The purchasing power of the northeastern states is an untapped territory that will contribute significantly to goods and services tax (GST) revenue growth if backed by huge investments and infrastructure development which will greatly push up consumption, experts said.

“With sustained efforts with an aim to speed up industrialisation, better connectivity through rail, road and air, and increase in purchasing power of the local population, the northeast is definitely an untapped territory and will contribute significantly to GST revenue in coming years,” Anchal N Arora, partner, Felix Advisory, a management consulting services firm, told Moneycontrol.

The northeastern states have also been the biggest beneficiaries of the five-year-old GST regime, according to the Reserve Bank of India (RBI) report on state finances released earlier this year. These states have recorded a compound annual GST revenue growth rate of 27.5 percent so far since the implementation of the GST against 14.8 percent for all states, according to the RBI report.

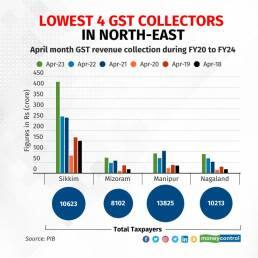

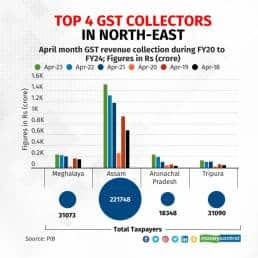

GST collection has grown exponentially in the past year in some north-east states like Sikkim and Mizoram. In these states states we are seeing infrastructure developing and investments are coming in. Thus we are seeing exponential high GST collection growth rate in these over the years. Mizoram has seen 53% increase in its GST collection for April 2023 month on month, Manipur 32%, Nagaland 29% and Sikkim has seen 61% month on month increase in April 2023. For April 2022, on the other hand Mizoram’s GST collection had fallen by 19% month on month while Manipur's fell by 33%. Sikkim had only 2% revenue growth rate while Nagaland had an impressive 32% GST growth in April 2022 month on month.

This can be mainly attributed to two reasons. First, unlike the central sales tax, an origin-based tax, GST is a destination-based tax levied at the time of consumption of goods or services. If, say, goods produced in Maharashtra are sold in Mizoram, GST would be levied in Mizoram and not Maharashtra. Hence, it benefits consuming states of the northeast, which do not have much production but gained immensely post-GST implementation.

Second, GST being a value-added tax has an inbuilt mechanism for higher tax compliance.

“All the northeast states have witnessed higher revenues from SGST, a component of GST representing taxes collected within the state,” Arora said.

With economic growth picking up in the region due to implementation of various infrastructure projects with an emphasis on the development of HIRA, i.e., highway, inland waterway, railway and airway, infrastructure projects like the Indian-Myanmar-Thailand trilateral highway connecting Manipur to Thailand by road and the rail project linking Agartala with Akhaura in Bangladesh are being undertaken with the intent to develop the northeast as India’s gateway to Southeast Asia. Work is underway to connect all the state capitals of the region by railway networks.

The Eastern Waterways Connectivity Transport Grid project, which is currently underway, aims to provide seamless connectivity between National Waterway-1 (NW-1) and NW-2 through the Indo-Bangladesh Protocol routes and is projected to offer seamless connectivity not only between the northeast and rest of the country but also in the subcontinent, upon completion, offering nearly 5,000 km of navigable waterways to and from the region.

Digital connectivity in the northeast has been enhanced by enhancing the optical fibre network. The number of airports in the region has jumped from 9 to 16 between 2014 and 2022, and the number of flights has increased significantly.

GST collections from the northeastern states rose to Rs 2,799 crore in April 2023 compared to Rs 2,290 crore in April 2022, a nearly 22 percent increase.

“The GST registration limit for northeastern States is Rs 10 lakh against Rs 20 lakh (elsewhere), and with this, the coverage under the GST net in the northeast is wide, and this has also led to an increase in the tax base. Efforts to disseminate information with regard to GST and approach to making the compliance process simpler are also resulting in more proactive compliances, which are driving GST collections in the northeast. A rise in GST revenues in these states is largely due to initiatives to educate taxpayers about compliances, and also making non-compliances more difficult by way of GSTR–2A matching and making e-invoicing mandatory for taxpayers above a certain limit. This combination of taxpayer education and disincentivising non-compliances is what has led to change in taxpayer behaviour and improved collections in the region, he said,'' Siddharth Surana, director, RSM India, an audit, tax and consulting firm, told Moneycontrol.

Union Minister Road Transport and Highways Nitin Gadkari announced new sanctioned projects worth Rs 1.6 lakh crore for the northeast in November 2022. Private investments, although limited, may also rise in the future once the infrastructure projects are complete. Arunachal Pradesh has been allotted Rs 44,000 crore of highway projects, the highest among the northeastern states. Assam has been sanctioned road projects worth Rs 38,000 crore, Manipur Rs 15,499 crore, Meghalaya Rs 12,500 crore, Tripura Rs 12,426 crore, Mizoram Rs 6,664 crore, Nagaland Rs 3,235 crore and Sikkim Rs 2,000 crore.

“Investments in infrastructure enable the creation of an ecosystem for businesses to thrive. Rising internet penetration and improved logistics and infrastructure will also enable entrepreneurship and development of e-commerce in this region. The approach to develop infrastructure, power supply, IT and telecom facilities in the northeast have led to a multiplier effect on the economies of these regions, which in turn have boosted the GST collections,” Surana said.

To attract investor interest and establish a helpful business climate, these states have been designated as special category states with the aim of increasing economic activity, thereby boosting GST collection.

“Northeastern states of India have immense potential for growth and development. Investments in these can contribute significantly to GST revenue growth. Development in the NE states is supposed to work on the area's financial development and increase GST income in the coming years. Better roads and rail network will work with better development of labour and products, reduce operations expenses, and boost exchange and trade. The expansion in air connectivity will help the travel industry, exchange, and business and draw in investment. The improvement of sustainable power will reduce energy costs, support modern development, and increase GST income,” Rajat Mohan, senior partner, AMRG & Associates, a chartered accountancy firm, told Moneycontrol.

The National Highways Authority of India (NHAI) has undertaken several major projects, including the construction of the Barak bridge, the longest rail-cum-road bridge in India, connecting Assam and Manipur. Another project is the 9.2 km Dhola-Sadiya bridge, connecting Assam and Arunachal Pradesh. The bridge has reduced travel time between the two states by almost four hours.

NHAI is also constructing the four-lane NH-27 between Barhi and Hapur, which will improve connectivity between the northeastern states and the rest of India.

The Jiribam-Imphal railway line in Manipur, which is currently under construction, will connect Imphal, the state’s capital, with the rest of India.

Once completed, the Agartala-Akhaura railway link is expected to improve connectivity and boost trade between the two countries.

The airport at Itanagar in Arunachal Pradesh is under construction and will provide easier access to the state. The Tezpur airport in Assam is being upgraded to an international airport, which will improve connectivity to Southeast Asia.

Several hydropower projects are being developed including the 2,000 MW Lower Subansiri hydropower project in Arunachal Pradesh and the 600 MW Kameng hydropower project in Arunachal Pradesh.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.