The three-day meeting of the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) began on June 6. Chaired by Governor Shaktikanta Das, the committee's decision is scheduled to be announced at 10 am on June 8.

The MPC is widely expected to leave the policy repo rate unchanged at 6.5 percent for the second consecutive meeting, after it surprised markets in April and unanimously rejected calls for a 25-basis-point rate.

One basis point is one-hundredth of a percentage point.

While voting on the interest rate decision, the committee members will examine a range of data to assess the economy's situation. Here, Moneycontrol takes a close look at the movement of key economic indicators since the MPC met between April 3-6. It goes without saying that while this list of indicators is not exhaustive, they are crucial in representing the state of the Indian economy.

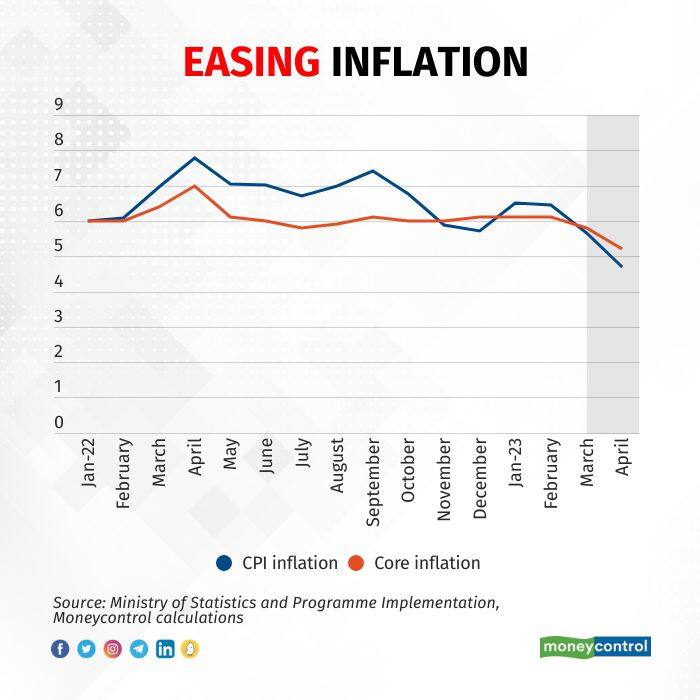

Inflation

First, the good news: inflation has dropped sharply.

After an unexpectedly large increase at the start of 2023, the Consumer Price Index (CPI) inflation collapsed to an 18-month low of 4.70 percent in April – admittedly due to a favourable base effect. Economists expect headline retail inflation to have fallen further in May, data for which will be released on June 12.

Policymakers will also be enthused by the decline in core inflation, which eased to 5.2 percent in April. Inflation expectations have cooled too.

While there is some uncertainty about prices due to risks from El Nino, economists see the possibility of the RBI lowering its inflation forecast for 2023-24 slightly to around 5 percent, from 5.2 percent.

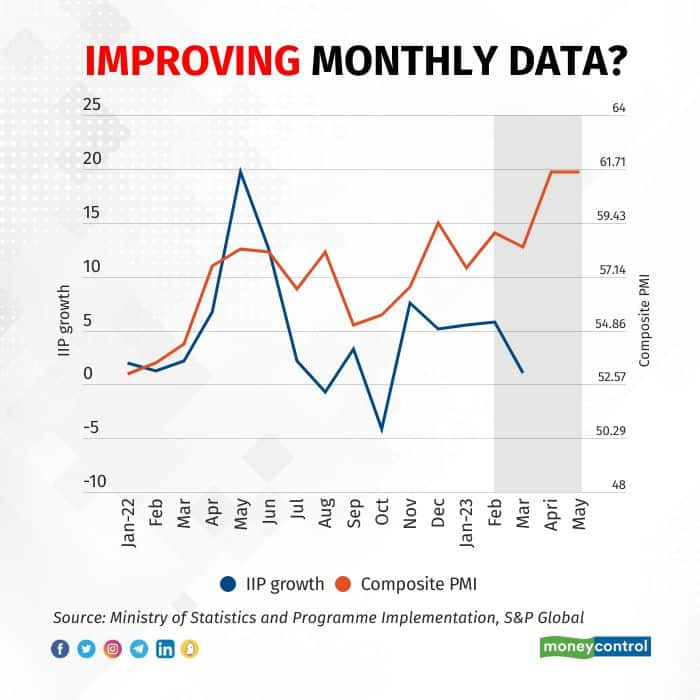

Growth

Second, even better news: the economy is performing better than expected.

Data released on May 31 showed that India's GDP grew by 6.1 percent in January-March, well above the consensus estimate of 5.1 percent. Of course, some concerns remain about the latest GDP numbers.

High-frequency data paints a similar picture.

While industrial growth weakened to just 1.1 percent in March, the performance of the services and manufacturing sectors as per the Purchasing Managers' Index (PMI) has been nothing short of remarkable. Such has been the positivity about the growth outlook that Chief Economic Adviser V Anantha Nageswaran has stuck his neck out and said he is now more confident about the government's 6.5 percent growth forecast for 2023-24 being met – which is also what the RBI has forecast.

