The Narendra Modi-led government, which has often cited policy paralysis and corruption as being responsible for the lackluster growth posted in the latter years of the UPA government, has gifted the opposition an opportunity to set right its tarnished reputation on the economic front.

A government-commissioned study that drew up figures for gross domestic product (GDP) growth rates, in line with the new baseline data, shows that India achieved much higher growth under the leadership of the UPA than previously thought.

The GDP numbers clocked by the NDA government over the last four years have divided opinion. Any comparison with corresponding numbers from earlier years would have been skewed on account of a change in methodology. The Central Statistics Office (CSO) changed the base year for GDP calculation from 2004-2005 to 2011-2012.

The CSO replaced the old base year at the recommendation of the National Statistical Commission. The new methodology has been followed since January 2015. The Commission had first suggested 2009-10 as the base year. However, the proposal was scrapped as the year in question was abnormal on account of the subdued macroeconomic scenario in the aftermath of the 2008 market crash.

The base year is important in GDP calculation as factors such as purchasing power and inflation are taken as the benchmark for subsequent years. The prevalence of anomalous factors in the base year can distort calculations going forward.

Instead of Reserve Bank of India (RBI) data on company finances, the new series incorporates information from the Ministry of Corporate Affairs' MCA21 database. This implies that corporate data is more accurately depicted in GDP figures. The review of the services sector, which accounts for almost 60 percent of India's GDP, is also more comprehensive than earlier.

The back series data released by the Sudipto Mundle-led committee show that GDP growth under the UPA government crossed 10 percent in 2007-08, which was only the second time in history. The back series data is essentially what the GDP growth rate and other macroeconomic indicators would have been, if computed with the present base year as the benchmark.

In addition to changing the base year, the new series adopted the system of measuring the gross value added (GVA) at basic prices in lieu of calculating the GDP at factor cost. The Indian Economic Service reckons that basic prices are less representative of the true cost as they do not take into account, the subsidies and taxes associated with the production process. The resultant numbers, arguably inflated, have often been brandished by the ruling dispensation to demonstrate the economic turnaround initiated under its watch.

The committee has adjusted the data going as far back as 1994. It found that under the prevailing methodology, the GDP growth rate for each of the years between 1994 and 2014 is higher by at least 0.3 percent to 0.5 percent.

The trajectory of GDP growth remains similar, but the Mundle committee report has magnified the divergences by pulling down the numbers for lean years like 2008 and amplifying it for the better part of a decade, effectively airbrushing the unflattering picture painted of the Manmohan Singh-led UPA government.

The GDP backseries data is finally out.

It proves that like-for-like, the economy under BOTH UPA terms (10 year avg: 8.1%) outperformed the Modi Govt (Avg 7.3%) .The UPA also delivered the ONLY instance of double digit annual growth in modern Indian history. pic.twitter.com/33Qt9x8YZS

— Congress (@INCIndia) August 17, 2018

"It proves that like-for-like, the economy under both UPA terms (10-year average: 8.1 percent) outperformed the Modi government (average 7.3 percent)," Congress said on its official Twitter handle. The Congress has been critical of economic data calculated under the new series, often accusing the ruling party of manipulating the system of accounting to present favourable figures.

According to the new data, the economy grew at an average of 9.42 percentage in the first four years of UPA-I, touching double digits in 2007-08. The impact of the global recession was felt in 2008-09, as GDP plummeted to 4.15 percent. Under the old series, the figure for 2008-09 stood at 6.7 percent, 2.55 percentage points higher than the revised number.

However, it is testament to the resilience of the Indian economy that the GDP rebounded to 8.84 in 2009-10, even breaching the 10 percent mark in 2010-11. Recovery took much longer in other emerging markets. Under the old series, GDP grew at 8.4 in each of the years between 2008 and 2010.

The unification of the base year for data since 1994 lends to comparisons between the performance of successive governments. The UPA-I government clocked 8.36 percent growth over a five-year period beset with high crude oil prices and the blowback from the global financial crisis of 2008. If the first four years of UPA-I are considered in isolation, the average GDP growth rate stands at 9.42 percent. In contrast, economic growth during the first four years of the Narendra Modi-led NDA government has been relatively anemic at 7.15 percent.

