The government has spent the better part of the last two years looking for ways to revive India's private investment cycle so as to raise the economy's growth trajectory. The solution it decided on was a government-led approach, one that has been backed by the Reserve Bank of India (RBI).

In its monthly State of the Economy article, released on May 17, the central bank noted that for India to grow faster on a sustainable basis, "private investment needs to be encouraged through higher capital expenditure by the government which crowds in private investment".

The government has certainly increased its capital expenditure, with the 2022 budget targeting a record capital expenditure of Rs 7.50 lakh crore for FY23, including Rs 1 lakh crore as an interest-free, 50-year loan to state governments for their capital expenditure.

But will this be enough to crowd in private investment, especially at a time when interest rates are on the rise and the RBI is in the midst of withdrawing the mammoth liquidity surplus it infused to support the economy following the onset of the coronavirus pandemic?

Tighter conditions

That financial conditions have tightened is clear but there remains room for comfort.

"So far, it seems rising interest rates have not constrained the supply of credit to the broader economy. Even as RBI is reducing excess liquidity in the system, it remains adequate to support credit growth," CRISIL said in a report on May 16 after its Financial Conditions Index returned to the "easy zone" in April.

Credit growth is finally showing signs of recovery, having recently entered the double-digit territory. In April, bank credit growth was up 11.1 percent year-on-year, the highest since December 2019, according to CRISIL.

"A look at sectoral data indicates a broad-based revival in credit across industry, services and retail segments,” CRISIL noted.

What may have helped is the negative real interest rate.

There are numerous ways to compute the real interest rate, some more reasonable than others.

In the minutes of the May 2-4 meeting of the Monetary Policy Committee, published on May 18, external member Jayanth Varma said if the real policy rate was calculated by subtracting the latest inflation print from the repo rate, then the real rate was now lower than it was after the April 6-8 meeting on account of the rise in inflation.

"Of course, it is more reasonable to calculate the real policy rate by subtracting the forecast inflation rate three to four quarters ahead, but even if one does that, it is obvious that the real policy rate continues to be sharply negative," Varma added.

Going by the first definition provided by Varma, the real rate of interest in India is -3.39 percent. The second definition results in a higher—but still negative—real interest rate of -0.7 percent, though this is based on inflation forecasts made by the RBI in April, one which will surely be revised higher come June.

According to a 2013 paper by RBI staff, evidence suggested it was the real interest rate that mattered when it came to decisions relating to investment, consumption, and saving.

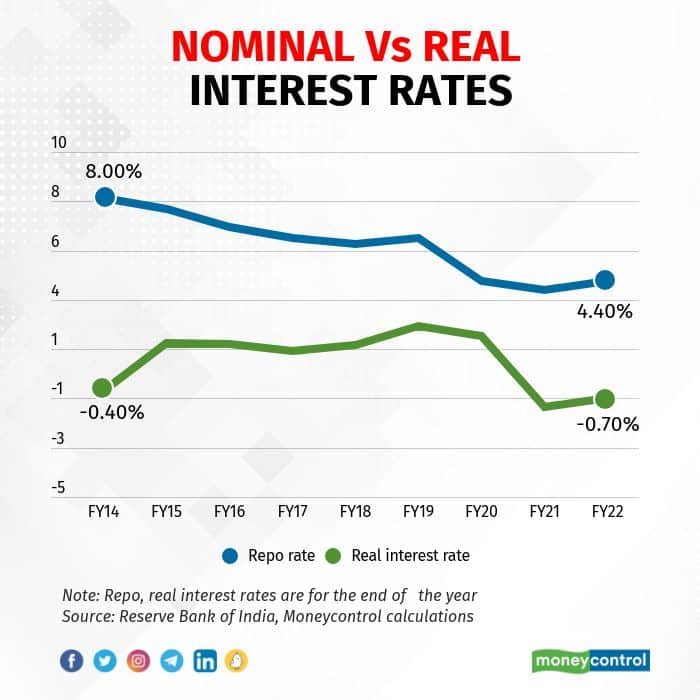

Real interest rates have been negative for some time now. Starting from FY14—prior to which there are no forecasts available for Consumer Price Index (CPI) inflation, either from the RBI or its survey of professional forecasters—and using the second definition for real rates mentioned above by Varma, it can be seen from the chart above that real interest rates dropped sharply from 2 percent at the end of FY20 to -1.1 percent at the end of FY21. At the end of FY22, this figure stood at -0.7 percent.

The capex story

According to Dipanwita Mazumdar, an economist at the Bank of Baroda, new investment is only coming from large industries.

An analysis of balance sheets of 2,241 non-financial companies showed net investment in gross fixed assets rose by Rs 20,058 crore in the first half of FY22. However, Mazumdar found that micro, small, and medium-sized enterprises all saw a decline in their fixed capital. These 1,467 companies saw their fixed capital fall by Rs 1,547 crore in the first half of FY22.

In contrast, 774 large enterprises made a net investment of Rs 21,605 crore over the same period.

But with the RBI raising interest rates—which will hopefully lower inflation—real rates will invariably rise and turn positive and could even return to the 1.5-2 percent levels seen prior to the pandemic. Will rising interest rates then put a dampener on the investments of even these large enterprises? Perhaps not.

"We have seen in the past that interest rates are not a limiting factor when it comes to investment decisions," said Madan Sabnavis, Bank of Baroda's chief economist.

"Investments carry on if there is good demand. The reason is that interest cost is 3-5 percent of turnover depending on the industry. But yes, investments of small and medium enterprises will be impacted by higher interest rates, although studies have shown that, in India, investments largely come from a handful of large companies," Sabnavis added.

The impact of the May 4 repo rate hike—and those that are likely to come in the coming weeks and months—on demand will surely complicate matters.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.