Inflows from foreign portfolio investors (FPI) in debt so far in November have risen to a 27-month high, which experts attribute to the impending inclusion of Indian government bonds in a global bond index.

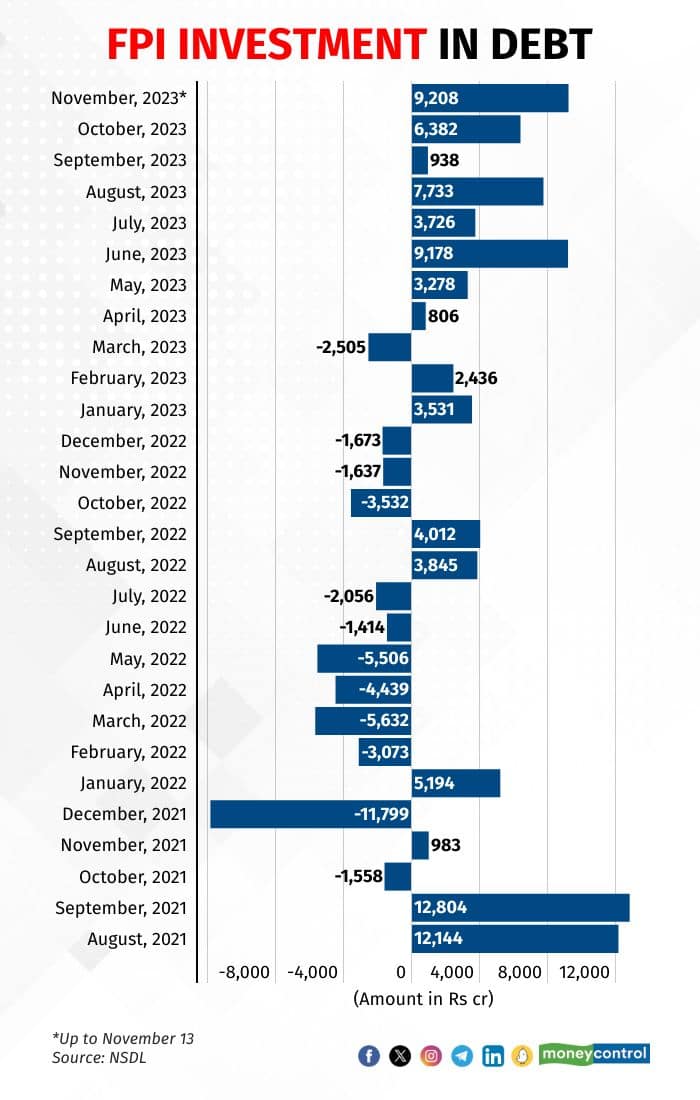

According to NSDL data, investment by FPIs in debt as of November 13 was at Rs 9,208 crore, compared to Rs 6,382 crore in the previous month.

“Through the FAR (fully accessible route) route, FPI allocation has been higher since the news on Indian government bonds’ inclusion into the JP Morgan Emerging Market bond index,” said Mataprasad Pandey, vice president, of Arete Capital Service.

Venkatakrishnan Srinivasan, founder and managing partner of Rockfort Fincap LLP, said some FPIs seem to have shifted from equity to debt and among them, some showed interest in high-yield corporate bonds.

JPMorgan said on September 22 that it would include Indian government bonds in its widely tracked emerging market index starting June 28, 2024. The inclusion of India’s sovereign bonds can potentially draw $30 billion in foreign inflows.

The decision has significant implications for India's debt market and global investors, with India's weight in the index limited to a maximum of 10 percent and eligible government bonds valued at $330 billion, analysts said.

Experts also attributed the rise in investments to the domestic market being hopeful that Bloomberg too will add Indian government securities to its bond index soon, spurred by optimism over reviews scheduled in October and November on their “potential eligibility” for inclusion.

Moneycontrol on October 31 reported that there is a high probability of this because the members of the Bloomberg Fixed Income Index Advisory Councils are the same as those on JPMorgan’s advisory council, according to market sources.

The numbers

Net investment by FPIs in the debt segment has been in positive territory in all of 2023 to date barring, when there were outflows. That month, FPI investment stood at a negative worth of Rs 2,505 crore.

At over Rs 9,200 crore, FPI investment so far in November is the highest since September 2021, when the corresponding figure was Rs 12,804 crore, as per NSDL data.

The investment by foreign players remained negative in the whole of 2022 due to uncertainty over interest rates and inflation across the globe.

In India, to tame higher inflation, the Reserve Bank of India (RBI) had started increasing its key repo rate since May 2022, raising it a total of 250 basis points (bps) before pausing in the last four monetary policy meetings.

Currently, repo rate stands at 6.50 percent. India's headline retail inflation rate fell to 4.87 percent in October.

The outlook

Money market experts believe that the allocation by foreign players in debt will increase in the coming months because, during the reversal of interest rates, the difference between US Treasury yields and Indian government bond yields will increase. This is likely to attract more investors towards emerging markets like India in search of higher returns, they added.

“Increase in FPIs’ allocations into the Indian debt market is a good sign and I expect allocation to go up as during rate reversal in the US, the spread is expected to widen, which is a good case for an increase in FPIs’ allocation into Indian debt,” Pandey added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.