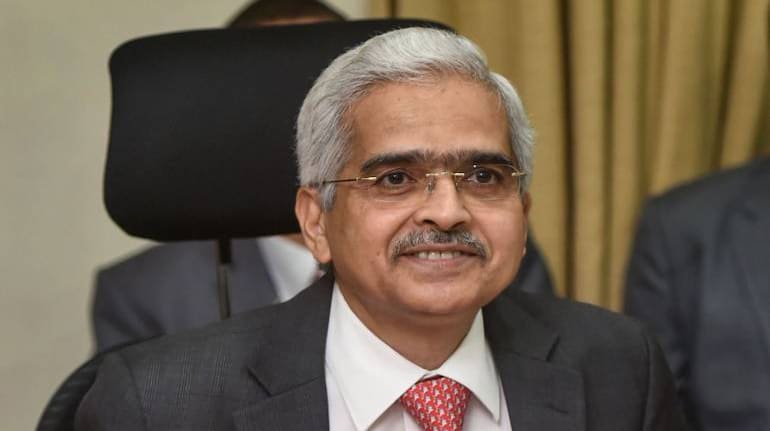

The Monetary Policy Committee (MPC) kept key interest rates unchanged on February 10 and retained the accommodative stance in its first policy meeting after Union Budget 2022. This is the tenth time in a row that the MPC headed by RBI Governor Shaktikanta Das has maintained the status quo.

Here are the key takeaways of the Reserve Bank of India Governor Shaktikanta Das' speech:

The MPC has kept both the repo rate and reverse repo rate unchanged at 4 percent and 3.35 percent respectively. Also, the panel continued with the so-called ‘accommodative’ stance in the backdrop of elevated level of inflation.

The MPC voted unanimously for keeping interest rate unchanged and decided to continue with its accommodative stance as long as necessary to support growth and keep inflation within the target.

The RBI projected GDP growth for FY23 at 7.8 percent. The central bank retained the growth projection for current financial year at 9.2 percent.

CPI inflation forecast for FY22 has been retained at 5.3 percent. It expected to moderate closer to 4.00 percent target in second half of FY23 and provide room for monetary policy to remain accommodative.

Retail inflation rose to a five-month high of 5.59 percent in December from 4.91 percent in November, mainly due to an uptick in food prices. MPC has been given the mandate to maintain annual inflation at 4 percent until March 31, 2026, with an upper tolerance of 6 percent and a lower tolerance of 2 percent.

There has been some loss of momentum in the economic activity due to Omicron. Considering the outlook for inflation and growth, uncertainty related to global spillovers and Omicron, there's a need for continued policy support is warranted for the economy.

Rupee has shown resilience in the face of global spillovers. Current account deficit (CAD) seen below 2 percent of FY22 GDP.RBI is committed to smooth conduct of the government borrowing program

The cap of e-vouchers has been proposed to be increased from Rs 10,000 to Rs 1 lakh.

Variable rate repo operations of varying tenors will henceforth be conducted as and when warranted. Second, variable rate repos and variable rate reverse repos of 14-day tenors will operate as the main liquidity management tool. Third, these operations will be aided by fine turning operations. Fourth, with effect from March 1, the fixed rate reverse repo and Marginal Standing Facility will only be available from 5:30-11:59PM on all days.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.