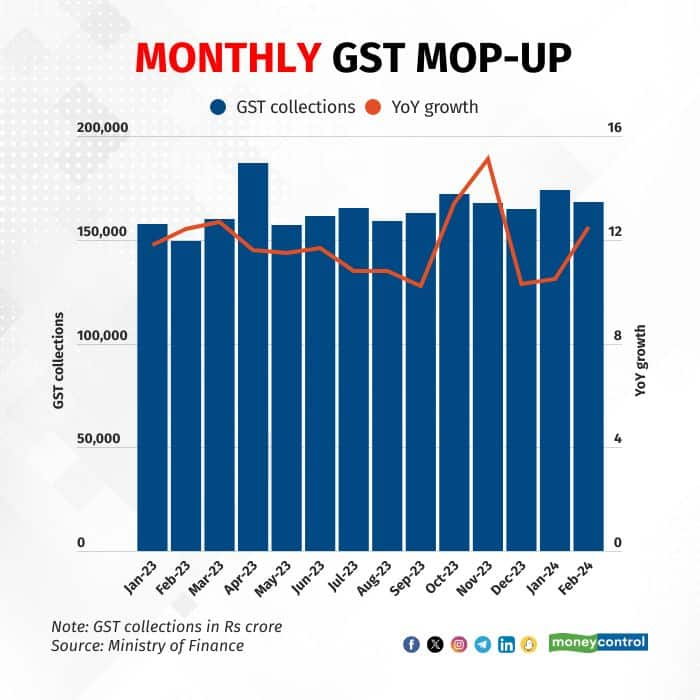

India collected Rs 1.68 lakh crore in goods and services tax (GST) in February, 12.5 percent more than the year-ago period, the finance ministry said on March 1.

At Rs 1.68 lakh crore, the February GST collection is 3.3 percent lower than the Rs 1.72 lakh crore in January, now revised upwards to Rs 1.74 lakh crore.

The latest GST figure, which has come in above the Rs 1.5-lakh-crore mark for the 12th month in a row, takes the average monthly collection in 2023-24 to Rs 1.67 lakh crore.

Monthly GST collections have risen over the years. From averaging under Rs 1 lakh crore per month in 2017-18 - the indirect tax regime's first year - collections rose rapidly after the pandemic-hit 20202-21 to average Rs 1.51 lakh crore in 2022-23.

"As of February 2024, the total gross GST collection for the current fiscal year stands at Rs 18.40 lakh crore, which is 11.7 percent higher than the collection for the same period in 2022-23," the finance ministry said in a statement.

Net of refunds, GST revenue for the first 11 months of 2023-24 is Rs 16.36 lakh crore, 13 percent higher than the same period last year.

"Overall, the GST revenue figures demonstrate continued growth momentum and positive performance," the finance ministry added.

Also Read: Economists focus on Q3 GVA growth to keep out noise in GDP from volatile taxes, subsidies

In February, Central GST collection stood at Rs 31,785 crore, State GST Rs 39,615 crore, Integrated GST Rs 84,098 crore, and cess was Rs 12,839 crore.

The government settled Rs 41,856 crore to Central GST and Rs 35,953 crore to State GST from Integrated GST. As a result, the total revenue for the month post settlement was Rs 73,641 crore for the Centre and Rs 75,569 crore for State GST.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!