Dear Reader,

After a brief, muted rally lasting just two weeks, the Indian market experienced a setback, losing nearly two percent as investors opted to reduce their holdings in response to fresh US tariffs and persistent selling by foreign institutional investors (FIIs). During the past week, the Nifty50 index fell by 1.78 percent, bringing the total decline for the month to 1.4 percent. This marked the ninth consecutive week of selling by FIIs, who offloaded equities worth Rs 21,151.90 crore, contributing to a monthly total of Rs 46,902.92.

The impact was felt across the market, with large-cap stocks decreasing by nearly two per cent, while mid-cap and small-cap indices dropped by nearly three per cent. On a sectoral basis, the Realty index saw a significant decline of over four per cent, closely followed by a similar drop in defence stocks. The PSU Bank index fell by 3.5 percent and Oil & Gas stocks were down by around three percent; however, the FMCG sector managed to end the week on a positive note, closing 0.7 percent higher.

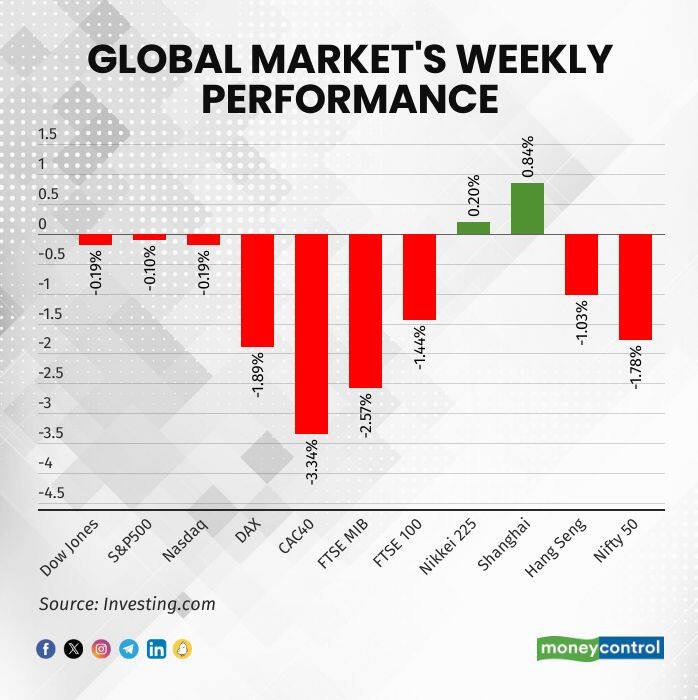

A sluggish global landscape compounded the weakness in the Indian market. As depicted in market charts, aside from a modest gain in the Nikkei and Shanghai indices, most other global markets closed in the red.

In the US, markets closed the week with marginal losses amid relatively low trading volumes. The Dow Jones Industrial Average had reached a new record high earlier in the week, only to close lower on Friday. Investor sentiment was shaken when President Trump announced the historic removal of Fed governor Lisa Cook, alleging her involvement in mortgage fraud.

European markets also struggled, hampered by renewed tariff uncertainties, political instability in France, and diminishing hopes for peace between Russia and Ukraine.

Looking ahead, the Indian markets may continue to face selling pressure from FIIs, as the uncertainty surrounding its relationship with the US and lacklustre corporate performance weigh heavily on investor sentiment. Without any decisive government action to mitigate the negative perception stemming from Trump’s tariffs, Indian markets are likely to remain under pressure in the coming weeks.

Further downside likely

The Nifty index has experienced a decline for both the week and the month. Current weekly momentum indicators remain in sell mode, confirming that the downward trend is still in effect. Traders are paying close attention to the 20-month average, which stands at 23800, as it could reveal the broader market's trajectory.

