China’s sudden reopening is set to offer a boost to a flagging world economy.

The growth impulse will be felt through services sectors such as aviation, tourism and education as Chinese people pack their bags for international travel for the first time since the pandemic. Tourism-reliant nations in Southeast Asia will likely be among the first to note a pick up, with developed economies also benefiting from the return of Chinese visitors.

While China’s economic reboot is expected to be rocky, the dramatic Covid shift coincides with efforts to shore up a real estate slump. That will give a lift to commodity producers like Chile and Brazil.

The impact is already flowing through financial markets. Copper prices have surged through $9,000 a ton for the first time since June, a gauge of Australian mining shares is honing in on an all-time high and the Chilean peso is enjoying its best streak of gains since August, all on China reopening bets.

The head of the International Monetary Fund last week described China’s pivot from Covid Zero as likely the single most important factor for global growth in 2023 and will mean China is a positive contributor to average global growth by around mid-year.

“China’s reopening will deliver a much needed jolt to global growth,” said Frederic Neumann, chief Asia economist at HSBC Holdings Plc. “As the second-largest economy in the world, accelerating Chinese household and investment spending will help put a floor under global trade at a time when demand in the West is faltering.”

For services, China expects the number of international flights to rebound to the equivalent of 15-25 percent of their pre-pandemic levels by the end of March.

Barclays Plc analysts including Jian Chang expect a surge in outbound tourism and note data from Ctrip International Ltd. that shows international travel bookings for the upcoming Lunar New Year holiday soared by 260 percent compared with a year earlier. They say developed economies such as the US, UK and Australia will be among the beneficiaries.

Before Covid, China ran a $260 billion services deficit, 85 percent of which was due to outbound tourism, according to Barclays.

Tourist hot spots in Southeast Asia including Thailand and Vietnam are also looking forward to a return of Chinese visitors. Thailand attracted around 11.5 million foreign visitors last year, way down from the 40 million before the pandemic in 2019 — when nearly a quarter were from China. The government expects 25 million foreign visitors this year.

At the same time, a domestic recovery in China will lend itself to firmer import demand and the purchases of foreign brands. While official data due Tuesday will likely show retail sales contracted last year, S&P Global have forecast retail growth of 5.8 percent in 2023.

Consumer Confidence

For sure, China’s rebound isn’t expected to be linear.

How the public health crisis plays out remains to be seen and it could yet leave a long shadow over consumer confidence. The big slump in property prices will weigh against a consumer rebound. And government stimulus, so far at least, has been relatively restrained.

“When the Covid situation settles down enough for China truly to re-open, probably around March, the re-opening boomlet will disappoint in comparison to the developed market response,” said Freya Beamish, chief economist at TS Lombard. “Chinese domestic stimulus has been pale in comparison and the pool of wealth to support pent-up demand is much smaller.”

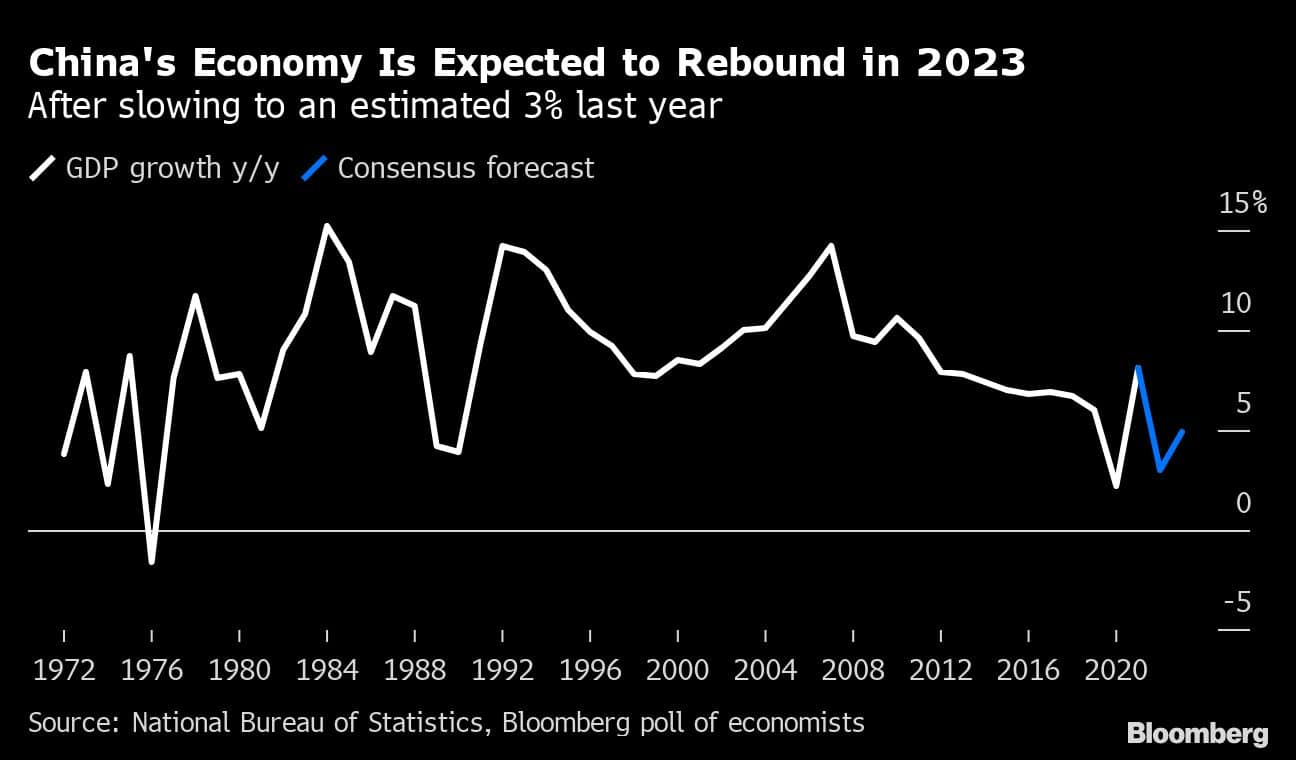

There’s also a question around how China will impact global inflation. Bloomberg Economics estimates the reopening will push China’s 2023 GDP growth to 5.1%, which would add about 0.9 percentage point to global inflation relative to what would happen if Covid Zero policies had continued.

Policymakers are wary of how China may impact prices. Bank of Korea Governor Rhee Chang-yong last week acknowledged that while China may boost his nation’s exports, it could also stoke inflation pressures.

“If China’s economy is recovering fast, that might be good for the current account balance of Korea, but it may cause crude oil prices to rise,” he told reporters.

Still, for a world economy clasping for good news, a rebound in demand out of China will be welcomed. If the recovery plays out as expected, China may end up accounting for half of global growth, estimates Alicia Garcia-Herrero, chief Asia Pacific economist at Natixis SA.

“Given the meager growth expected for the US and Europe, with downward risk of a recession for both, our expected 5.5 percent GDP growth for China in 2023 — even if not impressive – will greatly contribute to global growth,” she said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.