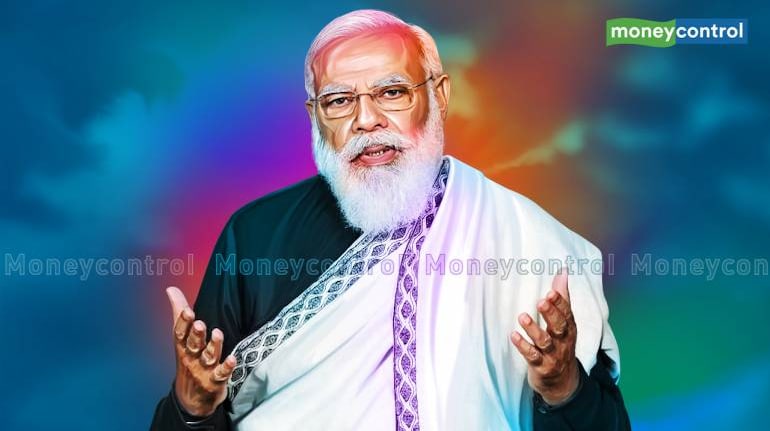

The Reserve Bank of India's initiative to allow retail investors to invest directly into government securities market is a step aimed at deepening capital markets and will help in financial inclusion, Prime Minister Narendra Modi said on November 12.

Modi was speaking at the launch of two schemes of the RBI - the RBI Retail Direct Scheme and the Reserve Bank-Integrated Ombudsman Scheme. Finance Minister Nirmala Sitharaman and RBI Governor Shaktikanta Das also attended the event.

"The retail direct scheme will allow retail investors to invest in a safe and easy manner. Earlier, the smaller investors could only invest in bond markets indirectly, through insurance schemes or mutual funds," Modi said.

Regarding the integrated ombudsman scheme, Modi said that the strength of a democracy can be assessed through how strong its grievance processes are.

Catch all the live action from the event here

The RBI Retail Direct Scheme is aimed at enhancing access to government securities market for retail investors. It offers them a new avenue for directly investing in G-secs and state bonds.

Under the scheme, which was first announced by RBI in July, retail investors will be able to easily open and maintain their government securities account online with the RBI, free of cost.

"The retail direct scheme offered by RBI is a good opportunity for retail investors to invest in government securities, sovereign bonds etc. The g-secs offers a low risk and low return on the investment as compared to investment in equity or asset. We advice the retail investors must diversify their investment and go for this advantage to have a better and safe return," said Ravi Singh, head of research and vice-president at ShareIndia.

The Reserve Bank - Integrated Ombudsman Scheme aims to further improve the grievance redress mechanism for resolving customer complaints against entities regulated by RBI. It brings all various RBI ombudsman services under one scheme.

The central theme of the scheme is based on ‘One Nation-One Ombudsman’ with one portal, one email and one address for the customers to lodge their complaints.

There will be a single point of reference for customers to file their complaints, submit the documents, track status and provide feedback. A multi-lingual toll-free number will provide all relevant information on grievance redress and assistance for filing complaints.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.