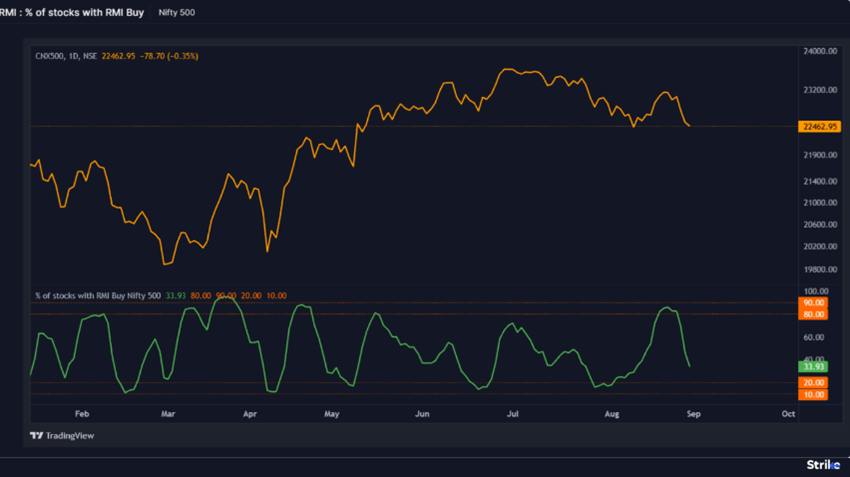

Additionally, a significant but often overlooked event this week has been the performance of the Indian currency, which has reached a new all-time low. The market's volatility was evident as the swing dropped to 7 during the week, yet it failed to produce a notable rebound. This situation reflects a free-fall phase and underscores a generally bearish market environment, where typical oversold readings are not yielding the usual results. To gain clearer insight, we will need to see a more pronounced convergence of oversold conditions across various indicators before making any decisive calls on the market's direction.

Source: web.strike.money

The 40-day advance/decline (A/D) ratio is once again on the decline and is nearing the first red line at the bottom of its range. Once it dips below this line, we will begin to designate the market as oversold. However, it's essential to note that the market's breadth can remain weak until we reach the second red line. Therefore, we should exercise patience as we monitor the situation.

Source: web.strike.money

Recently, the percentage of RMI buy signals among the Nifty 500 stocks has decreased to 34%. This drop suggests that the market is beginning to show signs of being somewhat oversold. Typically, when the RMI reading falls below 20%, it reflects a potential downturn in market conditions. Furthermore, a reading that approaches or dips to around 10 is ideal for indicating a significant oversold scenario, which could set the stage for a considerable bounce back in the market.

Source: web.strike.money

Sector Rotation

Nifty 50 – The Benchmark Index ended higher by -1.78% this week and closed at 24,426.85.

