SBI Life Insurance Company Ltd is expected to report 10-30 percent year on year (YoY) decline in its profit after tax (PAT) on April 28, when it will declare its results for the quarter and year ended March 2022.

Experts expect a steady performance in the reported quarter compared with the same period a year ago. Growth in net premium income is expected to be driven by strong distribution and deep penetration in both urban and rural markets. Profitability for the quarter, though expected to decline on year, will be aided by lower cost base compared to peers, favourable product mix and healthy persistency ratios.

Experts have a mixed opinion on the sequential performance of the SBI group company as some expect a flat bottomline while some expect a jump of about 30 percent.

Net premium income (NPI) is expected to grow 9-12 percent on year while on a sequential basis analysts foresee a decline of 3-9 percent.

The life insurer is expected to generate NPI of Rs 17,00-17,500 crore during the quarter while PAT is pegged at Rs 360-480 crore.

SBI Life had recorded a PAT of Rs 532 crore during the corresponding period of previous year on an NPI of Rs 15,556 crore.

During the quarter ended December 2021, the company had registered a PAT of Rs 364 crore when its NPI stood at Rs 18,025 crore.

Brokerage Views

Motilal Oswal Financial Services said, “SBI Life has witnessed strong traction in premium growth across segments, with individual weighted received premium (WRP) delivering growth of 38 percent over FY22 – much higher than the industry and other listed peers.”

The brokerage expects NPI of Rs 17,500 crore for the quarter, growing 12 percent YoY but declining 3 percent sequentially.

It forecasts 10 percent on year growth in first year premiums at Rs 4,030 crore. Renewal premiums are seen rising by 16 percent on year to Rs 11,000 crore while single premiums may grow 5 percent from last year to Rs 2,940 crore.

Motilal Oswal forecasts a PAT of Rs 480 crore for the quarter which is a decline of 10 percent on year but sequential growth of 30 percent.

Among key operating metrics, the annual premium equivalent (APE) is expected to grow 8.2 percent on year to Rs 4,290 crore; on a sequential basis there is a decline of 6 percent.

“We estimate a 26 percent APE compound annual rate over FY22-24, led by continued momentum in non-PAR savings and protection products and the share of ULIP (unit linked investment policy) has picked up and is showing improving trends,” Motilal Oswal said.

The value of new business (VNB) is seen improving by 3.2 percent on year but flat on quarter to Rs 1,130 crore. VNB margins at 26.4 percent for the quarter are 130 basis points lower from last year but are seen improving by 80 bps from the previous quarter.

“Persistency ratios are holding up well across cohorts, while cost ratios may increase moderately on revival in business growth, but cost leadership is likely to continue,” Motilal Oswal said.

Axis Securities forecasts NPI to grow 9 percent on year to Rs 16,933 crore. On a sequential basis, NPI is likely to decline 6 percent. APE is seen improving marginally by 4 percent on year to Rs 4,130 crore for the quarter. Sequentially, this is a decline of 10 percent. New business premiums are likely to remain flattish sequentially given higher base in Q3FY22 but on a YoY basis the new business premiums might surge 41 percent.

“We see sequential VNB margin improvement to be aided by changing portfolio mix and cost matrix which is the best in the industry,” Axis Securities said.

It sees PAT remaining flat on quarter at Rs 359 crore which on a yearly basis is a decline of 32.6 percent.

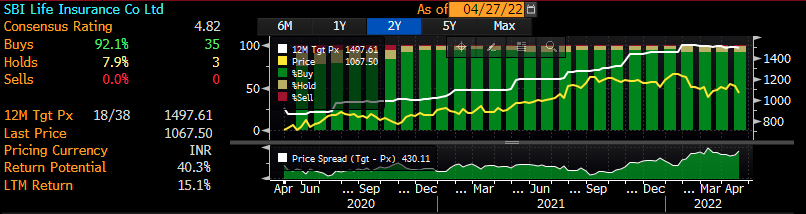

As per the above chart from Bloomberg, 35 brokerages have a 'buy' rating for the stock compared to 3 'holds' and nil 'sells'. The stock has a 12 month target price of Rs 1,497.61 with a return potential of 40.3 percent.

Disclaimer: The views and investment tips of investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.