A working group has suggested that the guarantees issued by state governments during any year have a ceiling either as a percentage of their receipts or their GDP.

According to the report of the Working Group on State Government Guarantees, published by the Reserve Bank of India (RBI) late January 16, additional guarantees issued by states in a year should have an upper limit of 5 percent of their revenue receipts or 0.5 percent of their Gross State Domestic Product, whichever is lower.

Also Read: Is India's co-operative federalism dream breaking down?

"A reasonable ceiling on issuance of guarantees may be desirable, as their invocation could lead to significant fiscal stress on the State Governments," the report said.

A guarantee is a contingent liability that protects lenders from the risk of default. These guarantees are usually given when the default risk is too high for lenders.

The working group's formation was decided in July 2022 at the 32nd Conference of state finance secretaries. The group comprised officials from Haryana, Jammu and Kashmir, Odisha, Andhra Pradesh and Karnataka from the states' side and officials from the Union finance ministry, Comptroller and Auditor General of India, and the RBI.

The recommendations come amid increasing discussions on the financial situation of states, with the decision of some governments to revert to the Old Pension Scheme seen as a big step back in improving their finances.

In its report, the working group said that if guarantees have to be paid out and there are not sufficient buffers, it could result in higher expenditure, deficit, and debt levels for states.

As at the end of 2020-21, guarantees given by states amounted to Rs 7.4 lakh crore, or 3.7 percent of the GDP. Meanwhile, the Guarantee Redemption Fund stood at Rs 10,839 crore as on March 31, 2023.

"Another related concern associated with the guarantees extended by the states, has been the increasing bank finance to government owned entities backed by government guarantee, especially, where the bank finance appeared to substitute budgetary resources of the state governments," the report said.

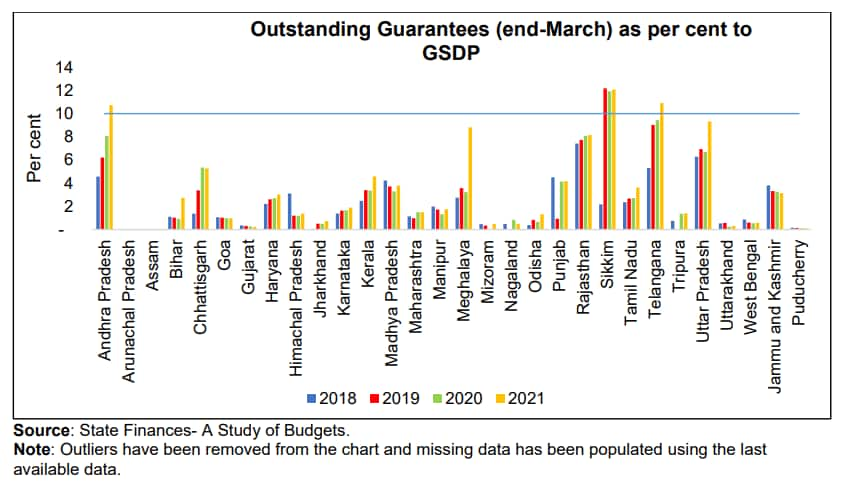

Outstanding guarantees amounted to under 10 percent of the Gross State Domestic Product for most states, though the percentage has been rising, data contained in the report shows. And while some states have fixed ceilings – some statutory, some administrative – on the amount of guarantees they can give out, they lack uniformity.

Source: Report of Working Group on State Government Guarantees

Source: Report of Working Group on State Government Guarantees

Some of the other recommendations of the working group are:

>> There should not be any distinction between conditional and unconditional or financial and performance guarantees when it comes to assessing the fiscal risk.

>> Guarantees should include all instruments that create an obligation for the state.

>> Government guarantees should not be provided to the private sector.

>> Government guarantees should not be used to obtain finance through state-owned entities, which substitutes budgetary resources of the state government.

>> Any guarantee, once given, must be honoured without delay. Otherwise, it could hurt the reputation of the state and create a legal risk.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.