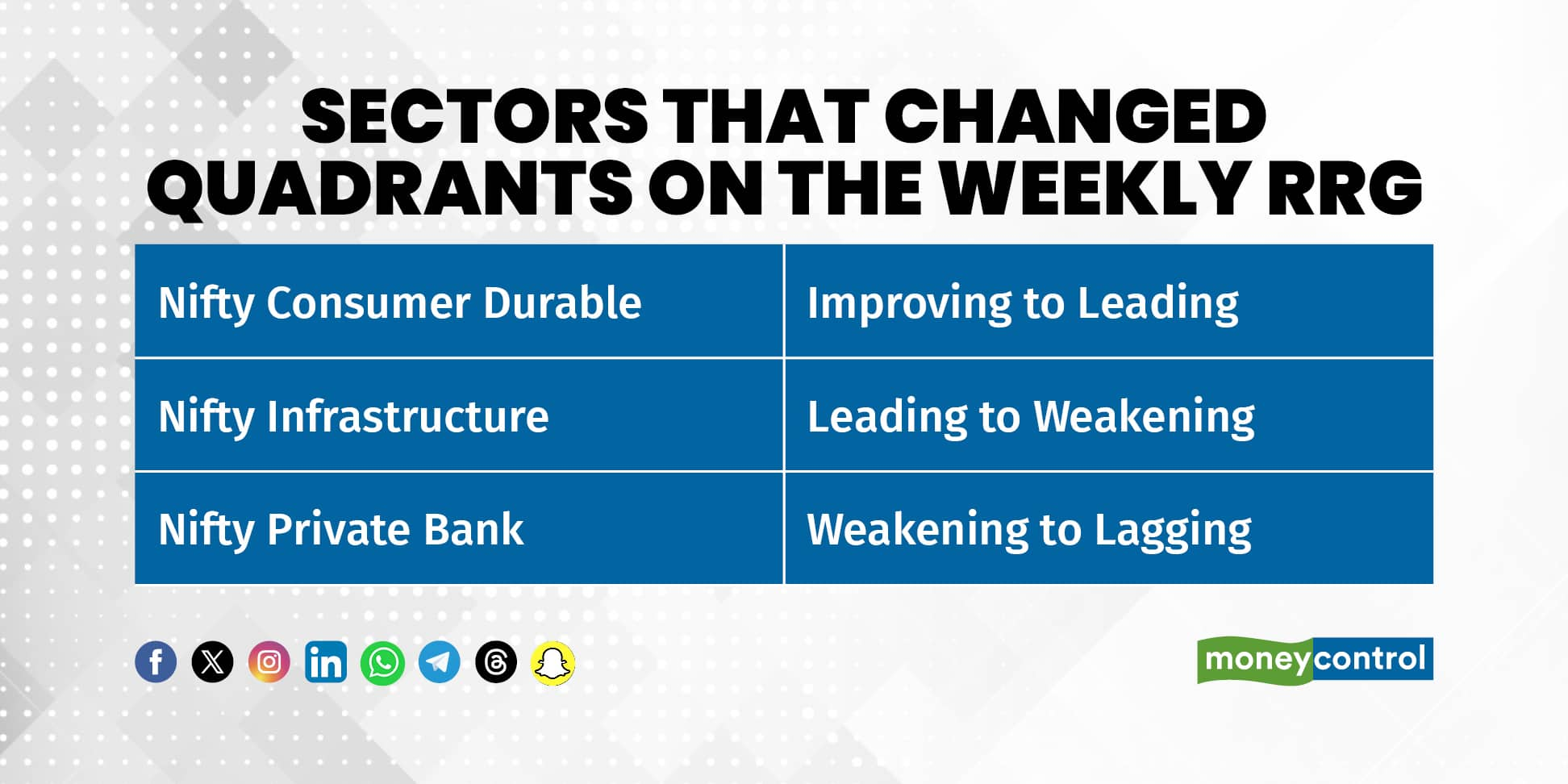

Sectors that changed Quadrants on the Weekly RRG:

Weakening Quadrant: A Lot of Nifty indices like Energy, PSE, Oil and Gas, Bank, Financial services, and Realty are continuously losing momentum as well as relative strength. Nifty infrastructure is in the weakening quadrant compared to the leading quadrant this week, and it is losing both momentum and relative strength.

Lagging Quadrant: Nifty Private Bank has moved to the lagging quadrant from the weakening quadrant.

Improving Quadrant: Nifty FMCG index continues to gain momentum as well as relative strength. Nifty Pharma's momentum has flattened out, but gained relative strength, and it is very close to entering the leading quadrant. The Nifty IT index has experienced a sharp decline in momentum over the past few weeks.

Leading Quadrant: The Nifty Consumer Durable index has entered the leading quadrant this week. It is gaining momentum as well as relative strength. Nifty Auto and Nifty MNC are also momentum and relative strength stocks. Nifty Media, Nifty Metal, and Nifty PSU Bank are witnessing a decline in momentum this week; however, they have seen a minor uptick in relative strength. Nifty Metal and Nifty PSU Bank are very close to the weakening quadrant. If these indices fail to gain momentum, they can enter the weakening quadrant.

