The life insurance industry had a total of 2.27 million agents at the end of FY20. These individuals were involved in distribution of life insurance policies to customers by the way of field sales involving visiting the person's home or office.

Now that the coronavirus (or COVID-19) has forced Indians indoors and social distancing is the new normal, field sales will at least take two quarters to resume. This is considering a scenario where the designated green and orange zones are completely opened up from June 1 onwards.

Face-to-face sales is considered the forte of insurance agents since policy terms and conditions are tougher to be explained over the phone or even online. Seasoned agents can earn as much as Rs 6 crore a year from policy sales commission, which could even overtake the annual pay of insurance company chief executives.

However, FY21 has already started presenting newer challenges for these distributors. Tele-sales has replaced field sales and agents have begun to struggle.

Fifty year-old insurance agent Pankaj Kumar says that he is not used to calling customers to sell products. Kumar has been selling insurance for the past 20 years.

"Unlike a home visit a customer can simply cut the call if he/she is not interested. I used to sell at least 15-20 policies a month but now I am barely able to sell three. I wonder how long this (COVID-19) will continue because I cannot survive," he adds.

Agents were also able to meet their sales targets and earn commissions by selling savings plans with bonuses (participating plan) and unit-linked plans (Ulips) where returns could be pegged to stock market movements.

Savings and investment plans which usually have higher premiums attached are slowly falling out of favour among customers who are now eager to conserve cash amidst employment uncertainty due to COVID-19. Volatility in the stock markets has also turned buyers against Ulips.

This change in preferences has led to a double whammy for agents. The result: falling short of sales targets and lower annual compensation. Agents are not paid any salary by insurers and earn only through commissions received from selling policies.

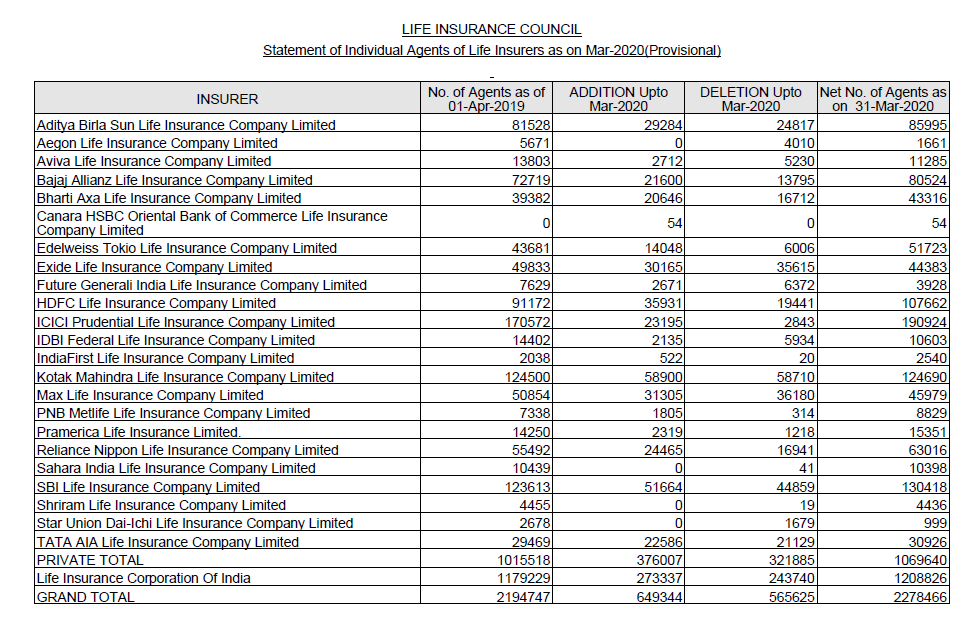

Every year, the life insurance industry loses about 0.5 million agents, mostly due to pink slips being handed out by insurers, apart from a small portion of inactive agents automatically removed from the system. Though at the overall level, there was a net addition in the agent numbers, it is no secret that life insurers regularly monitor agent performance and sales targets.

In FY20, there was a net addition of 83,719 life insurance agents. This was the net of 0.6 million agents added to the system and 0.5 million agents exiting the system.

In normal circumstances, not meeting sales targets or frequent misselling complaints are the two main reasons for an agent to be sacked. However, in FY21 inability to sell online can also seal the career prospects of such individuals.

New systems and online-only sales processes are being put into place. The top one-fourth productive agents (in terms of past sales) are being re-trained across life insurers, but the remaining three-fourth will purely need to rely on their offline selling skills.

Amidst this, it is likely that several agents would either be unable to cope up to the new processes or be unsuccessful in translating leads to sales online.

The future seems grim for life insurance agents in FY21. Those who are unable to make the digital transition would be shipped out quickly.

Follow our full coverage of the coronavirus pandemic here.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!