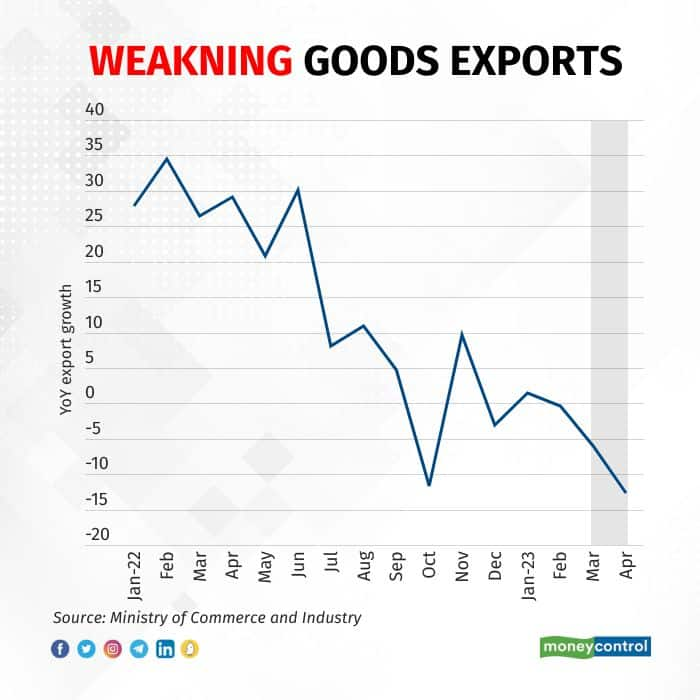

Export performance

A key driver of growth in January-March were net exports, which accounted for nearly a quarter of the headline GDP growth number of 6.1 percent after proving to be a drag in October-December. But, as is usually the case, the devil is in the details.

The turnaround in India's trade performance has been due to the booming services exports. Merchandise exports, meanwhile, have floundered.

In April, India's merchandise exports were down 12.7 percent year-on-year. These exports have contracted five times in the last seven months.

In June 2022, exports had jumped 30 percent. Since then, the average monthly growth in exports in year-on-year terms has been a measly 0.1 percent.

External factors

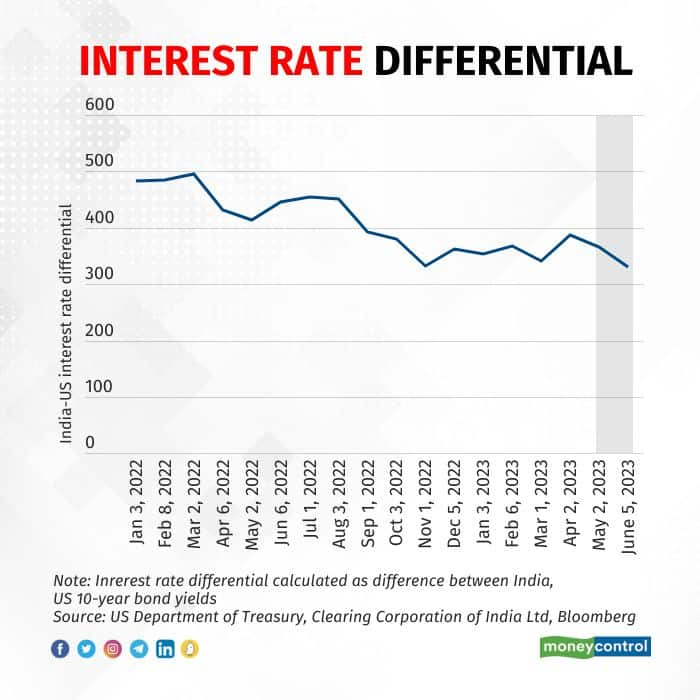

India's services trade is making up for weaknesses on the goods front, and that has helped stabilise the external situation further, with the median value of the rupee's closing levels against the US dollar being 82.4 in May – the same as in March - all while the difference between US and Indian interest rates has steadily declined.

Of course, cooling oil prices have helped. After a brief uptick in April, the price of India's crude oil basket fell to a 17-month low of $74.98 per barrel in May.

"The policy interest rate gap between India and US has narrowed to historical lows, at 1.25 percent, and could reduce further if the Fed continues to hike interest rates," said Gaura Sen Gupta, India economist at IDFC First Bank.

According to Sen Gupta, the rupee's exchange rate has been supported by a reduction in the current account deficit.

"Hence, despite the low interest rate differential, the depreciation pressures on the rupee remain contained. In case the Fed resumes hiking interest rates, then the depreciation pressures on the INR are likely to be more visible," she added.

Borrowing and lending

After a rapid increase in loan growth in 2022, the past few months have been about consolidation, with non-food bank credit growth in the 15-16 percent range. This has happened even as lending rates have risen.

"…interest rates remain well above the historical average. However, this has not translated into lower credit off-take, which continues to grow at a robust pace driven by steady demand," Aditi Gupta, an economist at Bank of Baroda, wrote on June 3.

However, interest rates on new loans declined in April.

"Despite a pause by the MPC, banks have continued to raise rates on their outstanding portfolio. Given the competitive intensity, pricing of fresh loans has reduced in April," CareEdge said in a note on June 2.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.