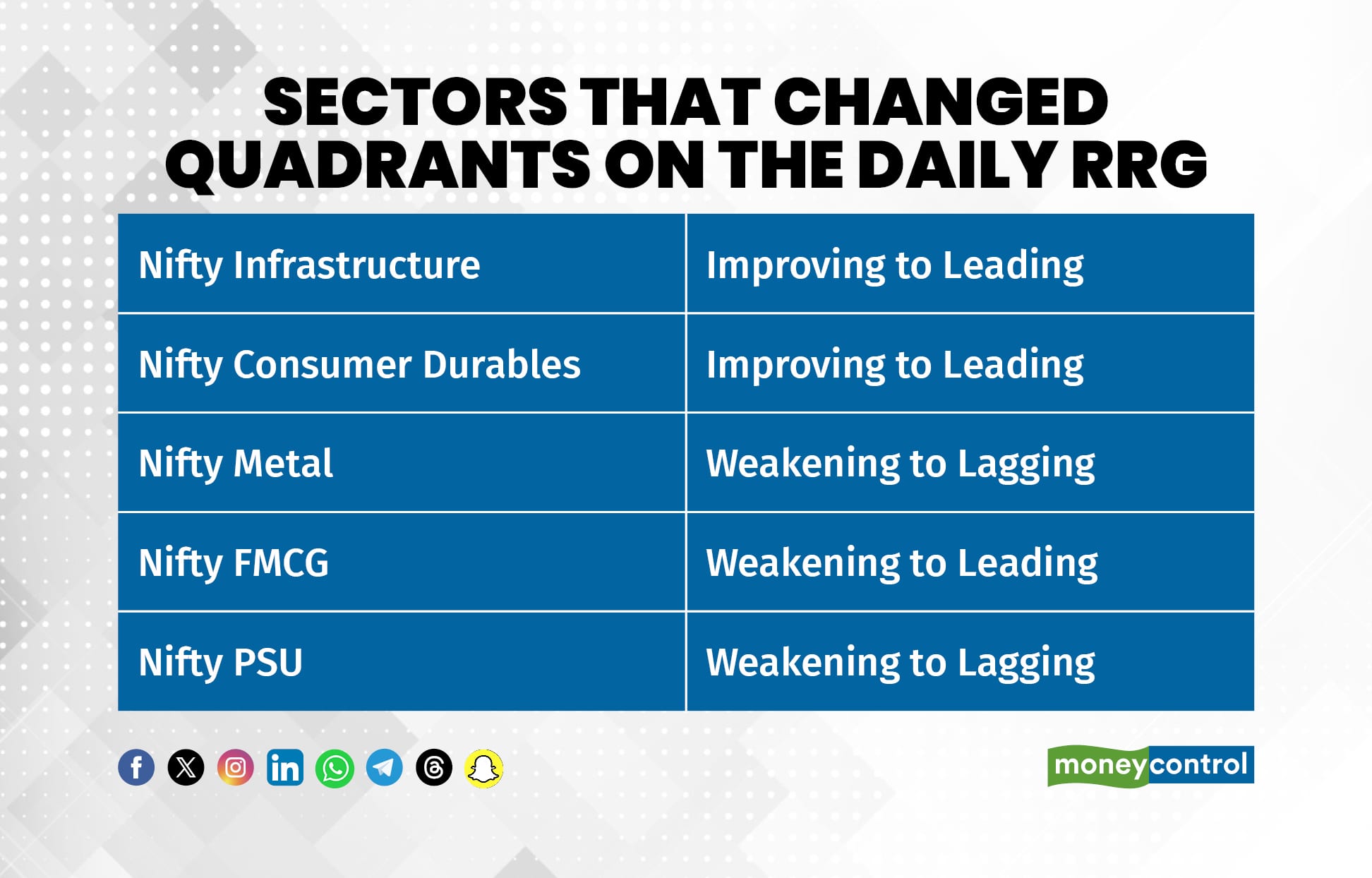

Weakening Quadrant: There are no Nifty indices in the weakening quadrant.

Lagging Quadrant: A few indices, such as Infrastructure, PSU banks, and the metal index, have entered the lagging quadrant. Nifty Infrastructure entered the lagging quadrant from the improving quadrant, whereas Nifty PSU Banks and Nifty Metal moved to the lagging quadrant from the weakening quadrant. The Nifty Media and Nifty PSE indices are experiencing a sharp deterioration in momentum and relative strength. Other indices, such as Nifty Bank, Nifty Financial Services, Nifty Private Bank, and Nifty Energy, have seen an uptick in momentum in Friday's trading session, but there are no signs of improvement in their relative strength yet.

Improving Quadrant: Nifty Realty and Nifty IT indices are gaining momentum and relative strength. The Nifty IT index can move into the leading quadrant if this trend continues. Nifty Oil and Gas is seeing a decline in momentum and is heading towards the lagging quadrant. The Nifty Pharma index was gaining momentum and relative strength, but in Friday's trading session, both momentum and relative strength declined.

Leading Quadrant: Nifty Consumer Durable in a sharp increase in momentum and relative strength, pushing this sector to the leading quadrant from the improving quadrant. Nifty MNC continues to gain momentum and relative strength. The Nifty FMCG index has moved back to the leading quadrant after turning around from the weakening quadrant.

Stocks to watch

Among the stocks expected to perform better during the week are Dalmia Bharat, Maruti, Uno Minda, TVS Motor, Ultracemco, Delhivery, Eicher Motor, Cummins India, Nykaa, Bosch, UPL, LTF and Grasim.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!