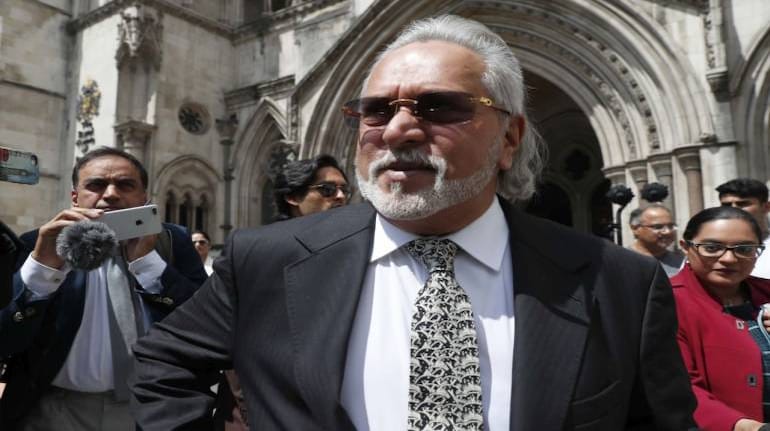

Five years have passed since billionaire businessman Vijay Mallya left India for United Kingdom citing personal reasons, only hours before a bank consortium moved the Supreme Court seeking his detention. Mallya left India on March 2, 2016.

Banks are still anxiously awaiting Mallya's extradition with the hope that the money they lent to the former Kingfisher boss will be returned to them. The legal battle is still continuing and is unlikely to end any time at least in the foreseeable future.

From a bank-corporate borrower issue, Vijay Mallya became more of a political issue after the Indian government cancelled Mallya’s passport in April, 2016 and the Government began efforts for the liquor King’s extradition.

In the latest development, a UK Court upheld an application by a lender-consortium led by State Bank of India (SBI) to amend their bankruptcy petition, in favour of waiving their security over Mallya’s assets in India. Chief Insolvencies and Companies Court (ICC) Judge Michael Briggs handed down his judgment in favour of the banks to declare there is no public policy that prevents a waiver of security rights, as argued by Mallya’s lawyers.

Still, there is no clarity on Mallya’s extradition. Even if it happens, an extradition doesn’t mean banks can get their money back as the billionaire is fighting the bank default case in Indian courts.

Mallya originally owed Rs 9,000 crore to banks. But, if one adds the accrued interest component, this amount could be over Rs 11,000 crore now, according to banking industry officials.

There are few important lessons for banks from the Vijay Mallya-Kingfisher episode:

One, banks acted too late to move against Mallya legally. Vijay Mallya’s Kingfisher became an NPA (non-performing asset) to banks in 2012 but banks began a serious legal fight only six years later. By then, there was nothing much to recover (the value of the underlying assets had eroded). Lenders got stuck in endless legal disputes.

Two, in the hurry to garner business, public sector banks conveniently forgot the golden rules of the game and looked at the celebrity status of borrowers like Mallya and Modi rather than the actual, recoverable assets against the loan. This proved to be a big mistake in hindsight when the loan turned bad.

“Who could have said no to Vijay Mallya when he asked a loan?,” said a former PSU banker commenting on the case. Interestingly, even during the Nirav Modi episode, bankers were heard speaking on the same lines. “Nirav Modi is far big a personality for any banker to mess with, particularly for an officer at a branch level,” said another banker. Both persons requested anonymity.

Three, banks probably overestimated the use of personal guarantee in this case. Lenders failed to ensure there is enough collateral to back the money they lent. Kingfisher loan was given against intangibles like company brand and goodwill and Mallya’s personal guarantee. At the end of it, brand and goodwill etc proved to be of no use for lenders. Banks could invoke only the personal guarantee of the businessman. Here also, the legal case are pending and multiple agencies are awaiting for resolution. The risk management systems failed miserably.

Banks, like in many other cases, couldn't use personal guarantees of the promoter effectively for loan recovery. Unlike a retail borrower, powerful corporate promoters have an army of lawyers and money power to drag banks to court rooms for years on end. That happened in Kingfisher case as well.

Four, banks refused to accept Mallya's multiple proposals for repayment through a settlement. According to senior banking executives, this was a mistake on the banks' part since accepting the offer could have helped to recover at least some part of the money Mallya owed to them. The last offer was made in May, 2020 when Mallya asked the banks and the government to accept his offer to repay 100 percent of his loan dues and close case against him. "Please take my money unconditionally and close," Mallya tweeted.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.