For most governments, especially of the developing economies, their expenses are larger than their income. This is true for India as well. And this difference between the expenses and income, i.e. the fiscal deficit of the country, is financed by taking on debts. The Central government’s gross debt, which has mushroomed in recent years, will be a closely watched figure in the upcoming Union Budget 2023.

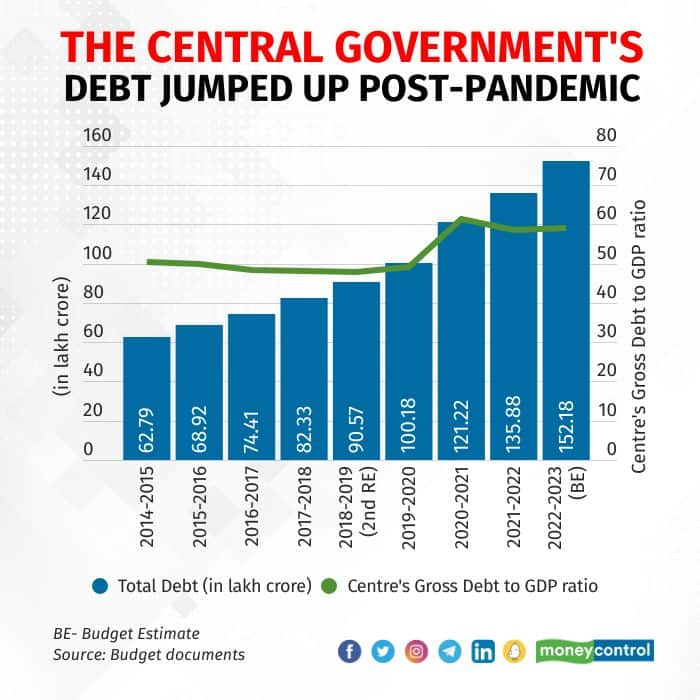

The Government of India’s total debt stood at Rs 135.88 lakh crore in FY22. According to the 2022 budget estimates, this will increase by 12 percent to reach Rs 152.18 lakh crore in this fiscal. When compared to the GDP, the central government’s gross debt ratio stood 58.53 in FY22, and an estimated 58.98 in FY23.

Also read: In Graphic Detail | The huge share of interest payments in India’s expenditureAlthough the government’s debt burden had been steadily rising before, FY21, which was marked by the Covid-19 pandemic, saw the biggest jump in recent years.

The government's total debt went up 21 percent from Rs 100.18 lakh crore in FY20 to reach Rs 121.22 lakh crore in FY21. Even when it comes to gross debt to GDP ratio, it reached 61.39 during the fiscal, the highest in many years.

Also read: In Graphic Detail | Moving the goalposts — fiscal deficit target and a 20-year delayThe fact that the central government’s gross debt ratio remains elevated post-pandemic should be a cause for concern. However, the pandemic-fuelled rise in debt is not isolated just to India. Most countries around the world are grappling with high debt post-pandemic, as their borrowings increased and income dipped.

In fact, the Government of India is doing better than the governments of many high income and emerging market economies when it comes to its debt ratio, as can be seen from the above chart.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.