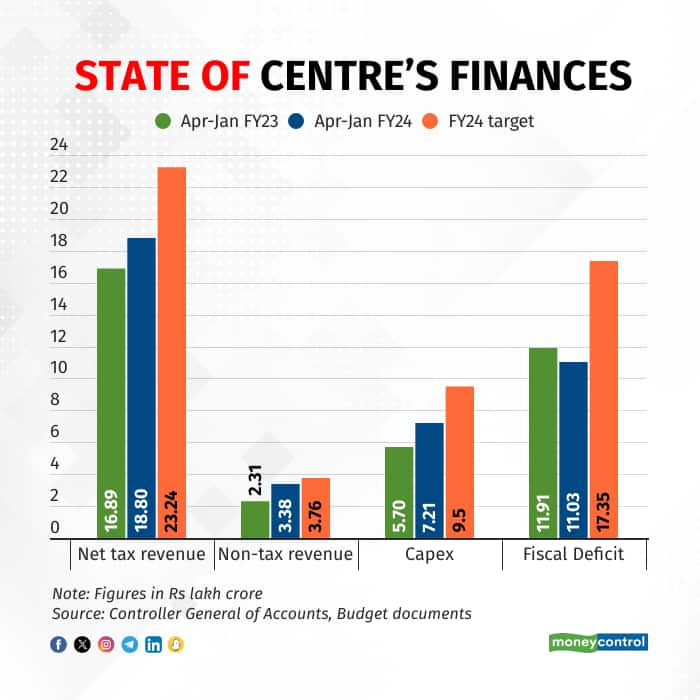

The Central government's fiscal deficit widened to Rs 11.03 lakh crore in April 2023-January 2024 from Rs 9.82 lakh crore in April-December, data released by the Controller General of Accounts showed on February 29.

At Rs 11.03 lakh crore, the fiscal deficit for the first 10 months of the current financial year accounts for 63.6 percent of the revised estimate of Rs 17.35 lakh crore. The original budget estimate was Rs 17.87 lakh crore.

Also Read: Budget and its numbers – A breakdown of key estimates for FY25

The fiscal deficit in April 2022-January 2023 was 67.8 percent of the target for 2022-23.

In January, the Centre's fiscal deficit stood at Rs 1.2 lakh crore, nearly 40 percent lower than a year ago, as tax collections grew robustly and expenditure contracted.

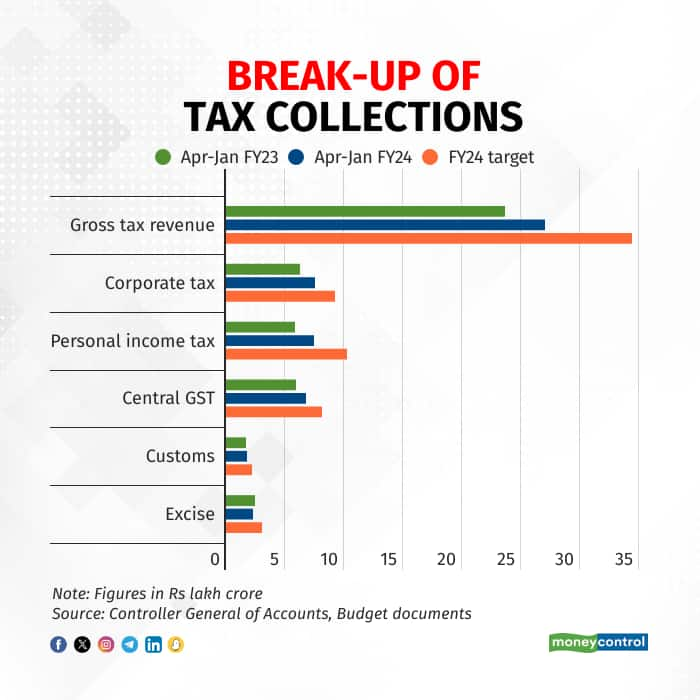

On the receipts side, the central government's net tax collections - arrived at after making tax devolution to states - were up 13 percent year-on-year (YoY) in the first month of 2024 at Rs 1.50 lakh crore, aided by a 63 percent jump in corporate tax collections and 17 percent increase in the personal income tax mop-up.

Meanwhile, non-tax revenue continued to grow far more than projected, and was up 55 percent YoY in January at Rs 25,711 crore. In fact, the Indian government's non-tax revenue in April 2023-January 20024 is only Rs 38,000 crore short of the revised full-year target of Rs 3.76 lakh crore.

Also Read: Consumer or exchequer - who will win after GST compensation cess expiry?

For April 2023-January 2024 as a whole, net tax collections were up 11 percent YoY at Rs 18.80 lakh crore, with corporate tax collections 20 percent higher at Rs 7.56 lakh crore and personal income tax 27 percent higher from last year at Rs 7.48 lakh crore.

On the whole, total receipts were 14 percent more in April 2023-January 2024 than what was collected in the same period of the previous year.

In terms of spending, January saw the Centre's total expenditure decline by 14 percent to Rs 3.01 lakh crore, with capital expenditure down 41 percent YoY at Rs 47,557 crore. This meant that total expenditure for the first 10 months of 2023-24 stood at Rs 33.55 lakh crore, up 6 percent YoY, while capex is 27 percent higher at Rs 7.21 lakh crore.

Also Read: FY25 capex target set at Rs 11.11 lakh crore, but FY24 aim missed

To meet its revised capex target of Rs 9.50 lakh crore for 2023-24, the Centre needs to spend Rs 1.15 lakh crore on average in both February and March. According to Aditi Nayar, ICRA's chief economist, the revised capex target may be missed by at least Rs 50,000 crore.

"While there may be some slippage in the disinvestment target and capex may trail the FY24 RE (revised estimate), ICRA does not expect the revised fiscal deficit target of Rs 17.3 lakh crore for FY24 to be breached," Nayar said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.