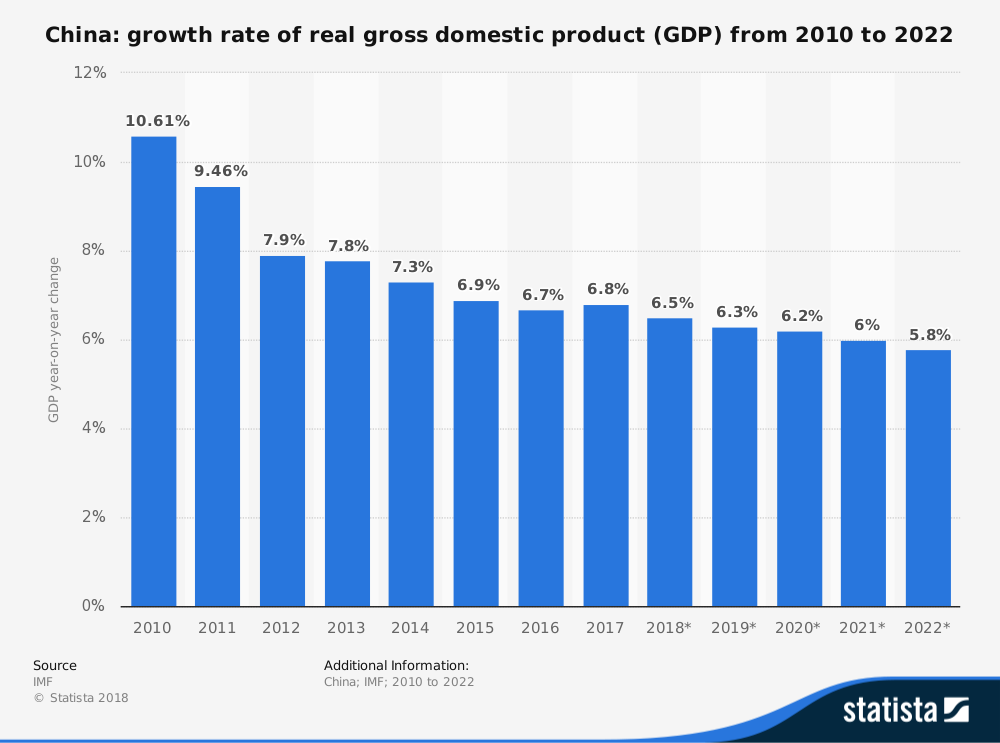

India overtook China to become the fastest-growing large economy in the world, a fact frequently advertised by the NDA government to highlight its achievements in micromanaging the economy. However, the GDP back series data throws up a slightly different picture.

According to the report, India's GDP growth rate for 2010-11 was 10.78 percent, 0.17 percentage points more than the 10.61 percent achieved by China in the same year. China's growth rate has slipped since then. This means that India outdid its neighbour in a year when the latter's economy was at its highest point in the past eight years.

More importantly, this came at a time when global oil prices were high, as was the government's subsidy bill.

India recently overtook France to become the sixth largest economy in the world, but problems persist. Disruptive measures like the implementation of the goods and services tax (GST) and the demonetisation of high-value currency notes have taken the wind out of the economy's sails. Recovery has been subdued.

The banking sector, which is saddled with bad debt, is adding to the pressure on the economy. Credit has been drying up. The Insolvency and Bankruptcy Code has just started delivering on resolution of bad loans but lenders will have to take a substantial haircut on large loans even if new promoters are found, or asset reconstruction companies manage to turn around sick ventures.

However, the outlook is not entirely bleak. The International Monetary Fund (IMF) reckons that the adverse effects of demonetisation and the implementation of GST are fading. In its bi-annual World Economic Outlook, IMF said India is projected to grow at 7.4 percent in 2018-19, and 7.8 percent in 2019-20.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.