Data released late Tuesday showed India's headline retail inflation rate, measured by the Consumer Price Index (CPI), shot up to a 17-month high of 6.95 percent in March. While inflation was seen rising, the extent of the increase has been far more than forecast.

But more than just being the highest in 17 months, CPI inflation has now come in above the Reserve Bank of India's (RBI) medium-term target for the 30th consecutive month. The last time inflation came in under 4 percent was way back in September 2019.

But what has spurred this latest increase in prices?

Food prices rose far more than expected in March. According to Bank of America Securities, food inflation was responsible for 70 basis points of the increase in CPI inflation, from 6.07 percent in February to 6.95 percent, in March.

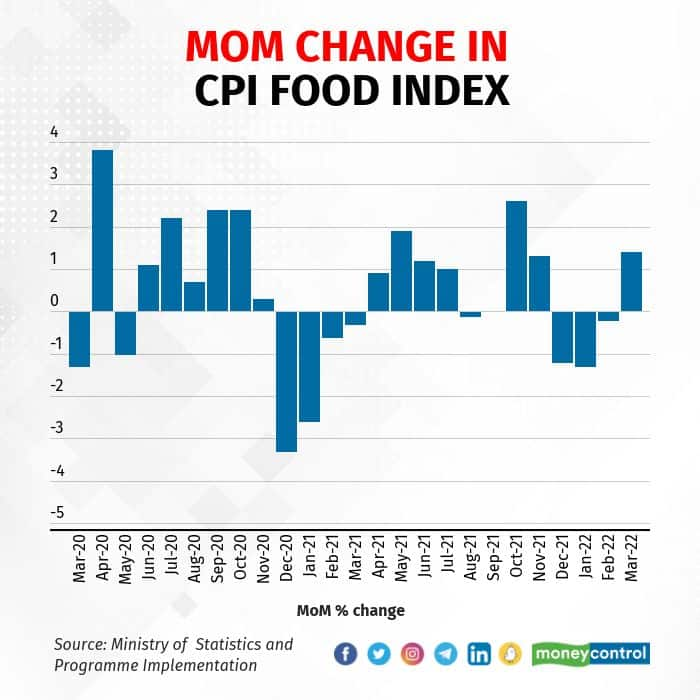

To understand the sequential build-up of price pressures and not get entangled in any base effects, we must look at the Consumer Food Price Index, which jumped 1.4 percent month-on-month in March — the first sequential rise in four months.

Looking back over the pandemic period, the Consumer Food Price Index has risen month-on-month 14 times, declined on 10 occasions, and stayed unchanged once.

Unsurprisingly, most of the biggest drivers of inflation were food items. Of the top five sub-groups with the highest month-on-month increase in their index in March, four were food-related: oils and fats, meat and fish, fruits, and spices. The fifth was personal care and effects, which includes items such as soap, sanitary napkins, and certain services, including those of barbers and beauticians, among other things.

But as the example of fruits shows, a high month-on-month increase in prices (2.5 percent) doesn't necessarily mean high inflation (2.54 percent). At the other end of the spectrum is vegetables. While vegetable inflation nearly doubled to 11.64 percent in March from February's 6.06 percent, the vegetable index actually declined by 1.6 percent on a month-on-month basis.

The pandemic period has seen core inflation — inflation excluding the volatile food and fuel components — stay elevated for a prolonged period. The most basic form of core inflation, computed by putting together four major groups — 1) paan, tobacco, and intoxicants 2) clothing and footwear 3) housing 4) miscellaneous — rose to 6.4 percent in March, calculations done by Moneycontrol show.

While economists like to refine this measure of core inflation further and remove certain individual items, the RBI has historically looked at this broad definition. And a major component of this is the 'miscellaneous' group, which accounts for 28.32 percent of the entire CPI basket and includes goods and services that form a portion of discretionary demand.

In March, miscellaneous inflation rose to a nine-month high of 7.02 percent. The last time it was under 6 percent was in May 2020. The last time it was under 4 percent was in November 2019.

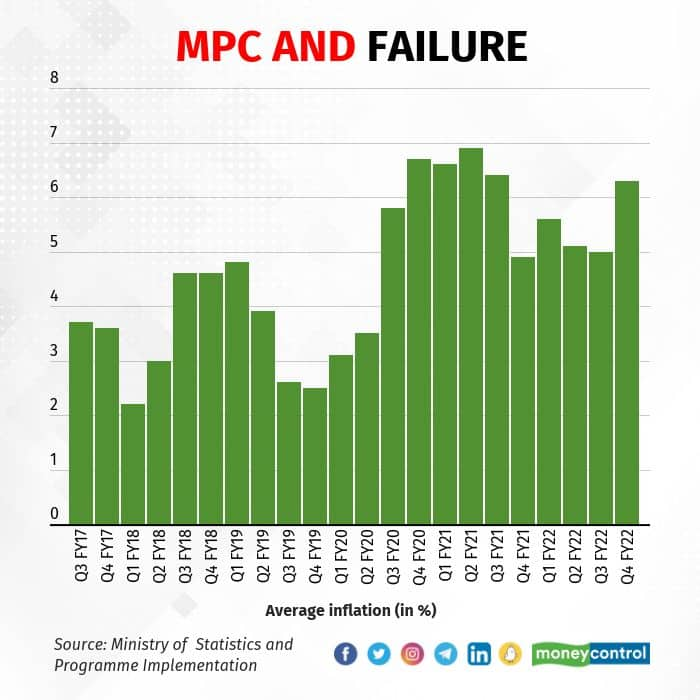

The bottomline, however, is the headline inflation rate and the RBI meeting its mandate. Failure for the RBI's Monetary Policy Committee (MPC) would mean CPI inflation staying out of the 2-6 target range for three consecutive quarters. While this has happened in the past — CPI inflation was above 6 percent in all four quarters of 2020 — it did not constitute a failure as the national lockdown imposed to contain the pandemic in April-May 2020 meant the data for those two months was incomplete.

The MPC treated the final numbers arrived at for these two months as a break in the series. However, the spectre of failure has reared its head yet again. The RBI has forecast 6.3 percent inflation for April-June and 5.8 percent for July-September. With CPI inflation averaging 6.3 percent in the first quarter of 2022, it is going to be a close call for the rate-setting panel.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.