The International Monetary Fund (IMF) has raised its 2023-24 GDP growth forecast for India for the second time in three months, taking it closer to the 6.5 percent predicted by Indian authorities. According to the multilateral agency's latest World Economic Outlook report, released on October 10, India's GDP is expected to grow by 6.3 percent this year, 20 basis points higher than what it had forecast in late July.

One basis point is a hundredth of a percentage point.

Also Read: RBI retains GDP growth forecast of 6.5% for FY24 and FY25The IMF has made no change to its forecast for next year and continues to see India's GDP growing by 6.3 percent in 2024-25.

The view of the IMF, which had raised its growth forecast for India for this year by 20 basis points to 6.1 percent in July, is now in line with that of the World Bank.

"Growth in India is projected to remain strong, at 6.3 percent in both 2023 and 2024, with an upward revision of 0.2 percentage point for 2023, reflecting stronger-than-expected consumption during April-June," the IMF said in its report.

The IMF's latest growth forecast comes a month or so after data released by the statistics ministry on August 31 showed the Indian economy expanded by 7.8 percent in April-June – marginally higher than economists' expectations of 7.7 percent but lower than the Reserve Bank of India's (RBI) view of 8.0 percent, with private consumption growing 6.0 percent as against 2.8 percent in January-March.

While the IMF's view on Indian consumption matches that of the government, private sector economists are more circumspect about household spending, especially on discretionary items.

Also Read: From clothes to PCs, falling Indian production points to weak demandAs per latest industrial production data, output of consumer durable goods in India was 2.7 percent lower on a year-on-year basis in July as well as April-July.

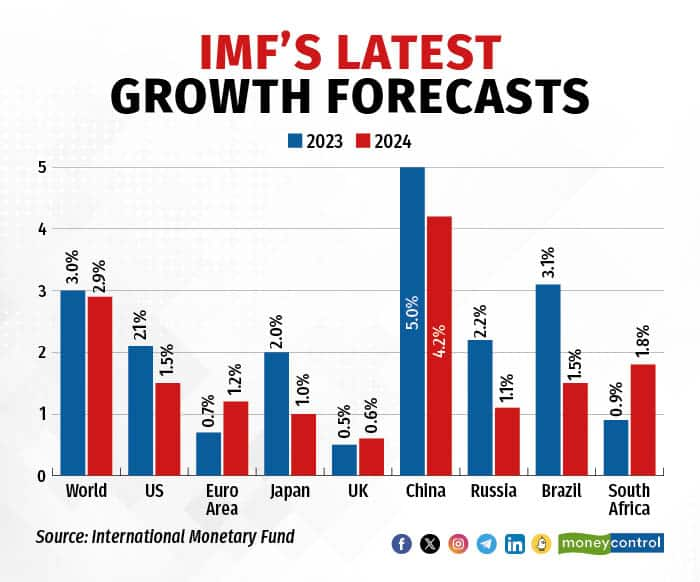

While the forecast for India was raised, the same cannot be said for global growth, with the IMF retaining its forecast for 2023 at 3.0 percent but lowering it for 2024 by 10 basis points to 2.9 percent, warning of "widening growth divergences".

"The strongest recovery among major economies has been in the United States, where GDP in 2023 is estimated to exceed its pre-pandemic path. The euro area has recovered, though less strongly—with output still 2.2 percent below pre-pandemic projections, reflecting greater exposure to the war in Ukraine and the associated adverse terms-of-trade shock, as well as a spike in imported energy prices," the IMF report noted.

"In China, the pandemic-related slowdown in 2022 and the property sector crisis contribute to the larger output losses of about 4.2 percent, compared with pre-pandemic predictions. Other emerging market and developing economies have seen even weaker recoveries, especially low-income countries, where output losses average more than 6.5 percent," it added.

The US is indeed expected to keep recovering smartly, with the IMF raising its forecast to 2.1 percent and 1.5 percent for 2023 and 2024, respectively—30 basis points and 50 basis points higher than what it had estimated in July.

The growth forecast for China, on the other hand, was cut by 20 basis points to 5 percent for 2023 and by 30 basis points to 4.2 percent for 2024.

Source: International Monetary Fund

Source: International Monetary FundOn the price front, the IMF now expects retail inflation to ease to 6.9 percent in 2023 and 5.8 percent in 2024 from 8.7 percent in 2022. However, these forecasts have been raised by 10 basis points and 60 basis points, respectively, from July – the latter due to higher-than-expected core inflation.

"Although monetary tightening is starting to bear fruit, a central driver of the fall in headline inflation projected for 2023 is declining international commodity prices," the IMF said, adding that the pace of disinflation is stronger for advanced economies.

"Part of this difference reflects advanced economies benefiting from stronger monetary policy frameworks and communications, which facilitate disinflation, but the difference also reflects lower exposure to shocks to commodity prices and exchange rates."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.