The Indian equity benchmarks' march to a new high seems to be getting longer, as the Sensex and the Nifty continued to struggle on June 2 in choppy conditions. The volatility is weighing on traders.

The 30-pack Sensex hit its all-time high of 63,583.07 on December 1, 2022. On the same day, the Nifty had its best showing at 18, 887.60

At 12.33 pm, the Sensex was up 0.19 percent at 62, 545.44, while the Nifty was at 18, 530, up 0.23 percent. The Bank Nifty also gained 0.45 percent to 43,990.

Rajesh Sriwastava, a Bengaluru-based derivatives trader, said he started the day with a neutral position but turned bearish as the indices dropped, However, his position was in loss at the time of writing the story.

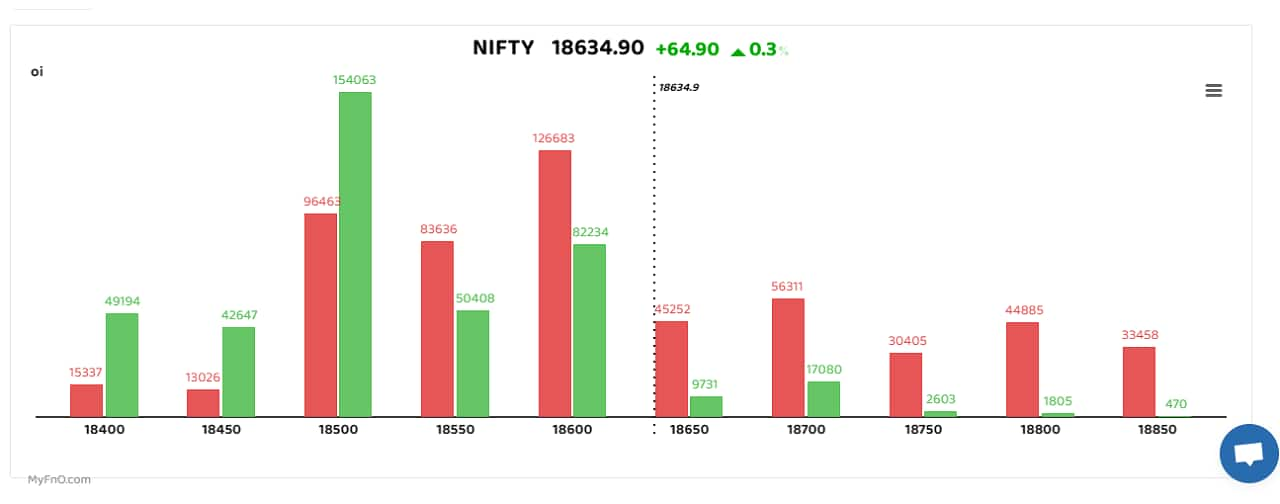

The bars reflect changes in open interest (OI) during the day. The red show call option OI and the green put option OI.

The bars reflect changes in open interest (OI) during the day. The red show call option OI and the green put option OI.

The weekly options data shows an accumulation of straddle trades -- a neutral strategy -- at 18,500 and 18,600, signalling that the volatility will continue. Though most traders and analysts are confident of a broader outlook.

On the monthly option chain, 18,500 and 18,6000 are seeing heavy accumulation of put contracts, signifying the zone emerging as a support for the index. Call writers are present at 19,000, as it emerges as a key hurdle for the index.

PSU bank and realty sectors continue to be investor picks, while information technology and oil & Gas seem to be bearish bets. The metal pack was also quite vibrant.

Power Finance Corporation, Astral and Hero MotoCorp were among key stocks in which traders have taken long positions. Hindalco and Tata Communication also saw long buildups.

Short covering – a bullish sign – was seen in Hindustan Aeronautics, Hindustan Copper and Jindal Steel.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.