at 14.7 percent for education and 6.2 percent for health. However, despite higher allocation, more needs to be done to ensure implementation on the ground.

Namit Bajoria, president of the Merchants Chamber of Commerce & Industry, Kolkata, said that for social upliftment of backward and weaker sections of the society, government intervention in terms of policy and provision of infrastructure are required in education as well as health.

“Also, there is a need to remove regional disparities prevalent in education and health in the state of West Bengal. This can only be corrected through government intervention at all levels as the private sector would not be forthcoming for establishing schools or hospitals in remote or backward areas,” Bajoria added.

A comparative study of regional inequalities in the state’s districts by Panchali Sengupta and Anjan Chakrabarti, published in April 2024, said that the developmental gaps between districts in the southern and northern parts of West Bengal have become prominent, and relatively low contribution of the secondary sector reveals an absence of a strong manufacturing base in the state.

West Bengal has reduced its infant mortality rates from 33 per 1,000 in 2010 to 19 per 1,000 live births in 2020 versus 28 at the all-India level. The average life expectancy in the state at 72.3 years over 2016-2020 is better than the all-India average of 70, data from RBI showed.

But in terms of insurance coverage, the state falls short with only 29 percent of households with any sort of medical cover, as per National Family Health Survey 2019-21. This is much lower than the national average of 41 percent. The survey, however, recommended exercising caution when interpreting and comparing the trends between states and all-India levels given the difference in sample size.

Though the percentage of children aged 6-17 years who attended schools increased from 85 percent in 2015-16 to 90 percent in 2019, only 18 percent of women and 22 percent of men (aged 15-49 years) in the state had completed 12 or more years of schooling, the survey showed.

In comparison, in Haryana only 23 percent of girls and 22 percent of boys between the ages of 2-4 years attended preschool in the state. As high a proportion as 94.3 percent of children aged 6-14 years attended school in the state. The number fell to 73.4 percent among children aged 15-17 years, as per the National Family Health Survey 2019-21.

And for Tamil Nadu, among children aged 2-4 years, a higher percentage of boys (34 percent) attended preschool compared to girls (33 percent). School attendance in Tamil Nadu was almost universal at 96.9 percent in the 6-14 years age group but dropped to 74.3 percent among children aged 15-17 years.

To be the sure, the survey metrics are varied for different states.

NIPFP’s Chakraborty agrees that the question is not about finances when talking about social infrastructure spending on education and healthcare in West Bengal. It is about accountability.

“The calculus of consent of voters depends on the government's last-mile connectivity with people. Skilling is significant for occupational mobility. The state should focus on skilling, strengthen the MSME (micro, small and medium enterprises) sector and on attracting private investments in key sectors like IT, manufacturing and tourism.” the economist said.

Steady de-industrialisation?

Perhaps the biggest complaint with West Bengal is how the state has seen less and less of industry presence over the years. Once British India’s most industrialised region, West Bengal started falling behind economically soon after Independence.

While this decline was slow to begin with, the descent soon became steep under 34 years of Left rule and the new Trinamool Congress regime began with a misstep, relating to the infamous incident surrounding Singur and the Tata group’s manufacturing plans in Bengal is a case in point.

The Left government in 2006 announced that Tata Motors would set up a car manufacturing unit to roll out its Nano model for which close to 1,000 acres of land would be allocated. Then in opposition, the Trinamool Congress led by Mamata Banerjee protested against the land acquisition by the auto major, leading to the latter announcing in 2008 that it was moving its plant to Sanand in Gujarat citing security reasons to discontinue work at Singur.

West Bengal has also seen some established businesses moving out of the state. Britannia Industries, a company that started in 1892 when a group of businessmen in Kolkata formed the entity to manufacture biscuits, shifted its base to Bengaluru in 2013. And as per recent media reports, India’s top government lender, State Bank of India plans to move its centralised global back office and some other foreign exchange-related departments from Kolkata to Mumbai. The back office was set up in 2015 in the City of Joy.

In the ease of doing business rankings led by the central government's industry department, West Bengal improved on its standing, coming in at the ninth place in 2018-19 versus 10th during the previous fiscal, but it is still behind other large states like Andhra Pradesh, Gujarat, Haryana, Karnataka, Punjab, Tamil Nadu and Telangana, which were the top achievers.

Data for the number of recognised startups in Indian states showed that West Bengal is lagging compared peers on this front as well. It had a total of 2,739 recognised startups from 2016-2022, around half that in Telangana and Tamil Nadu. And, exceptionally behind states like Karnataka and Maharashtra which boast of 9,904 and 15,571 startups respectively.

Though West Bengal is the fourth most populated state in India and Gujarat comes in at ninth place, foreign direct investment flows of the former stood at $1.54 billion between October 2019 and December 2023, while for Gujarat it was at $37.73 billion, according to data from commerce ministry’s Invest India platform.

To be sure the state still boasts of a thriving industry in certain sectors such as leather and steel. However, it has not kept pace with emerging trends when it comes to wooing industry.

It is the largest producer of rice, pineapple, vegetables and jute in India and is home to the second-highest number of MSMEs in the country.

Chakraborty says the acrimonious state of industrial relations in the state is a matter of huge concern.

“Militant trade unionism is yet another concern. Streamlining of regulatory framework is essential for entrepreneurship,” she added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.