With Vijay Mallya’s extradition from the UK uncertain, banks can only look at monetising his assets in India, which include shareholdings in United Breweries and United Spirits. Mallya’s overseas assets are beyond their reach.

So, what will the banks get if they sell Mallya’s shares in

United Breweries and

United Spirits? Just about Rs 3,411 crore as against the Rs 11,000 crore he owes them.

Loans to Kingfisher turned NPAs (non-performing assets) back in 2012.

The value of shares held by Mallya and his companies in United Breweries has eroded, while his real estate assets and personal property will not fetch the lenders anything meaningful. The banks gave Mallya loans on his personal guarantee, and hence, have the right to claim his personal assets.

The math

Story continues below Advertisement

As at end September, Mallya and his companies held 59.6 lakh shares in United Spirits or a 0.82 percent stake. At Rs 563.95 apiece, these shares are valued at Rs 336.3 crore. Similarly, in United Breweries, Mallya and his firms hold 2.9 crore shares or 11.04 per cent, which are valued at Rs 3,075 crore at Rs 1,053.85 apiece. Thus, the total value of Mallya’s shareholding in both companies as on date is Rs 3,411 crore.

This value has eroded since the beginning of this year following a fall in share prices. The share price of United Breweries has fallen 17.16 per cent so far this year, while that of United Spirits fell 5.92 per cent. India’s benchmark equity index, the Sensex, has risen 4.91 per cent during this period.

This is only a third of what Mallya owes banks. Senior Advocate Mukul Rohatgi, representing the

SBI-led banks consortium, on October 26 informed the apex court that the lenders still had to recover Rs 11,000 crore from Mallya. The banks have so far recovered only Rs 3,600 crore. Originally, Mallya owed the lenders around Rs 9,000 crore. But, the outstanding

loans have grown since then, including the accrued interest.

Real estate assets

Shares are the only major recoverable assets for banks. The rest of the collateral includes some of the real estate properties and Mallya’s personal assets. The value of these will be insignificant for lenders even if they manage to sell them. Last year, banks tried to auction ‘Kingfisher House’, the headquarters of Kingfisher Airlines, for the ninth time, unsuccessfully. The reserve price for the property has dropped by about 60 per cent.

The auctions have failed repeatedly as potential buyers are worried about the legal implications of the disputed assets. The banks managed to sell Kingfisher Villa in Goa for just Rs 73 crore.

But even selling the shares isn’t easy. There are multiple cases in various Indian courts filed by banks and the ED. “Both the ED and banks want a share of these assets. There is no clarity,” said a former chairman of a state-run bank that was part of the Kingfisher loan consortium.

Another banker said lenders indeed had first right to the proceeds from the sale of assets, and the ED can claim only those assets where financial fraud is involved.

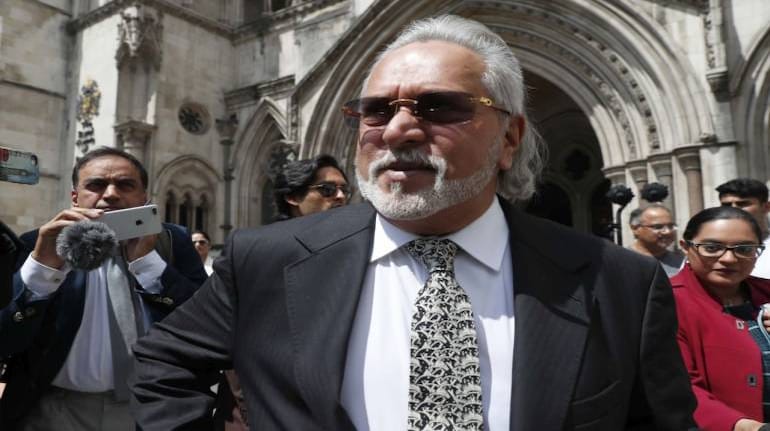

Time and again, Mallya has repeated his offer to repay the principal amount to banks. “I request the banks, with folded hands, to take 100 percent of your principal back, immediately,” Mallya repeated, outside the Royal Courts of Justice in London, early this year.

But banks that have dealt with Mallya in the past don’t attach too much importance to this offer. “These are just statements. Don’t read too much into it. Where is the money,” asked one of the senior bankers on condition of anonymity.

Extradition unlikely soon

Over four years after Mallya escaped to the UK after defaulting on repayment of Rs 9,000 crore to 17 banks, his extradition remains uncertain.

The UK has now cited a ‘confidential legal issue’ that is yet to be resolved before the extradition actually happens.

Bankers aren’t very hopeful. Senior bankers said Mallya’s extradition is unlikely to happen given the stringent laws that protect fugitives in that country.

“I don’t think he will ever come back,” said Naresh Malhotra, a former SBI senior executive and banking consultant. “The UK’s laws are conducive for rich economic offenders to seek asylum,” said Malhotra.

Banks are sitting ducks

Seventeen banks, with the country’s largest lender State Bank of India (SBI) in the lead, had lent money to Kingfisher over a few years (both fund based and non-fund) and issued fresh funding when Mallya’s company was struggling to stay in the air.

Close to Rs 1,700 crore was lent by SBI, the lead bank of the group, while IDBI Bank gave Rs 900 crore. Other banks, a mix of state-run and private lenders, contributed a few hundred crore each. Most of the loans were extended based on a personal guarantee by Mallya. The other collateral included the Kingfisher brand — one of the rarest cases when a huge sum was lent to a corporate just against a brand name.

These banks later converted a sizable chunk of their loans into equity. SBI and ICICI Bank had converted Kingfisher’s shares at Rs 64.48 each, which was at a 60 percent premium to the prevailing market price then. The prices crashed to penny stock values within 16 months. Kingfisher has since been de-listed from the exchanges.

The escape

Story continues below Advertisement

Mallya left for the UK on March 2, 2016. This was just hours before a consortium of banks rushed to the Supreme Court seeking his detention and the immediate repayment of outstanding dues on loans. Since his flight to the UK, Mallya has been waging a legal war against his lenders, investigators and the Ministry of External Affairs (MEA) by disputing the charges of financial fraud and wilful default levelled against him.

In April 2016, the MEA revoked his passport. Several rounds of hearings in British and Indian courts have taken place since then, which would lead to Mallya being arrested and released within hours multiple times. While the courtroom drama continues, the banks have become sitting ducks as only a small portion of the money has come back so far.